Around 70% to 80% of transactions in the crypto secondary market transactions occur between crypto assets and stablecoins. The South Korean government’s welcoming stance, coupled with the high popularity of crypto assets in the country, are among the reasons why the won is now the second most-used fiat currency. Decline in 2021/2 Crypto-to-Stablecoin Volumes According […]

Around 70% to 80% of transactions in the crypto secondary market transactions occur between crypto assets and stablecoins. The South Korean government’s welcoming stance, coupled with the high popularity of crypto assets in the country, are among the reasons why the won is now the second most-used fiat currency. Decline in 2021/2 Crypto-to-Stablecoin Volumes According […]

Source link

transactions

US Judge Backs SEC: Trading of Certain Cryptocurrencies on Secondary Markets Are Securities Transactions

A U.S. district judge has sided with the Securities and Exchange Commission (SEC) in a ruling that declares the trading of certain crypto assets on secondary markets to be securities transactions. This decision emerged from an insider trading case involving crypto exchange Coinbase’s former product manager Ishan Wahi, his brother Nikhil Wahi, and their friend […]

A U.S. district judge has sided with the Securities and Exchange Commission (SEC) in a ruling that declares the trading of certain crypto assets on secondary markets to be securities transactions. This decision emerged from an insider trading case involving crypto exchange Coinbase’s former product manager Ishan Wahi, his brother Nikhil Wahi, and their friend […]

Source link

Russian Digital Ruble Pilot ‘on Track,’ Registers About 25K Transactions

Elvira Nabiullina, Governor of the Bank of Russia, stated that the current pilot test of the Russian digital ruble was “on track,” with several operations being tested, including opening wallets, and interactions with smart contracts. Nabiullina revealed that over 25,000 transactions were registered, and confirmed the pilot expansion later this year. Russian Digital Ruble Pilot […]

Elvira Nabiullina, Governor of the Bank of Russia, stated that the current pilot test of the Russian digital ruble was “on track,” with several operations being tested, including opening wallets, and interactions with smart contracts. Nabiullina revealed that over 25,000 transactions were registered, and confirmed the pilot expansion later this year. Russian Digital Ruble Pilot […]

Source link

Whale transactions and ETF records fuel Bitcoin’s push toward $60,000

Quick Take

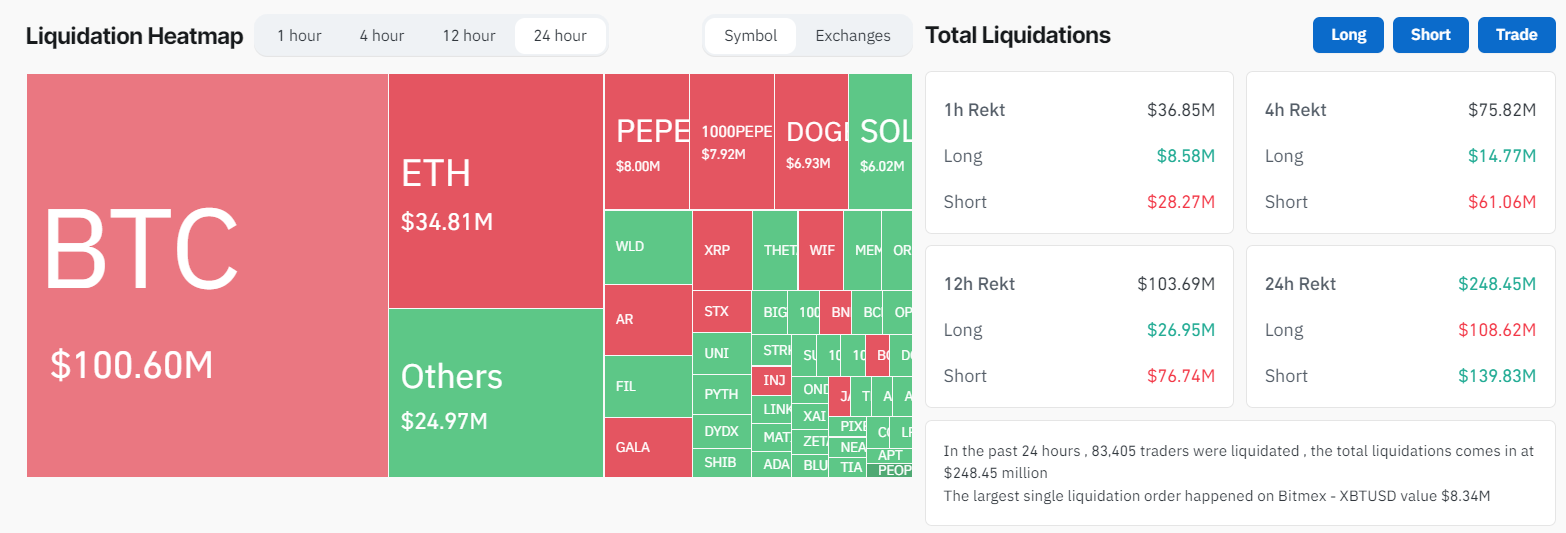

Bitcoin is currently demonstrating a robust market performance, bulldozing its way towards the $60,000 benchmark, up from its daily start of around $57,000. In the preceding 24 hours, a significant wave of liquidations hit the digital asset market, amounting to approximately $250 million. The liquidations depict a slight bias towards shorts, with an estimated worth of $140 million, according to Coinglass.

Coinglass data shows that in the same timeframe, Bitcoin experienced $100 million worth of liquidations, majorly shorts accounting for $70 million.

Simultaneously, the Exchange Traded Fund (ETF) inflows marked their third-best performance day, underlining the growing interest of institutional investors in this digital asset. A noteworthy mention is BlackRock, which recorded a record-breaking single-day performance with net inflows of $520 million.

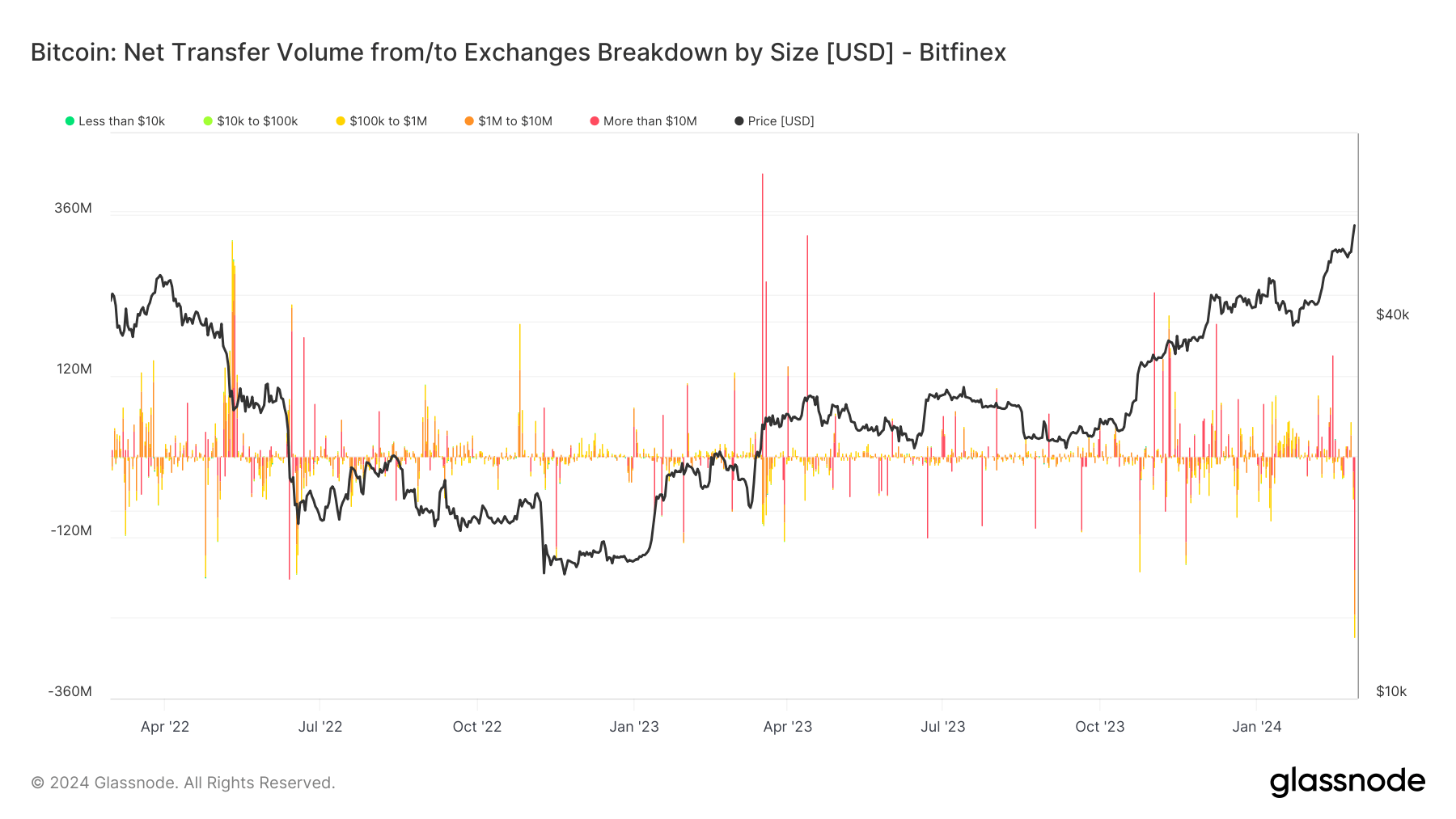

The day further witnessed the largest Bitcoin withdrawal from Bitfinex since 2021, exceeding $240 million. This substantial offloading, estimated to be the equivalent of 5,000 Bitcoins, was primarily attributed to large whale activities.

The post Whale transactions and ETF records fuel Bitcoin’s push toward $60,000 appeared first on CryptoSlate.

Bitcoin Network Faces Downturn in Transactions and Fees as Halving Approaches

The volume of daily transactions on the Bitcoin network has seen a significant decline since Jan. 28, 2024, with numbers falling from peaks above 600,000 to below 300,000 transactions per day. This downturn is in sync with a decrease in the daily creation of Ordinal inscriptions, overall easing congestion and reducing onchain fees. Network Activity […]

The volume of daily transactions on the Bitcoin network has seen a significant decline since Jan. 28, 2024, with numbers falling from peaks above 600,000 to below 300,000 transactions per day. This downturn is in sync with a decrease in the daily creation of Ordinal inscriptions, overall easing congestion and reducing onchain fees. Network Activity […]

Source link

Cardano, a blockchain platform known for its research-oriented strategy and eco-friendly Proof-of-Stake consensus, is experiencing substantial growth. Increased transaction volumes, a variety of project launches, and active development within its ecosystem underline this expansion.

Cardano Transaction Boom

December and January saw Cardano process over 4 million transactions, showcasing a significant increase in on-chain activity. This growth aligns with the platform’s ambition to become a scalable and sustainable blockchain for real-world applications.

The blockchain platform isn’t just processing transactions; it’s attracting developers and projects. Eight new projects launched on Cardano in the past two months, and an additional 17 are currently under development. This brings the total to 157 already launched and 1,320 in progress, indicating a thriving and diverse ecosystem.

#Cardano fam. It’s the weekly update!!

Check out the amazing thread from @IOHKMedia.

What jumped out to me: 4 MILLION transactions done on @Cardano in the last 2 months 🔥🤯 $ADA pic.twitter.com/TFOI8DNKrE

— Chris O (@TheOCcryptobro) February 2, 2024

Technology On The Move

Cardano’s technological advancements are fueling its growth. The number of token policies on the platform surged, leading to the minting of 480,000 new native tokens. Additionally, Plutus scripts, enabling smart contracts on Cardano, saw substantial growth, with both V1 and V2 scripts experiencing significant increases.

Project Catalyst, Cardano’s community-driven funding initiative, is fostering engagement and innovation. In its second week of voting for Fund11, nearly 5,000 wallets cast over 150,000 votes across 920 proposals seeking community funding. This active participation highlights the strong community backing for Cardano’s development.

Cardano currently trading at $0.50 on the daily chart: TradingView.com

ADA Price On The Rise

Reflecting the overall positive sentiment, Cardano’s native token, ADA, experienced a price increase of 1.3% in the last 24 hours and 7.4% in the past week.

While the report paints a positive picture, it’s crucial to acknowledge the broader context. Cardano faces competition from established players like Ethereum and emerging blockchains. Regulatory uncertainty surrounding cryptocurrencies remains a factor, and while touted as energy-efficient, Cardano’s environmental impact compared to other blockchains is still under debate.

Cardano’s Eco-Friendly Footprint

Charles Hoskinson created Cardano as a peer-reviewed blockchain, but what sets it apart is the Ouroboros proof-of-stake system. Compared to Bitcoin, Cardano can perform transactions with a far smaller environmental impact thanks to its energy-efficient methodology.

According to CExplorer, Cardano’s annual energy consumption is a meager 2.602 GWh. It is therefore around 214,672 times more energy-efficient than Bitcoin.

Cardano’s PoS system is scalable, flexible, and adaptable, making it a viable option for investors who are worried about how their cryptocurrency holdings may affect the environment.

Overall, Cardano’s recent growth momentum suggests a promising future for the platform. However, navigating the competitive landscape, evolving regulations, and sustainability concerns will be key to securing its long-term success.

Featured image from VistaCreate, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

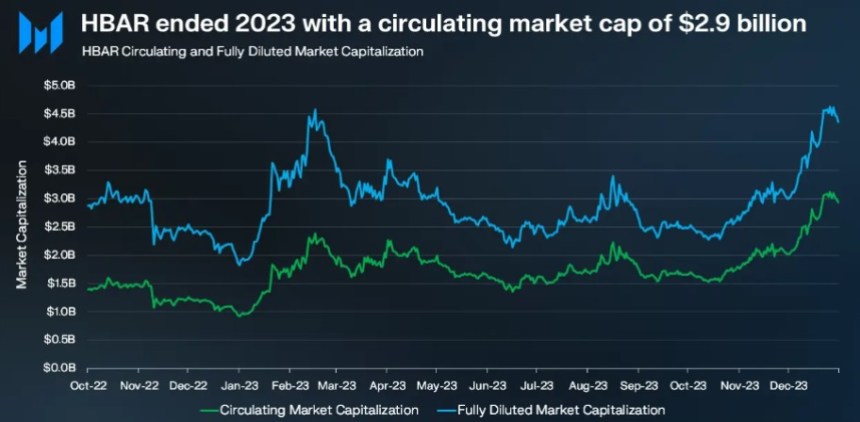

Record-Breaking 164 Million Daily Transactions, Market Cap Reaches $2.9 Billion

Hedera (HBAR), the open-source Proof-of-Stake (PoS) blockchain network, has made significant strides in the fourth quarter (Q4) of 2023, according to a recent report by Messari. The network’s performance showcased notable growth in key metrics, outpacing the crypto market.

Hedera Outpaces Crypto Market With 78% QoQ Increase

During Q4 2023, Hedera’s circulating market cap experienced a 78% quarter-over-quarter (QoQ) increase, reaching $2.9 billion. This growth surpassed the overall crypto market’s growth rate of 54%, signifying Hedera’s growing influence. The year-on-year (YoY) change for HBAR stood at 211%, reflecting the network’s progress and adoption.

In the same line, Hedera Network’s revenue witnessed a substantial 59% QoQ increase, amounting to $1.6 million in Q4 2023, primarily driven by a 66% QoQ surge in transactions, notably propelled by the Hedera Consensus Service.

Furthermore, the revenue generated from Token and Smart Contract Services contributed approximately 14% of the total revenue, exemplifying a healthy distribution in Hedera’s revenue streams.

With a fixed total supply of 50 billion HBAR, Q4 2023 saw 33.6 billion HBAR, or 67% of the total supply, in circulation.

The quarterly distribution of HBAR, reported through the Hedera Treasury Management Report, anticipates an additional 10% of the total supply to be unlocked in Q1 2024, including new ecosystem grants.

While the number of addresses experienced a decline in Q4 2023, with average daily active addresses decreasing by 22% QoQ to 6,600 and average daily new addresses dropping by 39% QoQ to 5,200, there was still substantial YoY growth. Active addresses were up 90% YoY, and new addresses witnessed a 123% YoY increase.

Hedera Network achieved a new record in transaction volume for the sixth consecutive quarter, with an impressive daily average of 164 million transactions in Q4 2023, marking a 66% QoQ surge. The Hedera Consensus Service remained the primary driver of this activity, accounting for 99% of all transactions on the network.

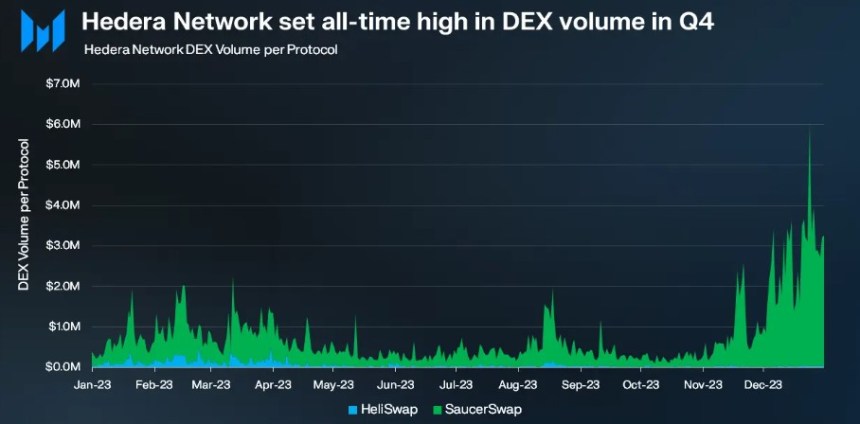

DEX Trading Volume Skyrockets 164% QoQ

In Q4 2023, the Hedera network reported 28 billion HBAR staked, representing 85% of the circulating and 56% of the total supply.

Entities such as Swirlds and Swirlds Labs played a significant role in staking their HBAR allocations, and the Hedera Treasury supported validators in meeting the minimum staking threshold for network consensus.

The Hedera network’s Total Value Locked (TVL) demonstrated positive growth, reaching $64 million by the end of 2023, reflecting a significant YoY increase of 169%. The TVL denominated in HBAR reached 733 million, indicating a 16% QoQ and YoY increase. Interestingly, Hedera’s TVL ranked among the top 40 blockchain networks.

Moreover, Hedera Network experienced a 164% QoQ increase in average daily decentralized exchange (DEX) trading volume, reaching $1.3 million, an all-time high. SaucerSwap dominated DEX trading volume on the Hedera network, accounting for most of the trading activity, as seen in the chart below.

Lastly, the stablecoin market cap on the Hedera network grew by an impressive 73% QoQ, culminating in a year-end total of $6.3 million. Circle’s USDC stood as the sole stablecoin available on Hedera.

The network’s rank in the stablecoin market cap among blockchain networks improved by four spots QoQ, solidifying Hedera’s position in the stablecoin market.

Under current market conditions, the price of HBAR stands at $0.0736, showcasing substantial growth in the past 24 hours, with a 5% increase.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

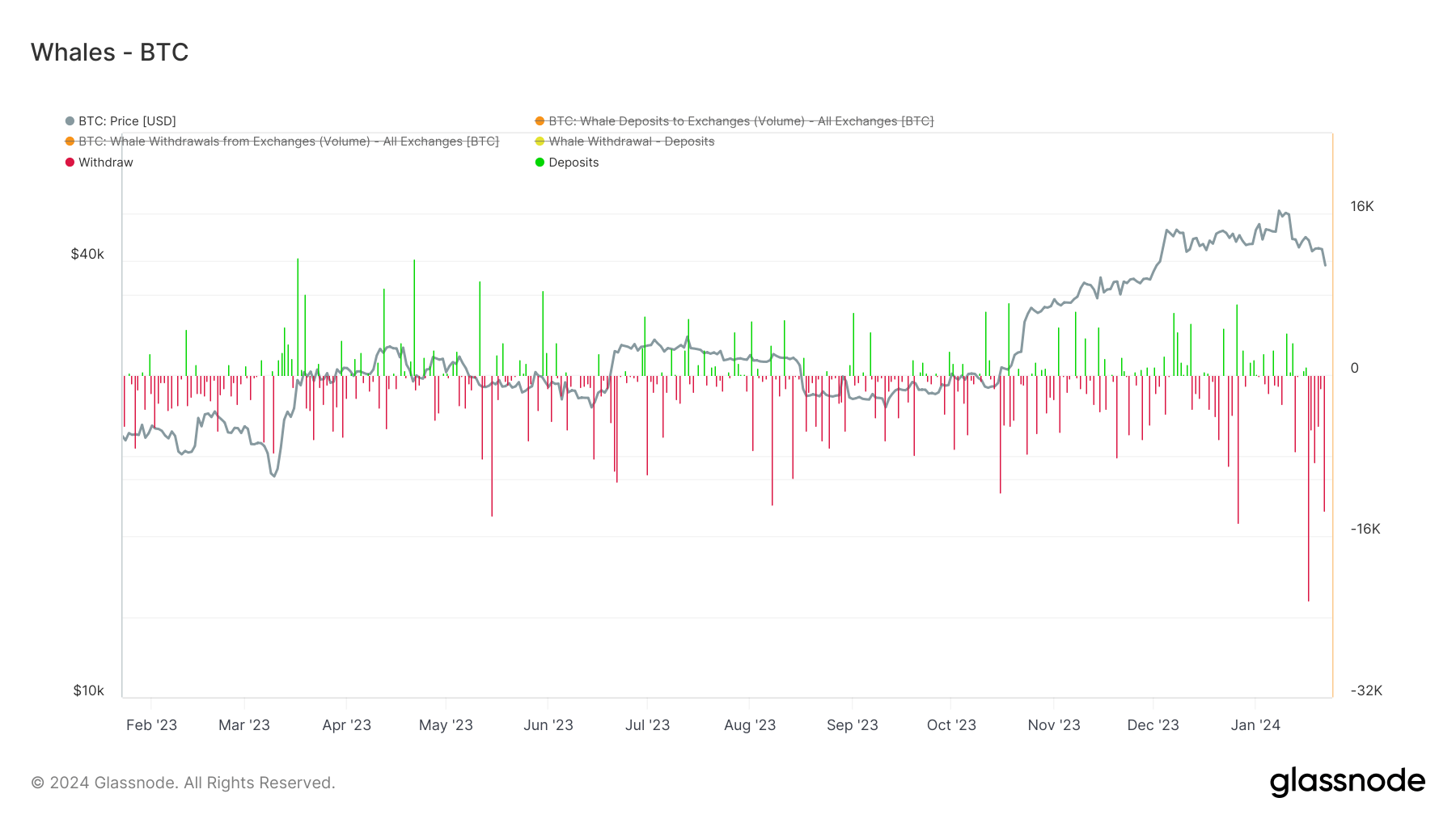

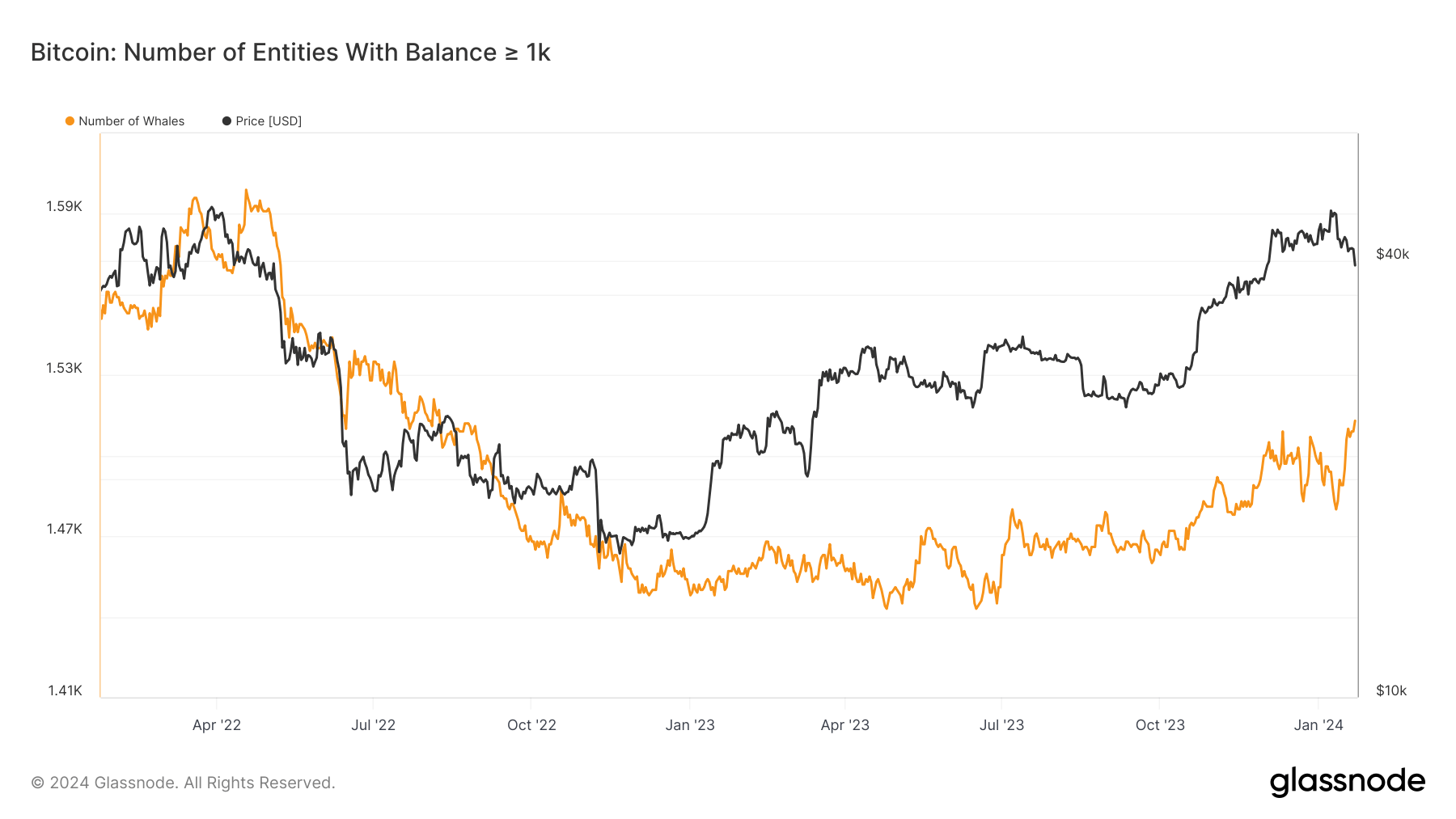

Quick Take

The digital asset landscape is seeing a noteworthy surge in Bitcoin whale activity, as signaled by CryptoSlate’s recent data analysis. Amid a 20% pullback from Bitcoin’s highs, these whales – entities holding 1k BTC or more – appear to be capitalizing on the opportunity to accumulate. A marked uptick in activity reveals a withdrawal of approximately 38k Bitcoin from exchanges, notably surpassing the 24k BTC deposited on Jan. 22. This suggests a penchant for buying, even as the price dips under $40,000.

Withdrawals have been outstripping deposits for six consecutive days. This divergence hit its peak on Jan. 17, with a staggering 22k Bitcoin difference. Jan. 22 witnessed a similar trend, albeit on a slightly reduced scale, with a 13k Bitcoin difference.

This trend of higher withdrawals than deposits suggests that whales are currently more inclined to move their Bitcoin holdings out of exchanges.

Simultaneously, the number of Bitcoin whales is increasing. The count has grown from 1,480 BTC to 1,513 BTC, a measure not seen since July 2022.

The post Surge in Bitcoin whale transactions defies market downturn appeared first on CryptoSlate.

ConsenSys Designs New Smart Routing Mechanism to Streamline MetaMask Transactions

The new routing tech is developed by the ConsenSys-backed Special Mechanism Group (SMG) to enable smart swaps on the MetaMask wallet.

ConsenSys Inc, a private blockchain software technology company that has focused on building web3 infrastructure, is on the verge of releasing a game-changer feature for the MetaMask wallet. According to a report by CoinDesk, MetaMask has been testing a transaction routing feature to enable users to get the best possible connection for token swaps. The new routing tech has been developed by web3 developers from the Special Mechanism Group (SMG), which was purchased by ConsenSys last year.

Notably, the new routing tech is meant to protect users from different challenges associated with token swaps including bot front-running through maximal extractable value (MEV). As a result, the new transaction routing tech can be used by other decentralized financial (DeFi) platforms to ensure every user accesses smart swaps with the best prices once the company releases them for public use.

“We are currently focused on ensuring we have built the best system of its kind in terms of safety, features, performance, and control. Once we are satisfied, everyone in the industry will have a chance to use it for themselves, and will be free to use it how they want,” Jason Linehan, director at Special Mechanisms Group (SMG), noted.

According to Linehan, the new routing technology is not centralized, thus users should not worry about a single entity controlling all the transactions in a given mempool. Furthermore, the new routing tech is intended to be an opt-in feature to give users flexibility in their transactions.

“We have taken such a unique approach with this technology that it doesn’t entirely make sense to call it a private mempool anymore. People tend to think it’s a public mempool if every node sees every message, and a private mempool if only some of the nodes see every message, but why should any node see every message in the first place?” Linehan added.

MetaMask and the Web3 Industry

MetaMask has grown into a mature ecosystem supporting the mass adoption of the web3 industry and digital assets. As of this report, MetaMask boasted more than 100 million global users due to its battle-tested self-custodial approach. MetaMask and other self-custodial wallets like Binance Holdings-backed Trust Wallet gained global recognition mostly after the implosion of FTX and Alameda Research in late 2022.

As a result, existing self-custodial wallets have been working on improving their user experience features to attract more retail investors. Furthermore, secure crypto wallets are the gateway to the vast web3 industry including non-fungible tokens (NFTs), metaverse, gamify, and real-world assets (RWA) tokenization among others.

Market Picture

The cryptocurrency industry is gradually entering the macro bull cycle that will be triggered at an exponential pace by the upcoming Bitcoin halving in April. Additionally, the recent approval of several spot Bitcoin ETFs in the United States has increased investors’ confidence in the future of digital assets.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

The Central Bank of Nigeria (CBN) has lifted the ban on cryptocurrency transactions in the country in a significant reversal of its previous stance.

The change was announced through a circular on Dec. 22. It allows Nigerian banks and other financial institutions to resume operations with cryptocurrency service providers.

The initial ban, imposed in February 2021, was primarily enacted over concerns related to money laundering and terrorism financing risks associated with crypto assets.

New guidelines for crypto

Under the new guidelines, financial institutions are now allowed to open accounts for businesses dealing in virtual/digital assets, but these accounts must be specifically designated for that purpose.

Banks and other financial institutions must comply with the requirements outlined in the CBN’s guidelines when dealing with accounts for crypto-related businesses. Meanwhile, Virtual Asset Service Providers (VASPs) involved in the crypto business are required to be licensed by the Nigerian Securities and Exchange Commission.

While they can facilitate transactions for VASPs, banks, and financial institutions are still barred from trading, holding, or transacting in cryptocurrencies on their own accounts.

The lifting of the ban is expected to significantly impact the Nigerian financial landscape, given the country’s young, tech-savvy population that has shown a keen interest in cryptocurrencies.

According to a report by Chainalysis, the volume of crypto transactions in Nigeria grew by 9% year-over-year to $56.7 billion between July 2022 and June 2023.

While the lifting of the ban opens up opportunities, it also presents challenges in ensuring compliance with international standards for preventing illegal activities. It underscores the need for a balanced approach that encourages innovation while safeguarding against risks.

Shifting tides

Nigeria’s decision aligns with global shifts towards recognizing and regulating cryptocurrencies rather than outright banning them. This reflects an increasing acknowledgment of the potential of digital assets and the need for comprehensive regulatory frameworks.

The Securities and Exchange Commission in Nigeria issued rules in May 2022 to provide a regulatory framework for digital assets and VASPs.

The CBN’s guidelines are in line with international recommendations, such as those from the Financial Action Task Force (FATF), to regulate the use of virtual assets.

The FATF updated its guidelines in 2018, emphasizing the regulation of VASPs to prevent the misuse of virtual assets for money laundering and terrorism financing.

The new rules represent a significant step in acknowledging and integrating cryptocurrencies into Nigeria’s financial system, balancing the need for innovation in digital assets with regulatory oversight to ensure security and compliance.