The U.S. Cities With the Most Cutting-Edge Tech Workers

Source link

U.S

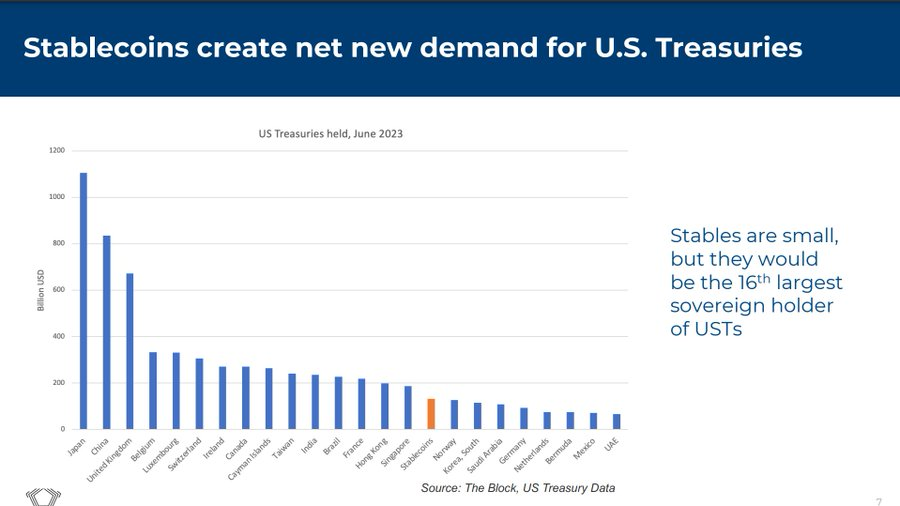

Stablecoin companies now 16th largest holder of U.S. treasuries globally – report

Quick Take

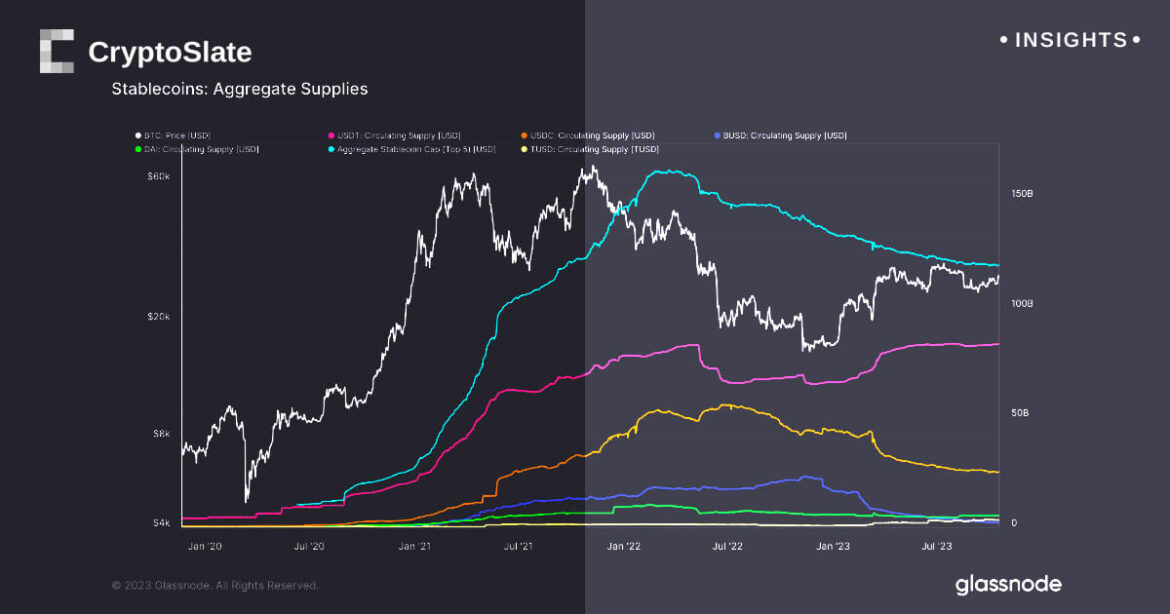

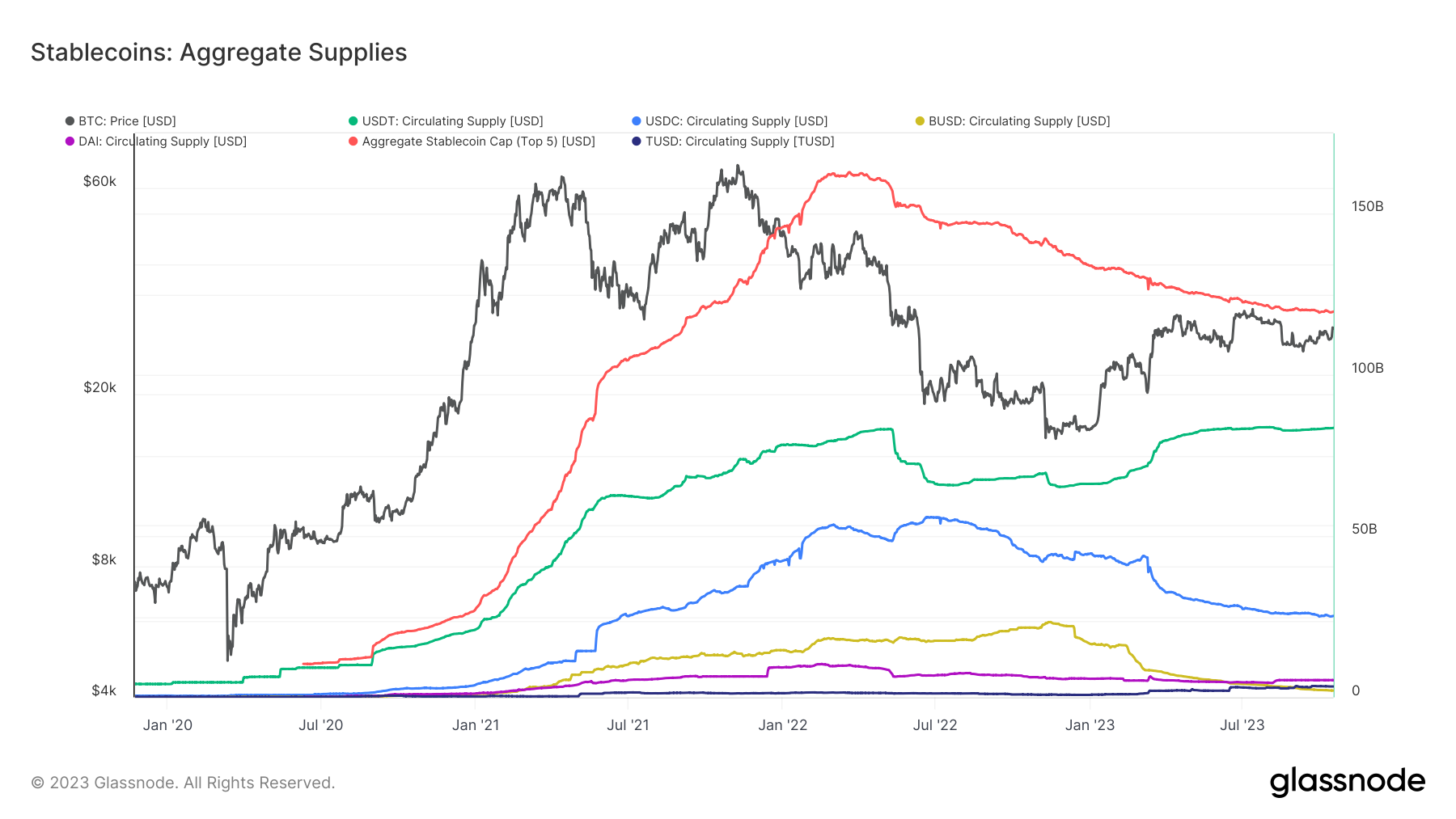

With the aggregate valuation of the top five stablecoins – USDT, USDC, BUSD, DAI, and Tron – currently amounting to approximately $120 billion, stablecoins have become major holders of US Treasuries.

Following concerns over the “cash and cash equivalents” of stablecoin reserves earlier in the current Bitcoin cycle, stablecoin issuers like Tether began migrating to US Treasuries to reduce the risk exposure of reserves.

Tether (USDT) leads the pack with a circulating supply of $83.5 billion, accounting for about 70% of the stablecoin market. Interestingly, this dominance has been on an upward trajectory, while the influence of USDC witnessed a decline from 38% to 21% within 16 months.

This high valuation places stablecoins as the 16th largest sovereign holder of U.S. treasuries, according to Will Clemente’s analysis using The Block’s data. Clemente suggests that as demand for these digital currencies escalates, they could become even more significant.

This evolving trend aligns with CryptoSlate’s analysis conducted in July, which revealed that Japan and China, the two largest foreign holders of U.S. treasuries, have been reducing their holdings. Consequently, if stablecoin demand continues to surge, they could constitute a more critical segment of U.S. treasury holders, accentuating their influence in the global financial market.

The post Stablecoin companies now 16th largest holder of U.S. treasuries globally – report appeared first on CryptoSlate.

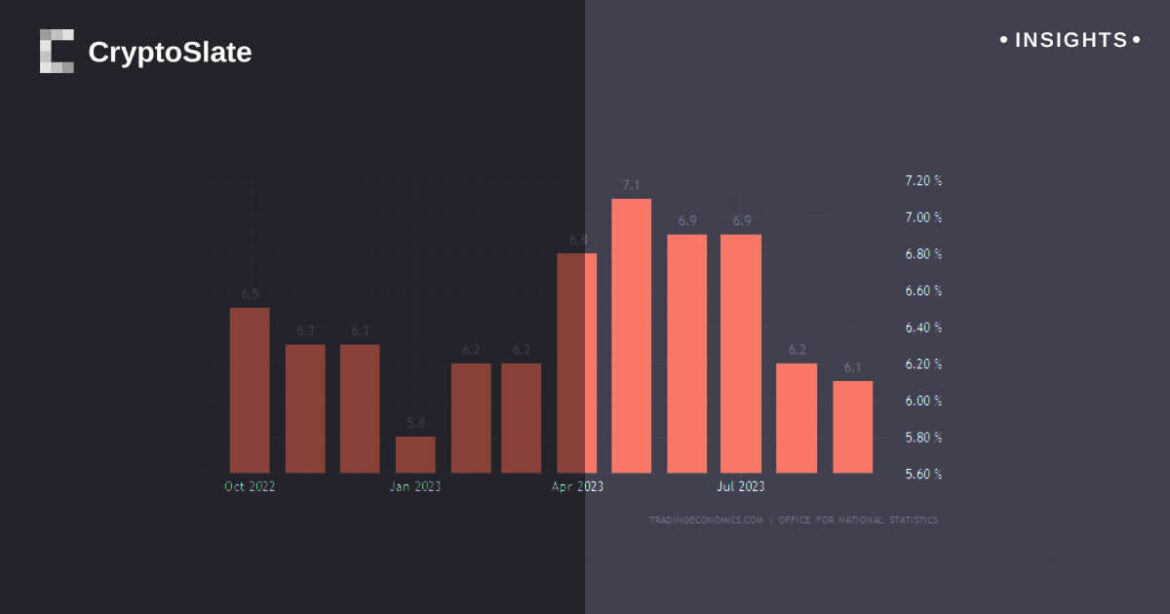

Bank of England wrestles with stubborn inflation as U.S. eyes rate hikes

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Soybeans have become a cornerstone of American agriculture, contributing $124 billion to the U.S. economy in 2022, according to a study conducted by the National Oilseed Processors Association and the United Soybean Board.

“Soybeans’ contribution to the U.S. economy is only increasing day by day,” Himanshu Gupta, CEO and co-founder of ClimateAI, told CNBC.

The legume is hailed as a versatile crop used in food, fuel and animal feed worldwide.

“Soybeans are kind of that wonder crop that has amazing capabilities” Arlan Suderman, chief commodities economist at StoneX, told CNBC.

The U.S. wasn’t always a soybean-producing powerhouse.

“I’m old enough to remember when soybeans were an alternative crop that a few people were playing with back in the 1960s,” Suderman said.

Soybeans were once considered a niche crop before U.S. farmers realized their potential for animal feed, protein use and export value. Farms would see their soybean yields increase.

“The average soybean production in our county 40 years ago, in 1980, was 31 bushels. Today, that same acre produces 51 bushels on average,” Soybean farmer Meagan Kaiser and chair of the United Soybean Board, told CNBC. “Most of the time it’s much higher than that.”

The global soybean market exploded in recent years with U.S. production at the forefront.

For example, in the early 2000s, the U.S. made about $9 billion from all oilseed crop exports combined. By 2021, the cash coming in from soybean exports alone skyrocketed to $26.4 billion, according to the U.S. Department of Agriculture.

However, the U.S. has since lost its dominance, in part, thanks to its reliance on a single export market: China.

China is the largest importer of soybeans in the world, making up about 60% of the total soybean trade. According to data from the USDA, about half of the value of U.S. soybean exports head to China.

This trade relationship turned sour in 2018 as the U.S. entered a tit-for-tat tariff dispute with China, and soybeans were key to that fight.

China would turn to Brazil for soybeans, and now the South American country has become the world’s No. 1 producer and exporter of soybeans.

“Over 30 or 40 years, [Brazil] dramatically increased soybean acreage and production,” Joe Janzen, assistant professor at the University of Illinois and its FarmDoc project, told CNBC.

“Brazil is a relatively low-cost place to produce corn and soybeans,” Janzen said. “The export market is very competitive and we need to be cost competitive with Brazil and Argentina if we want to capture market share.”

The heated international competition has pushed the American market to explore alternative uses for soybeans, including biofuels, renewable diesel and bioplastics.

“In the next 10 years, we’re going to have a whole new generation of farmers … and they’re going to solve [problems] in a more efficient way,'” Kaiser said. “Ways that I probably can’t even imagine.”

Watch the video above to learn more about how the U.S. became a soybean stronghold before falling behind Brazil, the influence of China’s demand and why soybeans are critical for food security and a clean energy future.

Emerging-market stocks are looking cheap, especially relative to the U.S. Does that mean it is time to buy?

Emerging-market stocks are coming off a tough quarter after facing down a triple threat of rising Treasury yields, a stronger U.S. dollar, and a lackluster recovery in China’s economy and markets.

But amid the pain, some see opportunity for a lasting rebound.

The iShares MSCI Emerging Markets ETF

,

which tracks the widely followed MSCI Emerging Markets Index, fell 4.1% during the quarter ended in September, outpacing a 3.7% decline for the S&P 500

,

the deeply liquid U.S. benchmark. Both benchmarks endured their worst performance in a year.

It is just the latest chapter in what has been a decade of persistent underperformance during both good times and bad. The EM ETF fell 22.4% amid the global equity-market rout in 2022, compared with a 19.4% drop for the S&P 500, FactSet data show.

But while the selloff in Chinese stocks has dominated headlines this year, some corners of the emerging markets universe have held up surprisingly well. Greek and Mexican stocks have even outperformed U.S. stocks in dollar terms, while other major markets like Brazil and India are trailing by only a modest margin.

This hasn’t gone unnoticed by Wall Street, where some are advising clients to consider expanding their exposure to markets once deemed too risky for many U.S. investors saving for retirement.

In a research note shared with MarketWatch, a team of equity strategists at Goldman Sachs Group

GS

pointed out that emerging-market stocks excluding China had outperformed developed-market stocks excluding the U.S. so far this year.

Meanwhile, dissatisfaction with lofty valuations in the U.S., well as the prospect of another recession potentially looming around the corner have helped to embolden portfolio managers to seek out better returns elsewhere.

| Country ETF | Ticker | Performance YTD (USD) |

| Brazil | +9.2% | |

| India | +7% | |

| South Korea | +4% | |

| Colombia | +2.5% | |

| Chile | -7.6% | |

| Mexico | +13% | |

| China | -7.6% | |

| Indonesia | -2% | |

| Saudi Arabia | +0.3% | |

| Greece | +22% | |

| MSCI Emerging Markets | +0.8% | |

| U.S. (S&P 500 index) | +13% |

Times are changing

Over the past 10 years, rock-bottom interest rates helped U.S. stocks best practically all comers. During the 10 years through Monday’s close, the S&P 500 has risen 161.8% excluding dividends, while the MSCI ACWI Index

,

a broad index of developed- and emerging-market stocks, gained nearly 74%, according to Dow Jones Market Data.

Emerging markets performed pretty poorly by comparison, with the MSCI EM Index down 9.6%.

But just because EM stocks have lagged their developed-world peers for a decade doesn’t mean they are doomed to repeat this dismal performance forever. Some pointed to the torrid gains for Japanese stocks in 2023 as an example of how a market that trailed the U.S. for decades can see its prospects suddenly brighten.

Japan’s Nikkei 225

NIY00

has risen more than 21% since the start of the year in U.S. dollar terms, according to FactSet.

To that end, a chorus of investment bank equity strategists along with big-name investors like GMO’s Jeremy Grantham have said a similar dynamic could play out in emerging markets.

Equity strategists like Bank of America’s Michael Hartnett and Barclays Emmanuel Cau have urged clients to look beyond the U.S. for returns. According to a research report from Cau and his team, emerging markets offer “better tactical risk-reward.” Hartnett told clients that U.S. stocks appear extremely overvalued compared with the rest of the world, and that it is time to diversify away from the U.S.

“From the perspective of relative performance, the U.S. market has been really strong the past 10 years. It wasn’t like that the prior 20 years, and at some point, a reversion will happen,” said Dina Ting, head of global index portfolio management at Franklin Templeton, during an interview with MarketWatch.

“That is helping to make the case for international markets.”

The bull case for emerging markets

With the possible exception of India, emerging-market stocks generally enjoy much lower valuations compared with their counterparts in the U.S.

That is according to a table of valuations and projected returns shared by analysts at Goldman. Many local equity markets enjoy forward price-to-earnings ratios below 10. By comparison, the S&P 500, considered the U.S. benchmark, presently enjoys a forward price-to-earnings ratio of 18.11, according to FactSet.

| Country | NTM P/E | 12-month return forecast (USD) |

| Brazil | 7.5 | +35% |

| Mainland China | 9.4 | +23% |

| Mexico | 10.7 | +27% |

| India | 20 | +8% |

| Colombia | 4.6 | +55% |

| Egypt | 6.7 | 0% |

| South Korea | 11.1 | 36% |

| Indonesia | 13.8 | +20% |

| Chile | 8 | +37% |

| Saudi Arabia | 14.9 | +13% |

| Total EM | 11.3 | +27% |

Developing economies have more rosy growth prospects, according to the International Monetary Fund, which released its latest batch of projections on Tuesday.

As a group, the IMF expects developing economies to grow by 4% in 2024, compared with 1.4% for a group of advanced economies that includes the U.S.

As Ting and other portfolio managers have pointed out, financials, producers of consumer goods and other industries are accounting for a growing share of emerging-market equity benchmarks. After so many years of being so heavily weighted toward China, and the commodity space, more diversity is seen as a welcome development.

Although few, if any, emerging-market economies enjoy the trifecta of rule of law, deeply liquid capital markets, and institutional independence that investors take for granted in the U.S., progress has been made. Ting cited India as a great example of a country that’s recently made major strides toward becoming more friendly toward international investors.

At the same time, paralysis in the U.S. Congress has raised concerns about potential political instability diminishing the attractiveness of the U.S. As House speakers are deposed and budget battles rage, some on Wall Street expect Moody’s Investors Service could join Fitch Ratings and S&P Global Ratings in stripping the U.S. of its AAA credit rating, as the agency has threatened to do.

Central banks in Mexico, Brazil and India have also had far less trouble tamping down inflation compared with the Federal Reserve, which also bodes well for future equity returns.

“In India and other emerging markets, certainly Brazil and others, their central banks have been much further ahead than the U.S. in fighting inflation,” said Ashish Chugh, a portfolio manager of long-only and long-short global emerging market equity strategies at Loomis, Sayles & Co.

“The U.S. government handed out free money during COVID-19, but these emerging-market countries didn’t do that. They gave out food and other stuff, but they didn’t send checks in the mail. Because of that, you didn’t have as big of an inflation problem.”

A word of caution

While emerging markets have matured in many ways, the sheer number of disparate economies and governments can make risk management difficult. The emerging-market space as defined by MSCI consists of two dozen countries.

Chinese stocks are still the most heavily represented in popular EM equity indexes like the MSCI Emerging Markets index, which is roughly 30% weighted toward the world’s second-largest economy.

Many investors in the West are already familiar with the risks of investing in China, including those emanating from China’s authoritarian system to the fallout from burgeoning geopolitical tensions with the U.S. But the potential pitfalls of investing in India or Brazil may not be quite as well understood.

That is why Zak Smerczak, an analyst and portfolio manager specializing in global equities at Comgest, would advise newcomers interested in the sector to start by investing in only the most established companies, even if their valuations don’t look quite as attractive.

“Being selective is the key,” he said during an interview with MarketWatch. “Making a broad investment in emerging markets right now seems risky to us, but there are pockets of opportunities and in specific companies.”

Consumers buckling for first time in decade: Former Walmart U.S. CEO

The draw of bargains may be fading.

As three of the nation’s biggest retailers kick off a key sales week, former Walmart U.S. CEO Bill Simon warns consumers are starting to buckle for the first time in a decade.

He’s blaming a list of headwinds weighing on consumers including inflation, higher interest rates, federal budget wrangling, polarized politics and student loan repayments — and now new global tensions connected to violence in Israel.

“That sort of pileup wears on the consumer and makes them wary,” the former Walmart U.S. CEO told CNBC’s “Fast Money” on Monday. “For the first time in a long time, there’s a reason for the consumer to pause.”

The timing comes as Amazon begins its two-day Prime Big Deal Days sale on Tuesday. Walmart and Target are trying to compete with their own sales events to get an early jump on the holiday- shopping season.

Simon observes the retailers have a glaring thing in common: The bargains are not as deep.

‘You’re not real proud of your price point’

“They usually say 50-inch TV [is] $199 or something like that. And now, they say 50-inch TV [is] 40% off,” said Simon. “You use percentages when you’re not real proud of your price point. I think you’ve got inflation pushing the relative price points up.”

Shares of Amazon, Walmart and Target are under pressure over the past two months. Target is performing the worst of the three — off 19%.

Simon, who sits on the Darden Restaurants and HanesBrands boards, believes Walmart does have a big advantage over its competitors right now.

“It’s solely because of the food business,” Simon said. “They’re going to have both the eyeballs and the food traffic to probably have a better Christmas than maybe their competitors.”

Disclaimer

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

U.S. stocks see losses accelerate as traders on edge ahead of Friday jobs report

U.S. stocks saw their losses accelerate on Thursday, reversing most of the S&P 500’s gains from its best session in three weeks a day earlier, as Treasury yields whipsawed, keeping investors on edge ahead of Friday’s monthly jobs report from the Labor Department.

What’s happening

-

The S&P 500

SPX

was off by 30 points, or 0.7%, at 4,233. -

The Dow Jones Industrial Average

DJIA

fell by 111 points, or 0.4%, to 33,011. -

The Nasdaq Composite

COMP

declined by 138 points, or 1%, to 13,098.

On Wednesday, the Dow Jones Industrial Average rose 127 points, or 0.39%, to 33,130, snapping a three-day losing streak, while the S&P 500 gained 34 points, or 0.81%, to 4,264 for its biggest percentage-point gain in three weeks, FactSet data show.

What’s driving markets

Treasury yields were volatile in early trade on Thursday, which added to pressure on U.S. stocks as investors digested a batch of fresh economic data ahead of Friday’s all-important September jobs report.

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

was last pegged at 4.73%, near a 16-year high reached earlier this week. Bond yields move inversely to prices.

“I think the momentum is still on the down side,” said Liz Ann Sonders, chief investment strategist at Charles Schwab, in a phone interview with MarketWatch. “There’s nothing specific that you could point to today.”

A weekly report on jobless-claims data showed no sign that layoffs have been increasing. Rising layoffs are seen as a necessary prerequisite for the Federal Reserve to start easing its monetary policy, which has weighed on both stocks and bonds since early 2022. Government data showed the number of Americans who applied for unemployment benefits last week rose slightly to 207,000, but remained near pandemic-era lows.

See: U.S. jobs report forecast: 170,000 new workers and 3.7% unemployment

Investors also received data on the U.S. international trade deficit which suggested some weakness in consumer spending, but analysts chiefly blamed the jobless claims numbers for the impact on yields and stocks.

Rising Treasury yields, particularly on the long end of the yield curve, have been widely blamed for driving the selloff in stocks that has taken place since early August. But as stocks continued to fall on Thursday with no obvious driver in sight, equity strategists see signs of investors simply following the latest trend.

“Financial markets have been rattled in the last few days,” said Bill Adams, Chief Economist for Comerica Bank. “The yield on the 10-year Treasury note has jumped about 0.6 percentage points since the beginning of September, extending a steady march higher since the early summer.”

“There are competing explanations for the surge in interest rates and they have very different implications. Treasury issuance is way up this year with a higher deficit, and the Fed is no longer a buyer; rising interest rates would be the classic warning that the deficit is starting to crowd out private-sector access to capital. But Treasury yields rose in August, too, even though the Federal government ran a monthly surplus in the month.”

“On net the increase in long Treasury yields makes the Fed more likely to choose an earlier peak in short-term interest rates and an earlier pivot to rate cuts in 2024.”

Several senior Fed officials are set to speak on Thursday, including Cleveland Fed President Loretta Mester, who spoke at the Chicago Payments Symposium at 9 a.m., and San Francisco Fed President Mary Daly, who is set to speak in New York at noon. Richmond Fed President Thomas Barkin is set to speak in North Carolina at 11:30 a.m. Eastern.

Choppy trading in recent days sent the Cboe VIX index

VIX,

a gauge of expected equity-market volatility, to 20 for the first time in four months as stocks tumbled. Some analysts see a near-term rebound ahead, but many argue the direction of bond yields remains critical for stocks.

Looking ahead to Friday, economists polled by The Wall Street Journal expect 170,000 jobs were created last month, which would be lower than the 187,000 created during the month prior.

Companies in focus

-

Exxon Mobil‘s

XOM,

-1.70%

shares fell after the company said rising crude prices are likely to boost its third-quarter profit by $1 billion, but thinner margins from chemicals will hurt profits by as much as $600 million. Analysts at RBC say that the update from Exxon is likely to result in earnings above consensus expectations but roughly in line with investor expectations. -

Rivian Automotive Inc.

RIVN,

-19.92%

shares dropped after the EV maker said it plans to offer $1.5 billion worth of “green” convertible senior notes due in 2030, and issued preliminary sales estimates that met Wall Street’s expectations. Rivian stock rose by 9% on Wednesday. -

Clorox Co. shares

CLX,

-7.38%

fell after the company cut its outlook following disruptions caused by a cyberattack first reported in August.

The U.S. stock market saw a rise in common dividends in the three months through September, although companies appeared “cautious,” according to S&P Dow Jones Indices.

“Dividend payments picked up in the third quarter,” bouncing back from their second-quarter decline, said Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, in a note emailed Wednesday. The rise was bolstered by T-Mobile US Inc.’s

TMUS,

$3.1 billion dividend initiation and Microsoft Corp.’s

MSFT,

$2.1 billion increase in dividends, according to Silverblatt,

“Absent these two increases,” he said, the quarterly rise points to “a cautious corporate approach to longer-term dividend commitment” that to him seems justified in the short term “given the acceptance of higher-for-longer interest rates,” their impact on consumer spending and uncertainty surrounding the economy.

Bond yields have risen steadily since May this year and jumped further in the past 10 days as investors have been anxious about the Federal Reserve potentially holding its policy interest rate higher for longer as the U.S. economy chugs along with inflation still running above its 2% target.

Silverblatt pegged the S&P 500’s dividend yield at 1.63% on the last trading day of September. Real-estate and utilities stocks offered the highest dividend yields among the index’s 11 sectors at the end of the third quarter, at 3.89% and 3.72%, respectively, data he provided in the email shows.

But those yields are below what investors have been able to get in the U.S. Treasury bond market.

“Why own any dividend equity for the dividend” when a T-bill yields more than 5%? said Matthew Tuttle, chief executive officer and chief investment officer of Tuttle Capital Management, by phone Wednesday. “I get equity risk and a subpar yield.”

Read: Utilities stocks ‘decimated’ by rising rates fall into uncommon trading territory, Bespoke chart shows

The U.S. stock market slumped in the third quarter.

The S&P 500’s utilities

XX:SP500.55

and real-estate

XX:SP500.60

stocks are the index’s worst-performing sectors this year. Based on Wednesday afternoon trading, the utilities sector has plummeted almost 20% in 2023 while real estate was down nearly 11% over the same period, according to FactSet data, last last check.

Meanwhile, the yield on the two-year Treasury note

BX:TMUBMUSD02Y

was trading around 5.08% on Wednesday afternoon. Six-month T-bills

BX:TMUBMUSD06M

were yielding 5.57%, according to FactSet data, at last check.

Read: Here is the area bond-ETF investors favored in September as yields jumped

The U.S. stock market was trading mostly higher on Wednesday, as investors weighed an estimate from ADP that private-sector job growth slowed in September more than Wall Street expected. The S&P 500

SPX

was up 0.3% in afternoon trading, while the Dow Jones Industrial Average

DJIA

dipped 0.1% and the Nasdaq Composite

COMP

advanced 0.9%.

“Absent an economic event, I would expect a record dividend payment for the S&P 500 Q4 period as large caps appear to be weathering the uncertainties better than others,” Silverblatt said. “For 2024, I expect companies to remain cautious over both consumer and government spending, and consider any impact of the political environment.”