“I would be partially unretired.”

Source link

work

Disney upends activist investor Nelson Peltz. Now it’s real work time

Bob Iger, CEO, Disney at the Allen & Company Sun Valley Conference on July 11, 2023 in Sun Valley, Idaho

David A. Grogan | CNBC

Disney shareholders overwhelmingly voted to keep the company’s current board intact during Wednesday’s annual meeting, suggesting they believe current CEO Bob Iger has a plan to boost shares and install a strong successor.

Now, Iger will have to prove it, or he risks facing yet another activist campaign this time next year.

Iger can show progress in a number of areas over the next 12 months. That starts with turning his streaming services into a profitable unit, explaining ESPN’s digital strategy, scoring some box-office hits and picking a successor with a transition plan.

If Disney struggles to show investors the entertainment giant has a coherent strategy, or if Iger kicks the succession can down the road once more, activist investors may be knocking on the company’s door again during next year’s annual meeting to demand change.

“They still have the same problems they’ve had before, which are really industry problems,” said TD Cowen analyst Doug Creutz. “Direct-to-consumer streaming is just economically inferior to the old linear bundle model, which is going away. They have to try to manage through that.”

Peltz told CNBC on Thursday that he would not wage another proxy fight if Iger shows progress on his key priorities.

“I hope Bob can keep his promises,” Peltz said Thursday. ” I hope they can do all the things they assured us they were going to do. I’ll watch and wait. If they do it, they won’t hear from me again.”

‘Turning Red’ … to black

Still from Pixar’s “Turning Red.”

Disney

Disney said earlier this year it plans to turn a profit in its streaming TV businesses in its fiscal fourth quarter this year.

That would mark a milestone for the company, which launched Disney+ on Nov. 12, 2019. It would be the first time Disney showed it can make money from Disney+, Hulu and ESPN+.

Disney will need to sustain and grow streaming profit to justify Iger’s five-year-old strategy to go “all in” on the segment.

Iger’s confidence that Disney will make streaming profitable by the end of the fiscal year stems from draconian cost-cutting on content, which includes new movies, sports rights spending and TV production. Disney said in November it was targeting an “annualized entertainment cash content spend reduction target” of $4.5 billion.

“What they have to do next is fix the streaming losses,” said Needham & Co. analyst Laura Martin. “They still need to cut costs on the streaming side to get to profitability.”

ESPN’s strategy

Disney has set up a two-pronged digital strategy for ESPN. For decades, Disney reaped billions by keeping ESPN exclusive to the cable bundle.

Those days are nearly over.

In the fall of 2024, Disney plans to launch a skinny sports bundle that includes ESPN’s linear network, along with sports channels from Warner Bros. Discovery and Fox. The yet-to-be-priced digital streaming service will likely cost about $45 or $50 per month, CNBC reported in February. Disney owns one-third of it.

ESPN will then debut its own flagship streaming service in the fall of 2025. It will include new personalized features that cater to sports bettors and fantasy sports players. The Athletic reported last month that service is likely to cost $25 or $30 per month.

Disney risks confusing consumers with its multiple offers and will need to roll out its new products with clear messaging. Disney has already offered ESPN+, a sports streaming service that has some but not all of ESPN’s content. That costs $10.99 per month and can be bundled with Disney+ and Hulu.

The Disney+ website on a laptop in Brooklyn, New York, on July 18, 2022.

Gabby Jones | Bloomberg | Getty Images

ESPN will also stay an essential part of the cable bundle. Subscribers will want to know what they’re paying for and what content they do and don’t get with their additional subscription dollars.

Box-office turnaround

Disney has been mired in a yearslong box-office slump, from live-action flops to Pixar disappointments, from Marvel fatigue to the absence of Star Wars (the last movie released in theaters came in 2019).

Disney hired David Greenbaum, previously co-president of Searchlight, on Feb. 26 to take over as president of Walt Disney Motion Picture Studios, replacing Sean Bailey. He’ll report to Disney Entertainment co-Chairman Alan Bergman, who is on the hot seat to change the division’s fortunes.

Other than 2022′s “Avatar: The Way of Water,” which Disney acquired as part of its $71 billion deal for the majority of 21st Century Fox, the company has not had a movie generate more than $1 billion since the last Star Wars release in 2019, according to data from Comscore. Sony produced and distributed “Spider-Man: No Way Home,” which made $1.9 billion, although Disney’s Marvel Studios did serve as a co-producer.

Several big-budget franchise films have flopped. “Indiana Jones and the Dial of Destiny” in 2023 generated $378 million globally. “Ant-Man and the Wasp: Quantumania” secured $476 million worldwide, unusually low for a Marvel film (until “The Marvels” reached just over $200 million late last year). And Pixar’s “Lightyear” collected less than $250 million globally in 2022.

Trian Partners’ Nelson Peltz, who failed to join Disney’s board Wednesday after securing just 31% of the vote, publicly questioned what he has called Disney’s “woke” content strategy. The company’s creative team has actively sought to create films and television shows centered on people of color as well as exploring narratives outside heteronormativity.

“People go to watch a movie or a show to be entertained,” Peltz said in an interview with the Financial Times. “They don’t go to get a message.”

Iger said Wednesday that while the company wants to instill positive messages into its content, that shouldn’t be the first priority.

“Our job is to entertain first and foremost, and by telling great stories,” Iger said during the company’s annual shareholder meeting. “We continue to have a positive impact on the world and inspire future generations, just as we’ve done for over 100 years.”

Success on succession

The biggest existential question for Disney is who follows Iger as CEO. This was Trian’s strongest argument to land Peltz a board seat. Iger has five times pushed back his retirement as CEO, and when he did leave in 2020, he stuck around as chairman for 22 months, butting heads with his successor Bob Chapek as the two jockeyed to co-run the company during the pandemic.

Iger returned in late 2022 as the CEO when the board fired Chapek. Iger’s plan to hand over Disney to a new leader has been to name a successor in or around early 2025 and then stick around to teach that person the job, CNBC reported last year.

He’ll want to make sure that person is prepared to run an expansive company, with a flourishing parks business, a declining legacy TV unit, a still young streaming division, and a struggling but legendary movie studio. Internal candidates include Bergman, ESPN Chairman Jimmy Pitaro, Parks and Resorts Chairman Josh D’Amaro, and Disney co-chairman of entertainment Dana Walden, who could be the first female CEO in the company’s 100-year history.

“The problem is how do you replace Bob Iger? They’ve been trying to do it for 10 years, and it’s very difficult for multiple reasons,” said TD Cowen’s Creutz. “Bringing someone from the outside into Disney, which has a very strong, unique culture, is risky. Then you’re down to internal candidates, and if there isn’t anyone internally you think can step into the role, you’ve got a problem.”

The board has now been given the greenlight to proceed with its search process. That’s a win for Iger, and shareholders voted Wednesday they believe it’s a win for them, too.

— CNBC’s Sarah Whitten contributed to this report.

Don’t miss these stories from CNBC PRO:

WATCH: Disney still needs to cut costs on streaming side to get to profitability, says Needman’s Martin

I Have $1 Million and Want It to Work for Me. How Do I Maximize Passive Income and Minimize Taxes?

I have a million dollars and I want to put it to work for me. Where can I put it to make the most amount of passive income from it? Also, how can I minimize taxes on that to be able to keep more of that money?

– Andrea

While today’s high-interest rate environment has been challenging in many respects, the silver lining is that investors seeking to earn passive income can do so more easily than they could at any point since the global financial crisis of 2007-2009.

Before laying out some options to capitalize on prevailing yields and considering the associated tax consequences, it’s helpful to evaluate your existing financial picture and ask yourself some important questions that will impact where you put the money. (A financial advisor can help you do both and this tool can help you match with one.)

Evaluate Your Financial Situation

Investing your $1 million dollars with an eye toward generating passive income may very well be the best option for this money. However, rather than viewing your decision in a vacuum, I would recommend looking at the money in the context of your broader financial situation and longer-term goals. In particular, it might be helpful to consider the following questions:

-

Your total assets: Do you already have a portfolio of investments? Where are those assets located and what are their tax implications (e.g., IRA, Roth IRA, 401(k), brokerage account)?

-

Your work status: How many more years will you have an income to add to your assets?

-

Other income: Do you have any other sources of income (Social Security, pension, etc.)?

-

Purpose for generating passive income: Are you retired and seeking to fund your ongoing expenses? Or is it to provide supplementary income while the rest of your portfolio continues to grow?

-

Growth vs. income: Are you willing and/or able to sacrifice growth and preservation of purchasing power for the sake of income? If income is the only goal or need, then expectations for growth and your ability to maintain the purchasing power of the assets should remain low.

It is possible that after thinking through these questions you might pursue a different goal for the money. (And if you need more help assessing your financial situation, consider speaking with a financial advisor.)

Options for Generating Passive Income

Given the rise in interest rates since March 2022, income-oriented assets have become more attractive for those looking to earn a reasonable yield from their investments. Building a portfolio that includes a variety of assets capable of generating an aggregate yield is often a sound approach, as opposed to investing in a single product or security. While a financial advisor can help you build a robust portfolio, here are a few options to consider:

Money Market Funds

While generally considered an alternative to holding cash in a savings account, money market funds have become a popular topic among investors amid rate increases. Prior to the Federal Reserve’s recent series of rate hikes, money market yields were close to 0%, meaning you effectively earned no interest on your investment. Today, however, yields are closer to 5%, making this a much more compelling option for generating low-risk income.

Municipal Bonds

Municipal bonds are another solid option for income-focused investors. As with any investment, you’ll want to consider your goals before investing in municipal bonds since the risk profile and income potential will vary across securities. Evaluating credit ratings and maturities in relation to the yield you expect to earn in exchange for taking on credit and duration risk is a necessary step to take. Because they are typically not subject to federal taxes (or state taxes in the state where they are issued), municipal bonds tend to be a tax-efficient investment.

Certificates of Deposit

Like money market funds, certificates of deposit (CDs) have gained popularity as rates have increased. CDs can be particularly attractive if you do not need to liquidate the investment over its intended time horizon since you generally will pay a penalty for early withdrawals. It is therefore important to align a CD’s maturity date with the date at which you expect to need the money back.

Dividend Stocks

If you will need some growth to accompany the passive income your money generates, you may want to consider investing in dividend stocks. The S&P 500 High Dividend Index was paying a dividend yield in excess of 5% as of the end of September, making it competitive with other options listed. Unlike fixed-income products, dividend stocks will typically provide more opportunity for appreciation, which may help you maintain purchasing power over time if that’s a concern.

Other Options

Of course, there are additional options for generating passive income. These include Treasuries, high-yield bonds, master limited partnerships (MLPs), real estate investment trusts (REITs) and many others. Before committing to each, consider the level of risk you are able and willing to take, the amount of income you will need, and whether some element of growth is necessary. Also, evaluate the tax implications of the investments you choose. (And if you need more help evaluating and selecting investments, consider matching with a financial advisor.)

Mitigate the Impact of Taxes

Each of the options cited above is treated differently for tax purposes. The interest earned by fixed-income securities is taxed at ordinary income tax rates. Taxes on dividends from equity securities depend on how long you own the asset – qualified dividends are taxed at long-term capital gains rates while ordinary dividends are taxed at ordinary income rates. Appreciation from equity securities is taxed at capital gains rates.

It’s important to understand the tax treatment of individual assets since that will play a role in determining the type of account that holds these assets. Generally speaking, owning individual stocks and bonds, as well as their passively managed index alternatives, is more tax-efficient than actively managed mutual funds. Therefore, it’s typically advisable to own individual stocks, bonds and index funds in taxable brokerage accounts. Tax-advantaged accounts like IRAs and 401(k)s, and after-tax Roth IRAs, are generally more suitable for your actively managed funds and less tax-efficient securities like high-yield bonds.

Thinking holistically about the assets you own and where to allocate them will ultimately help you mitigate taxes. Of course, it can be helpful to speak with your tax advisor to better understand the impact on your individual situation, given your specific tax brackets. (Consider matching with a financial advisor with tax expertise.)

Bottom Line

Positioning your assets for passive income generation is a sound strategy, but only if it aligns with your long-term financial needs and goals. Before committing to this approach, critically assess your personal situation and the rationale behind seeking passive income. From there, you may consider various fixed-income products like bonds and CDs, as well as equity securities like dividend-paying stocks. Each option has its own tax consequences, and the type of account the securities are held in will also have an impact on taxes.

Tips for Generating Passive Income

-

A CD ladder is one way to capitalize on today’s high-interest rate environment while also generating income. The strategy calls for opening multiple CD accounts, each with varying maturity dates. The idea is that you’ll always have a CD reaching its maturity date and paying out interest. Here’s a look at today’s CD rates.

-

A financial advisor can help you decide which investments are most aligned with your financial goals. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Jeremy Suschak, CFP®, is a SmartAsset financial planning columnist who answers reader questions on personal finance topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Jeremy is a financial advisor and head of business development at DBR & CO. He has been compensated for this article. Additional resources from the author can be found at dbroot.com.

Please note that Jeremy is not a participant in the SmartAdvisor Match platform, and he has been compensated for this article. Some reader-submitted questions are edited for clarity or brevity.

Photo credit: ©iStock.com/Viorel Kurnosov, ©iStock.com/Sam Edwards

The post Ask an Advisor: I Have $1 Million and Want It to Work for Me. How Do I Maximize Passive Income and Minimize Taxes? appeared first on SmartReads by SmartAsset.

Warren Buffett Proposed A Way To Ensure ‘Anybody Who’s Willing To Work 40 Hours A Week Has A Decent Living’ — And It Wouldn’t Cost Employers Anything

In a 2016 interview with CNN, famed investor Warren Buffett shared insightful views on the state of the economy, the distribution of wealth and the mechanisms through which a fairer economic system could be achieved. Buffett’s observations came years before concerns over inflation intensified. Given that the federal minimum wage has remained unchanged at $7.25 since 2009, his proposals for ensuring a livable wage have become increasingly relevant today.

Buffett emphasized the disparity within the American economy, noting, “We’re in an economy where specialized talents bring incredible sums and where if you’re a little bit where you really don’t fit well into the market system you are left behind.”

This statement underscores the growing divide between the highly skilled and those struggling to find their place in the economy.

When asked about the need for a more inclusive form of capitalism, Buffett pointed to the Earned Income Tax Credit (EITC) as a vital tool for economic adjustment. He advocated for a significant expansion of the EITC, suggesting that while no single measure can solve all problems, targeted adjustments can alleviate economic disparities. Buffett’s stance highlights a preference for government intervention over wage adjustments by businesses, arguing that meddling with the market system through enforced wage increases could lead to decreased employment.

Don’t Miss:

-

Investing in real estate just got a whole lot simpler. This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

-

Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Buffett’s insights on the minimum wage debate are particularly notable. He argued against the necessity of a higher minimum wage, instead proposing a minimum income achieved through a combination of employer wages and government supplements like the EITC.

“We have to make sure that in a super-rich country, anybody who’s willing to work 40 hours a week has a decent living,” Buffett said. He cautioned against setting unrealistic wage floors that could exclude millions from the workforce because of a lack of necessary skills.

When probed on why the responsibility for ensuring a minimum income should fall on the government rather than on businesses, Buffett offered a pragmatic perspective. He explained that imposing higher wage requirements on businesses could disrupt the market system and lead to a reduction in employment.

“If you tell me I’ve got to run a business that pays $15 an hour in many industries, I’m going to employ fewer people than before,” he said. “I don’t want to employ fewer people; I just want that person to make $15 an hour.”

This view suggests that while businesses play a critical role in the economy, government intervention through mechanisms like the EITC could provide a more effective and less disruptive means of ensuring that workers achieve a decent living without compromising employment levels.

The crux of Buffett’s argument is not against capitalism or the market system but rather on how the benefits of economic growth are distributed. He acknowledged the efficiency of the market system in generating wealth but called for adjustments to ensure fairer distribution. This vision involves not a fundamental overhaul of capitalism but targeted reforms to address specific inequities.

Buffett’s perspective on economic reform, focusing on the EITC rather than mandated wage increases, offers a nuanced approach to addressing income inequality. It underscores the importance of balancing market dynamics with social policies to ensure that economic growth benefits a broader section of society. As discussions on economic policy continue, Buffett’s 2016 interview remains a compelling point of reference for understanding the challenges and potential solutions in creating a more inclusive economy.

Read Next:

Image courtesy of Fortune Live Media on Flickr

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Warren Buffett Proposed A Way To Ensure ‘Anybody Who’s Willing To Work 40 Hours A Week Has A Decent Living’ — And It Wouldn’t Cost Employers Anything originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I lost $11,300 to identity fraud. What I learned: Usual safeguards don’t work.

“Looks like someone is trying to take more than $10,000 from us.”

That’s the message my husband typed to me on a Monday morning in October. By the time I wrote back, he was on the phone with our bank. The weekend before, someone walked into a bank branch, pretended to be one of us, and took thousands of dollars from our checking account.

We joined the tens of millions of Americans who each year are victims of identity fraud, where criminals steal a bank or credit card number and use the personal information to achieve illegal financial gain.

We were lucky in so many ways, most notably that our bank reimbursed our losses within 36 hours.

What we learned is this: The many steps we take to safeguard our personal data don’t always work.

Experts suggest creating strong passwords with extra layers of authentication, changing them often, and not using the same one on multiple accounts.

Having text alerts on your credit and debit cards for all transactions can also thwart illegal activity in real time, as can email alerts when someone tries to change an email or address associated with your account.

You should do all these — and we did — but they wouldn’t have prevented the fraud we experienced. Our data was already out there for the picking.

Hacks that expose the personal financial information of Americans soared to a record high of 3,205 in 2023, according to the nonprofit Identity Theft Resource Center. That total includes breaches of companies across many industries such as healthcare, utilities, financial services, and transportation.

A well-known example of this was the massive Equifax data breach in 2017 that affected 147 million Americans — including us. That motivated us to freeze our credit reports at Equifax, Experian, and TransUnion.

“At this point, all of our information is out on the dark web,” Suzanne Sando, senior analyst for fraud and security at Javelin Strategy & Research, told me. “It’s now just a matter of when is it going to be used against me.”

‘Huge time suck’

Here’s what else we learned: Knowing how to respond to one of these frauds after they happen is also crucial — and time consuming.

Because of my past reporting on this subject, I knew we needed to act quickly. We checked our other accounts — bank, credit, and retirement — for any suspicious activity. There was none. We then met up at our local bank branch to shut down the old account, establish another, and identify which upcoming transactions to allow to go through.

It took more than two hours, and we weren’t close to done.

“Fixing a run-in with identity fraud, it’s a huge time suck,” Sando said, “and people don’t necessarily have the time to do it.”

My husband fortunately was able to take the day off and spent the afternoon undoing automatic transactions from the old account and rerouting them to the new one. I also took off the day from work and headed to our local police precinct to file a report to provide to other financial institutions if the fraud followed us elsewhere.

Our local precinct took our report immediately. That’s not often the case for identity theft, according to Identity Theft Resource Center CEO Eva Velasquez, because it’s so hard to solve these cases.

Several factors worked in our favor, she said. In New York, the total amount stolen — which ended up being $11,300 — made the crime a Class D felony, which includes thefts of more than $3,000 but less than $50,000.

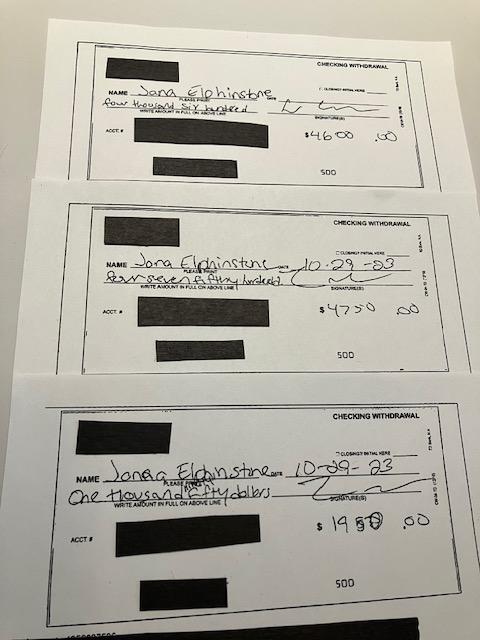

The bank also gave me copies of the withdrawal slips, which became critical evidence. The criminal made the withdrawals under my maiden name, albeit misspelled on each slip. It’s a name that hadn’t appeared on my checking account for well over a decade.

The slips also showed where the withdrawals occurred: three bank branches in south New Jersey — nowhere near New York City, where we bank regularly. That meant the perpetrator was likely captured on surveillance tape at the bank.

“I’m sure that played into their increased willingness to give you the report,” Velasquez said of the police, “and to make that a priority.”

Getting that report was more than many fraud victims receive. But five months later we still don’t know how this happened or who did it.

A detective assigned to the case told me about a month ago that the police department was working on issuing a subpoena for the security cameras in the bank branches. When I visited the precinct on Friday for another update, the detective was in court and unavailable.

“We need more streamlined processes so that people know where to start,” Velasquez said, “and they don’t have to relive this nightmare over and over.”

It’s a nightmare that more and more people are forced to face. Almost 7 in 10 people said they had previously been the victim of an identity crime, according to a general population survey of 1,048 people that ITRC conducted last year.

A survey of 144 ID theft victims who reached out to the nonprofit in 2022 found that almost two-thirds said their issues were still unresolved months after discovering the fraud.

The lasting impact of identity fraud

Like so many things in life, the impact of identity fraud often depends on the resources available to you.

“Some people will look at a $100 loss and go, ‘That sucks, but it’s not that big of a deal’… and other people will say, ‘This is going to derail everything, that was all that I had left after I paid my bills to buy groceries. I can’t feed my family. I can’t keep the lights on,'” said Velasquez, the ITRC CEO.

We were fortunate. We had a financial cushion to fall back on if we had not gotten our money back as quickly as we did.

Still, we encountered hassles. We spent the next weeks getting late fees and interest charges waived because some bill payments were denied. We also had to scramble to make sure a maturing CD was deposited into the new checking account, rather than the old one.

But the financial fallout was largely limited.

That’s not how it always is for many people who have their credit histories ruined, loans denied, and employment opportunities lost due to the lingering effects of fraud. After all, the type of fraud I experienced cost 15 million Americans $24 billion in losses in 2021, according to Javelin’s latest data.

And there’s the emotional side, too. For me, it’s unnerving to think that someone is walking around impersonating me. Could it happen again? Possibly.

The ID theft victims ITRC surveyed often reported feeling violated and having trust issues — and 16% considered suicide, up by double since 2021.

“The emotional impacts are increasing,” Velasquez said. “People are feeling even more vulnerable and unable to recover.”

Janna Herron is a Senior Columnist at Yahoo Finance. Follow her on Twitter @JannaHerron.

93% ghost interviews and 87% have not even shown up for their first day of work

Ghosting isn’t just for dating anymore. Now Gen Z are treating their would-be employers like bad dates and not showing up for job interviews or their first day on the job without as much as a phone call.

Employment website Indeed surveyed 1,500 businesses and 1,500 working people in the U.K. and found that job ghosting is rife, with 75% of workers saying they’ve ignored a prospective employer in the past year.

But the youngest generation of workers are by far the worst offenders.

A whopping 93% of Gen Zers told the global recruitment platform that they’ve flaked out of an interview.

Worse still, a staggering 87% managed to charm their way through interviews, secure the job, and sign the contract, only to leave their new boss stranded on the very first day.

Their reason for doing so? According to the survey, it makes them “feel in charge of their career”.

But it’s having the opposite effect on businesses left high and dry: More than half of businesses surveyed have said that ghosting has made hiring more difficult.

Businesses and millennials are at it too

Although Gen Z are the biggest culprits, baby boomers, Gen X, and millennials aren’t off the hook: Indeed’s data found that everyone is guilty of ghosting occasionally.

Almost half of those surveyed said they plan on pulling a disappearing act again, with a third deeming it acceptable to do so before an interview.

However, unlike Gen Z who feel emboldened by blanking bosses, older workers say they instantly regret it.

Millennials, for example, are most likely to feel anxious after ghosting and worried that ghosting will negatively impact future opportunities.

What’s more, while more than half of Gen Zers are repeat offenders, the researchers found that a candidate’s likelihood to ghost again decreases with age.

Even businesses are joining in: One in five workers complained that a prospective employer has failed to show up for a phone interview, while 23% have been provided with a verbal offer only to be left hanging.

It’s why workers today think that ghosting is fair game: More than half agree that since employers ghost job seekers, it’s okay to do it back.

And, perhaps surprisingly, over a third of companies agree that this sentiment is reasonable.

The data confirms suspicions—and offers a solution

For many employers, Indeed’s data will finally confirm their suspicions that Gen Z has commitment issues.

Towards the end of last year, an MIT interviewer and finance CEO was so fed up with young candidates not showing up for their interviews that she ranted about it on X—and the now-deleted post went viral.

“One no-showed after picking the time on my calendar,” Christina Qi, CEO of the financial services firm Databento and an MIT board member wrote. “Look, I know college isn’t for everyone, but this 1 meeting could affect where you go for these next 4 years of your life.”

Like MIT, Britain’s Office for National Statistics (ONS) similarly found that Gen Z is hard to pin down.

The government body was forced to scrap key employment data because young people didn’t bother responding to its telephone surveys.

If employers want to get a hold of Gen Z, Indeed’s data says they should sweeten the deal: When suggesting ways employers could prevent being ghosted, workers ranked higher pay first, followed by better benefits.

Indeed found that the cost-of-living crisis has exacerbated ghosting, with around 40% of those surveyed admitting that they’re more likely to ghost if they find a job offering better pay or a cheaper commute.

Ultimately, it’s not just about getting the job. For young workers, it’s also about being able to afford to accept the offer.

Gen Zers are being forced to turn down the roles because they can’t foot the bill for the expenses associated with starting a new job, like buying work-appropriate attire and a monthly train ticket.

“It’s clear that the financial offer is the biggest carrot for employers trying to attract talent, with pay, benefits and other factors that support the rise in cost-of-living likely to prevent a jobseeker from ghosting,” concluded Indeed’s U.K. head of talent intelligence, Danny Stacy.

“Of course, not all businesses will be in the position to increase their offer, but being transparent about the financial package from the outset is likely to prevent jobseekers from ghosting further along the hiring process.”

This story was originally featured on Fortune.com

Welcome to my new weekly column, Core Corner. This feature is focused on Core Blockchain (XCB), a layer-1 ecosystem attempting to reshape the decentralized digital landscape.

Last year, I met with the chain’s core developers, CoDeTech, and produced this short documentary on the development up to that point. Since then, the team has launched the first applications on the network, notably the CorePass ID digital identity wallet and Ping Exchange, a peer-to-peer CEX trading from hybrid cold storage wallets.

Core Blockchain XCB Ping and CorePass launch.

One of the most interesting choices for Ping was to remove market makers from the equation, meaning every trade is between two real traders with no synthetic volume or orders. CEO Ockert Loubster said on X,

“Trading on a hybrid decentralized exchange (DEX) like Ping exchange, which operates without market makers and is driven purely by person-to-person (P2P) trading, offers a unique approach to buying and selling digital assets.”

From what I’ve seen, the decision to launch without market makers aligns with CoDeTech’s continual approach over the years of its development. When presented with two options, one commercially advantageous and the other less so but aligning with a P2P, decentralized, self-sovereign ethos, they always choose the latter, and much harder, option.

It’s likely for this reason that the blockchain has gone under the radar by much of the Web3 world and why I refer to its development as being in ‘public stealth.’ While it has been building in public for years, it has done so without utilizing the methods other chains used to gain notoriety, such as eye-catching VC funders, token sales, airdrops, influencer shilling, or celebrity endorsements. While I’m not saying these methods are detrimental to the health of an ecosystem, bootstrapping it in the way that CoDeTech has done creates a highly level playing field for anyone looking to get into the space.

After nine years of development, Core XCB is a nascent layer-1 blockchain that I believe has the potential to emerge from the next bull run as a leader in Web3, similar to the eventual winners after the dot-com bubble popped. Further, recently deployed token standards open the door to a new developer community beyond its original developers, making the white space available one of the more exciting opportunities in an increasingly saturated marketplace.

Core Blockchain (XCB)

The Core blockchain represents a novel approach utilizing a proof-of-work consensus variant called Proof of Distributed Efficiency (PoDe). It operates on a low-energy Proof of Work (PoW) mechanism, differentiating it from its predecessors and optimizing it for IoT devices. With proof-of-stake networks coming under greater regulatory scrutiny than PoW and PoW being criticized for its high energy usage, PoDe may offer some exciting opportunities in the current market.

While much of the energy debate regarding PoW can be somewhat mitigated through renewable energy, lower energy usage is still beneficial. Still, Core XCB is not in competition with networks like Bitcoin. Instead, it compares to chains in the Web3 world, such as Ethereum and Solana.

Retiring in 2024? 3 Financial Moves to Make as Soon as You Resign From Work.

If 2024 is the year in which you’ll be retiring, you may be counting down to that milestone. And you may be growing increasingly excited about it by the day.

Retirement can bring about a world of financial change since you’re going from earning a paycheck to potentially not working at all. So it’s important to start off on the right financial foot. With that in mind, here are three key moves to make as soon as you tender your resignation.

Image source: Getty Images.

1. Set up a budget

Maybe you’re used to living on a $95,000-a-year salary. Ideally, between money from your savings and Social Security benefits, you’ll be able to cover your living expenses in the absence of that paycheck. But it’s important to manage your bills carefully to avoid racking up debt or depleting your nest egg too quickly.

Once you’re retired and can see what your basic living costs look like, set up a budget so you know what each expense entails. From there, you can assess your spending and make sure the various bills you’re paying are ones you should keep. You may, for example, realize that hanging onto your home isn’t financially feasible, given your lingering mortgage payments.

2. Decide if you need to claim Social Security right away

Once you turn 62, you can sign up for Social Security at any age. However, you’re not entitled to your full monthly benefit, based on your personal wage history, until you reach full retirement age (FRA). You can also delay your filing past FRA for a boosted monthly Social Security benefit, though this incentive runs out as soon as you turn 70.

If you’re retiring prior to the age of 70, it pays to assess your financial situation and see if you need to sign up for Social Security immediately. If you don’t, then waiting should result in a higher monthly benefit — for life.

3. Make sure you have health coverage in place

Many people have their health coverage tied to their jobs. Once you resign, though, you may no longer be eligible for health insurance through your employer. It’s important to put coverage in place as soon as possible because going without insurance could mean risking catastrophic bills in the event of an injury or illness.

Once you turn 65, you’re allowed to sign up for Medicare. If you’re retiring before the age of 65, you may have the option to move onto your spouse’s plan if they’re still working and have health coverage through a job. Or you may be entitled to pay for continued coverage through your employer’s plan via COBRA for a limited period.

COBRA can be extremely expensive, though, because you’re effectively paying the entire cost of your health insurance without your employer subsidy. It may, however, be a reasonable solution if you’re within a couple of months of being eligible for Medicare and don’t have a spouse’s plan to jump onto.

You may be thrilled with the idea of being as close to retirement as you are, but make a point to tackle these essential moves as soon as that stage of life kicks into gear. That way, you can start on a financially sound note.

Citigroup told most of its employees that they can work remotely the final two weeks of December, CNBC has learned.

Workers can log in remotely from anywhere in their country of employment from Monday to Dec. 29, a Friday, making this week the last in-person experience this year for many staffers, according to people with knowledge of the situation.

The policy applies to hybrid workers, which make up the majority of the bank’s 240,000 employees, said the people, who declined to be identified.

Unlike last year, when the perk was introduced, employees are on edge over CEO Jane Fraser’s sweeping corporate reorganization, and some expressed concern over whether their jobs will still exist next year. Citigroup has said that Fraser’s review of the third-biggest U.S. bank by assets will be complete by the end of March.

The project, known internally by its code name Bora Bora, has already resulted in executive departures and the shuttering of the firm’s municipal bond business. Citigroup will disclose severance expenses tied to the project in January and again in April, the bank has said.

“This past year has been one of significant change across the firm, and as we approach the end of 2023, we look forward to this special time of year,” Citigroup’s human resources chief said last week in a staff memo announcing the remote policy.

“We hope that you will enjoy a break from commuting while continuing to stay focused on closing out the year,” the HR chief said.

Read more: Citigroup considers deep job cuts for CEO Jane Fraser’s overhaul, called ‘Project Bora Bora’

Don’t miss these stories from CNBC PRO: