TBD, a subsidiary of Block, owned by Jack Dorsey, has formed a partnership with Chipper Cash, an Africa-focused fintech company. This partnership aims to expedite consumer remittances and make them more affordable. According to a statement, Chipper Cash plans to use the decentralized exchange protocol of TBD. This will enable trusted transactions that comply with […]

TBD, a subsidiary of Block, owned by Jack Dorsey, has formed a partnership with Chipper Cash, an Africa-focused fintech company. This partnership aims to expedite consumer remittances and make them more affordable. According to a statement, Chipper Cash plans to use the decentralized exchange protocol of TBD. This will enable trusted transactions that comply with […]

Source link

cash

Bitcoin Cash hits new peak since 2021, sparking debate over Bitcoin’s next move

Quick Take

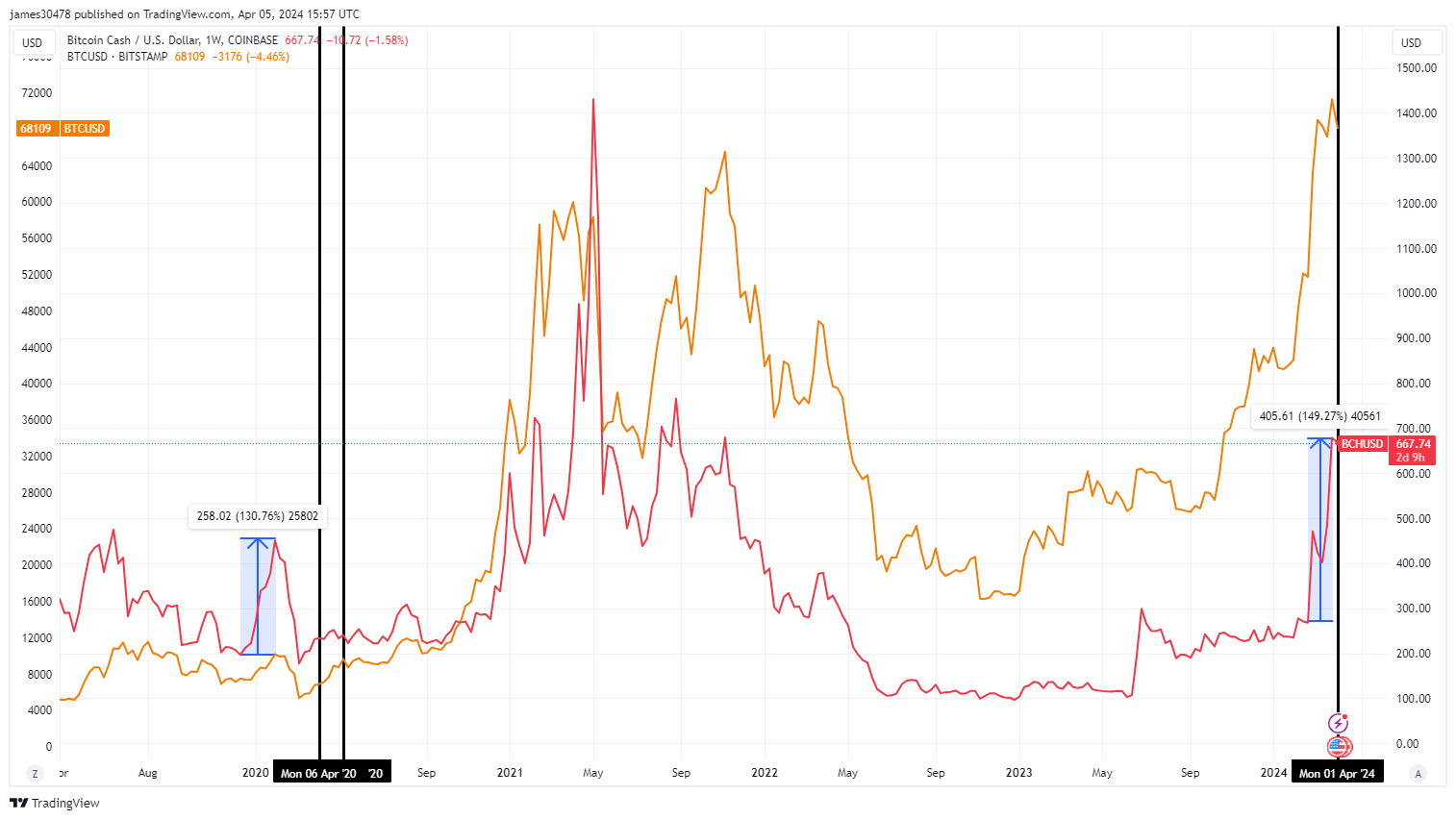

The recent Bitcoin Cash (BCH) halving has sparked a significant price rally, propelling the digital asset to its highest level since 2021.

Based on CryptoSlate research, an intriguing pattern has been observed in the lead-up to this halving event, potentially holding implications for the broader digital assets market.

In the months preceding the previous BCH halving in April 2020, BCH experienced a remarkable price appreciation of around 130%. However, BCH dipped just before the previous halving in April 2020.

It took roughly six months for Bitcoin (BTC) to lead BCH after its halving, which occurred in May 2020.

Ahead of its halving on April 4, BCH has surged by approximately 150%. Interestingly, Bitcoin has also seen unprecedented growth and reached a new all-time high in the last month weeks before its halving.

This raises the question: could the BCH price surge before its halving be a harbinger of a similar rally for Bitcoin?

The post Bitcoin Cash hits new peak since 2021, sparking debate over Bitcoin’s next move appeared first on CryptoSlate.

Bitcoin Cash Demonstrates Resilience With Price Increase Post-Halving

Bitcoin Cash (BCH) experienced a notable fluctuation in its value surrounding its most recent block reward halving, initially dropping to $565 just before the halving but later recovering to around $676, marking an 11% increase for the day and nearly 20% for the week. The halving event, which reduced the reward for Bitcoin Cash miners […]

Bitcoin Cash (BCH) experienced a notable fluctuation in its value surrounding its most recent block reward halving, initially dropping to $565 just before the halving but later recovering to around $676, marking an 11% increase for the day and nearly 20% for the week. The halving event, which reduced the reward for Bitcoin Cash miners […]

Source link

Bitcoin Cash (BCH) is experiencing a surge in trading activity and open interest ahead of its second halving event set for April 4, with open interest in futures perpetual contracts reaching a record high of $708 million, an increase from the previous peak in May 2021. The increase in open interest and trading activity is […]

Bitcoin Cash (BCH) is experiencing a surge in trading activity and open interest ahead of its second halving event set for April 4, with open interest in futures perpetual contracts reaching a record high of $708 million, an increase from the previous peak in May 2021. The increase in open interest and trading activity is […]

Source link

Bitcoin Cash (BCH) has registered a sharp 15% rally in the past 24 hours after plans of a futures listing on Coinbase have surfaced for the asset.

Coinbase Plans To Launch Bitcoin Cash Futures Product On 1 April

As an X user has pointed out, the cryptocurrency exchange Coinbase appears to have filed certifications with the Commodity Futures Trading Commission (CFTC) to list futures products for three coins on its platform: Bitcoin Cash (BCH), Dogecoin (DOGE), and Litecoin (LTC).

Coinbase Derivatives LLC quietly filed certifications with CFTC to list US regulated futures for Dogecoin, Litecoin and Bitcoin Cash.

They filed them on March 7 and surprisingly nobody seemed to notice.

Futures are set to start trading on April 1 if there are no objections from… pic.twitter.com/DYbWjuS6G2

— Summers (@SummersThings) March 20, 2024

As per the CFTC filing, all of these products were certified on March 7, and they are set to go live on trading on the first of the month.

The BCH, LTC, and DOGE futures contracts were all certified earlier in the month | Source: CFTC

Interestingly, all three of these digital assets happen to be based on the original cryptocurrency: Bitcoin. Bloomberg analyst James Seyffart has hinted that this may be why Coinbase has chosen them.

This is interesting… wonder if the SEC objects to these being classified ‘commodities futures’ vs ‘securities futures’. These all forked from Bitcoin so “these are securities” claims would be hard to make after spot #Bitcoin ETF approvals. Might be why Coinbase chose them🤔

— James Seyffart (@JSeyff) March 20, 2024

Unlike LTC and DOGE, which are based initially on BTC’s code, BCH is a direct fork of the cryptocurrency made to fulfill BTC’s original purpose as a fast and cheap form of currency that may be used for regular purposes (hence the name).

The filling made by Coinbase on Bitcoin Cash reads:

The market position of Bitcoin Cash reflects its role as an alternative to Bitcoin that prioritizes transaction efficiency. While it has not matched Bitcoin in terms of market capitalization or price, Bitcoin Cash has established itself as a significant player in the cryptocurrency space, with a dedicated user base and ecosystem.

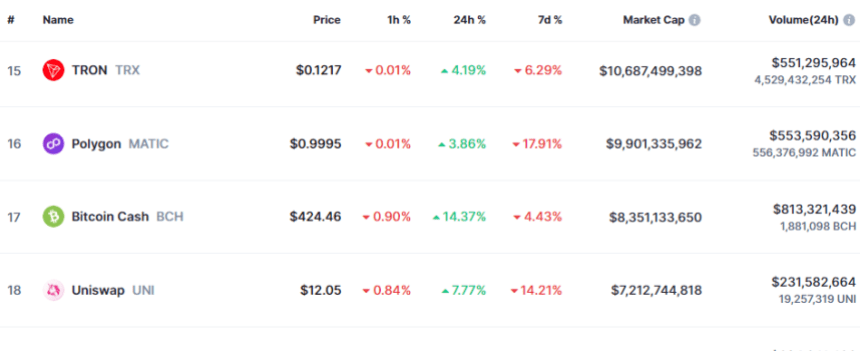

BCH Has Enjoyed A 14% Surge During The Last 24 Hours

The cryptocurrency sector has been up in the past day, but two coins in particular have stood out among the top 20 assets by market cap: Bitcoin Cash and Dogecoin.

Both of these have managed more than 14% returns in this period, notably outperforming their peers. Bitcoin itself has only been able to put together a rally of about 6%.

Given that the Coinbase filling has been making the rounds in this window, it would appear likely that it was at least partially responsible for the extraordinary surges of these coins.

Even though Litecoin is also planned to see its futures contract launch on the same day as the other two, its price performance has been more or less in line with the rest of the market with its profits sitting at just 4%.

Following the sharp rally, Bitcoin Cash has now arrived at the $424 level. The chart below shows how the cryptocurrency’s trajectory has looked in the last few days.

Looks like price of the asset has shot up over the past day | Source: BCHUSD on TradingView

Regarding the market cap, Bitcoin Cash is currently the 17th largest asset. While there is some distance to Polygon (MATIC) in 16th place, LTC may be able to catch it if it can keep up this rally.

The BCH market cap seems to be $8.3 billion at the moment | Source: CoinMarketCap

Featured image from Shutterstock.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Nigerian fintech startup, Chipper Cash, recently abolished the roles of 20 workers based in the U.S. and U.K. The CEO Ham Serunjogi said this decision aligns with its goal of maintaining high operational efficiency and moves the startup closer to profitability. Layoffs Set Chipper Cash on Course for Positive Cash Flow in the First […]

The Nigerian fintech startup, Chipper Cash, recently abolished the roles of 20 workers based in the U.S. and U.K. The CEO Ham Serunjogi said this decision aligns with its goal of maintaining high operational efficiency and moves the startup closer to profitability. Layoffs Set Chipper Cash on Course for Positive Cash Flow in the First […]

Source link

Hackers like Lazarus continue to use Tornado Cash despite US sanctions

Blockchain analytics firm Elliptic revealed that the North Korea-backed hacker group Lazarus is once again using sanctioned crypto mixer Tornado Cash to obfuscate its transactions.

Last year, the group ceased using the crypto mixer after US government sanctions, which were imposed due to allegations of aiding criminals in laundering illegally obtained digital assets.

Following the sanctions, Tornado Cash saw an 85% decline in overall volume as hackers began using alternatives like Sinbad.io and cross-chain bridges.

Why Lazarus group returned to Tornado Cash

However, the US government’s sanctions on Sinbad.io for facilitating money laundering activities of North Korean state-sponsored hacking groups have limited options for Lazarus.

Consequently, the group has turned to Tornado Cash, which has remained operational despite the US sanctions due to its decentralized nature.

Elliptic also disclosed that the group recently moved approximately $13 million in funds stolen from the HTX Exploit. These funds were transferred through Tornado Cash in over 40 transactions within the last three days, marking their first movement since the November 2023 incident.

What does this mean for the industry?

Lazarus Group’s return to Tornado Cash reflects the government’s inability to curb the mixer’s operations effectively, according to Elliptic.

The firm explained that Tornado Cash cannot be seized and shut down like centralized mixers because it operates through smart contracts on decentralized blockchains.

Tom Robinson, the co-founder of Elliptic, added:

“The takedowns of centralized mixers by law enforcement agencies is perhaps pushing crypto laundering back towards decentralized alternatives.”

Data from DeFillama further suggests a resurgence of the platform, with the total value of assets locked reaching $565 million, marking its highest level since the US government imposed sanctions in 2022.

This uptrend is also reflected in the protocol’s native TORN token, which was trading at roughly $2 as of press time — up 13% during the past day, based on CryptoSlate data.

Meanwhile, the crypto community has rallied behind the project’s developers after multiple governments, including the US, targeted them with legal action. Notable crypto stakeholders like Coinbase have supported the developers’ legal defense.

Mentioned in this article

Latest Alpha Market Report

Arbitrum Proposal to Fund Tornado Cash Developers’ Defense Withdrawn

A proposal aiming to contribute to funding the legal defense of the developers of Tornado Cash, the Ethereum-based mixing platform, was removed by the Arbitrum community over apparent legal concerns. Devansh Mehta, lead of the working group of the Arbitrum treasury, criticized the move, stating that there was “absolutely nothing wrong with paying for the […]

A proposal aiming to contribute to funding the legal defense of the developers of Tornado Cash, the Ethereum-based mixing platform, was removed by the Arbitrum community over apparent legal concerns. Devansh Mehta, lead of the working group of the Arbitrum treasury, criticized the move, stating that there was “absolutely nothing wrong with paying for the […]

Source link

Bitcoin Mega Whale Resurfaces, JPMorgan Expects BTC Price to Drop, Bitcoin Cash Soars 40%, and More — Week in Review

A significant bitcoin “mega whale” moved 3,000 vintage bitcoins from 2010 as BTC peaked at $69,210. JPMorgan predicted a post-halving drop in bitcoin’s price to $42,000, citing current euphoria levels. Meanwhile, bitcoin cash experienced a 40% surge in anticipation of its halving event and a major 2024 upgrade. Additionally, rumors circulated about a Qatari billionaire’s […]

A significant bitcoin “mega whale” moved 3,000 vintage bitcoins from 2010 as BTC peaked at $69,210. JPMorgan predicted a post-halving drop in bitcoin’s price to $42,000, citing current euphoria levels. Meanwhile, bitcoin cash experienced a 40% surge in anticipation of its halving event and a major 2024 upgrade. Additionally, rumors circulated about a Qatari billionaire’s […]

Source link