Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Metrics reveal that cryptocurrency premiums in South Korea consistently outpace the global average. As of now, bitcoin exchanges hands at $69,245 per piece globally, while on the South Korean platform Upbit, it’s being traded at $73,513 each. Additionally, March witnessed a notable increase in Upbit’s trade volume, skyrocketing by 172.25% from February’s data. Ethereum, Solana, […]

Source link

continues

Blockchain Space Continues to Evolve Even During Lean Periods, Says Michael Amar

The blockchain and crypto industry has never stood still including during the prolonged lean period known as the crypto winter, asserted Michael Amar, co-founder of the Paris Blockchain Week Summit. Amar believes the resilience shown by market participants during this period demonstrates a new level of maturity in the industry. Engagement Between Startups and Developers […]

The blockchain and crypto industry has never stood still including during the prolonged lean period known as the crypto winter, asserted Michael Amar, co-founder of the Paris Blockchain Week Summit. Amar believes the resilience shown by market participants during this period demonstrates a new level of maturity in the industry. Engagement Between Startups and Developers […]

Source link

The Solana network’s native cryptocurrency, SOL, has been on an upward surge in the past three days, climbing from around $180 to over $210.

Having failed to break its previous low of $162.74, the coin, which is currently ranked 5th in the crypto market with a total supply of 441 million and a market capitalization of over $88 billion, SOL is showing no signs of stopping.

Will Solana Continue To Surge Upward?

At the time of writing, Solana has been up by 6.25% trading around $198 in the past 24 hours, and has broken above the previous resistance level of $195. The price is also trading above the 100-day moving average on the 4-hour chart of the SOL/USD pair. If the price continues to move upward, it might break above its major resistance level of $210 and move even higher to create a new high for the year.

All these can be seen in the image below:

Looking at the chart with the help of the RSI (Relative Strength Index) indicator in the image above, we can see that the RSI line is trending above the 50 level. This is an indication that the price of SOL is still in a bullish zone and could even surge further upward.

A further look at the 4-hour timeframe chart with the help of the MACD indicator, we can see that the MACD is on the bullish side as the MACD line, the signal line, and the MACD histogram are all trending above the zero line.

Finally, using the bull vs bear power histogram indicator, it appears buyers have taken over the market with powerful momentum and are ready to push the price even higher.

We can confirm this in the image below:

With the momentum that Solana is moving with, there is a possibility that it could break above its previous resistance level of $210.27. If this manages to happen we could see prices soaring higher especially with the level of demand momentum in the market

Could SOL Dip?

If the price of Solana fails to break above the resistance level of $210, it could start a downside correction to its initial support level of 162. If the price closes below this support level, it could decline even further and probably start a downward trend.

Featured image from YouTube, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

5 things next week that could determine if Wall Street win streak continues

People walk by the New York Stock Exchange (NYSE) on December 29, 2023 in New York City.

Spencer Platt | Getty Images

Wall Street wrapped up another positive week, with the S&P 500 closing Friday above 5,000 for the first time ever. The Nasdaq finished less than 0.5% away from its November 2021 record-high close.

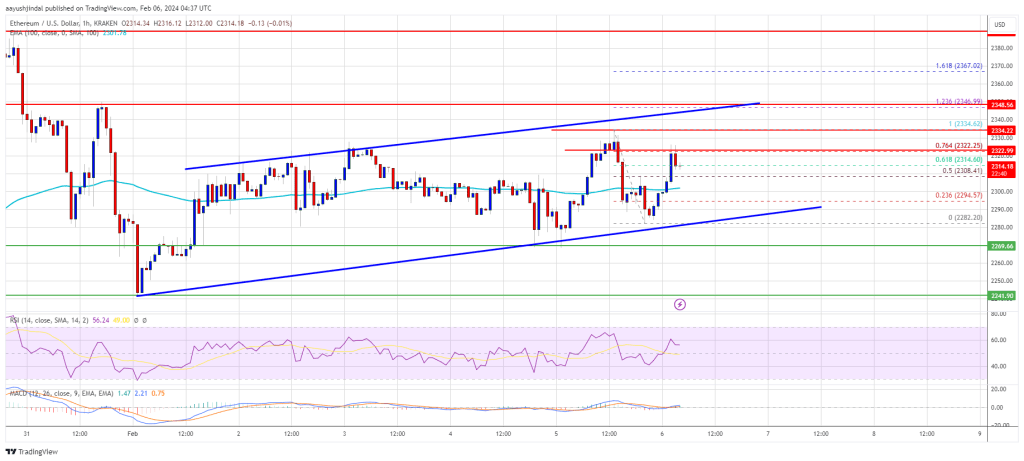

Ethereum Price Topside Bias Vulnerable If It Continues To Struggle Below $2,400

Ethereum price is consolidating above the $2,250 zone. ETH could start a decent increase if it clears the $2,340 and $2,380 resistance levels.

- Ethereum is struggling to gain pace for a move above the $2,350 zone.

- The price is trading above $2,300 and the 100-hourly Simple Moving Average.

- There is a short-term rising channel forming with resistance near $2,350 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair might start a fresh increase if it manages to clear the $2,350 resistance zone.

Ethereum Price Eyes Fresh Increase

Ethereum price remained in a range below the $2,350 resistance zone. ETH traded lower below $2,320, but the bulls were active near the $2,280 support zone.

A low was formed near $2,282 and the price is now attempting a fresh increase in a range, like Bitcoin. There was a move above the $2,300 resistance zone and the 100-hourly Simple Moving Average. The price even cleared the 61.8% Fib retracement level of the recent decline from the $2,334 swing high to the $2,282 low.

Ethereum is now trading above $2,300 and the 100-hourly Simple Moving Average. There is also a short-term rising channel forming with resistance near $2,350 on the hourly chart of ETH/USD.

On the upside, the first major resistance is near the $2,325 level or the 76.4% Fib retracement level of the recent decline from the $2,334 swing high to the $2,282 low. The next major resistance is near $2,350, above which the price might rise and test the $2,380 resistance.

Source: ETHUSD on TradingView.com

If the bulls push the price above the $2,380 resistance, they could aim for $2,450. A clear move above the $2,450 level might send the price further higher. In the stated case, the price could rise toward the $2,500 level.

Another Decline in ETH?

If Ethereum fails to clear the $2,350 resistance, it could start another decline. Initial support on the downside is near the $2,280 level and the channel trend line.

The next key support could be the $2,240 zone. A clear move below the $2,240 support might send the price toward $2,180. The main support could be $2,120. Any more losses might send the price toward the $2,040 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $2,240

Major Resistance Level – $2,350

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

XRP Price Topside Bias Vulnerable If It Continues To Struggle Below $0.60

XRP price is consolidating above the $0.520 support. The price could gain bearish momentum unless there is a close above $0.550 and $0.570.

- XRP is showing bearish signs below the $0.550 and $0.570 resistance levels.

- The price is now trading below $0.5420 and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance near $0.540 on the 4-hour chart of the XRP/USD pair (data source from Kraken).

- The pair start a fresh increase if it clears the $0.540 and $0.550 resistance levels.

XRP Price Aims Recovery

After a decent recovery wave, XRP price faced heavy resistance near the $0.6200 zone. The bears stepped in and managed to start a fresh decline. There was a move below the $0.600 and $0.570 support levels, like Bitcoin and Ethereum.

There was also a drop below the $0.550 support. The price tested the $0.5180 zone. A low was formed near $0.5178, and the price is now consolidating losses. There is also a key bearish trend line forming with resistance near $0.540 on the 4-hour chart of the XRP/USD pair.

The price is now trading below $0.5420 and the 100 simple moving average (4 hours). On the upside, immediate resistance is near the $0.540 zone or the trend line. It is near the 23.6% Fib retracement level of the downward move from the $0.6238 swing high to the $0.5178 low.

The first key resistance is near $0.550. The next major resistance is near the $0.570 zone or the 50% Fib retracement level of the downward move from the $0.6238 swing high to the $0.5178 low.

Source: XRPUSD on TradingView.com

A close above the $0.570 resistance zone could spark a strong increase. The next key resistance is near $0.625. If the bulls remain in action above the $0.625 resistance level, there could be a rally toward the $0.680 resistance. Any more gains might send the price toward the $0.700 resistance.

More Losses?

If XRP fails to clear the $0.550 resistance zone, it could start a fresh decline. Initial support on the downside is near the $0.5180 zone.

The next major support is at $0.5120. If there is a downside break and a close below the $0.5120 level, XRP price might accelerate lower. In the stated case, the price could retest the $0.500 support zone.

Technical Indicators

4-Hours MACD – The MACD for XRP/USD is now losing pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $0.5180, $0.5120, and $0.500.

Major Resistance Levels – $0.5420, $0.5500, and $0.5700.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

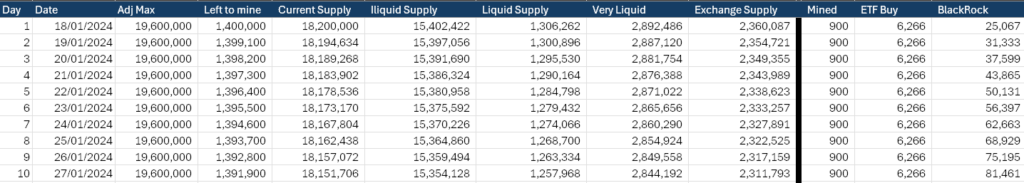

If BlackRock continues 6k BTC daily buys we get a supply crunch within 18 months, here’s why

Building on CryptoSlate’s recent analysis of the competing Bitcoin inflows and outflows between BlackRock and Grayscale, I extrapolated the data even further to see just how long BlackRock could sustain its current average Bitcoin accumulation.

At a high level, BlackRock’s entry through Bitcoin ETFs is a substantial moment for Bitcoin’s reputation in the United States. Along with the other ‘Newborn Nine‘ ETFs, BlackRock’s endorsement is likely to decrease the liquid and very liquid supplies as more investors gain access to Bitcoin as a long-term investment. Further, it will increase investor confidence for those unfamiliar with blockchain and enhance the credibility of Bitcoin as an asset class, thereby affecting its liquidity and volatility profiles.

Before I go any further, I want to add a very clear disclaimer here. The analysis below is a hypothetical look at possible accumulation levels from spot Bitcoin ETFs. I have used the debut inflows for BlackRock as the yardstick. There is no guarantee these levels will persist, and if they did, it would very likely result in an increase in the price of Bitcoin. The demand for Bitcoin is unlikely to remain consistent at any price, so assuming the same BTC inflows over a prolonged period is improbable.

That said, looking at the numbers from a purely theoretical standpoint does reveal some extremely headline-worthy data points, which can then be used alongside other analyses to identify if and when a supply crunch is on the horizon for Bitcoin.

The longer these new ETFs continue to acquire Bitcoin at these elevated levels, the better for long-term HODLers and laser eyes.

In my opinion, now, more than ever, HODLing Bitcoin has a real purpose. The fewer Bitcoins available for purchase inside ETFs, the closer we come to a MOASS (Mother Of All Supply Squeezes) where Bitcoin moons, not because shorts have to cover, but because institutions have to buy Bitcoin on the open market like the rest of the world.

Liquidity in Bitcoin and BlackRock’s immediate impact.

Since the debut of spot Bitcoin ETFs in the US last week, BlackRock has acquired an average of 6,266 BTC daily for a cumulative total of 25,067 BTC as of press time. The total acquired by the Newborn Nine over just four trading days is now at 70,000 BTC ($2.9 Billion.) When we include Grayscale, the total Bitcoin under management is 660,540 BTC ($27.6 billion.)

To understand the analysis, I’ll first outline the buckets used, as defined by Glassnode data.

“The liquidity of an entity is defined as the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is considered to be illiquid / liquid / highly liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.”

More info on calculating L can be found on Glassnode’s blog.

- Current Supply: The total number of bitcoins that have been mined and are currently in circulation.

- Illiquid Supply: Bitcoins held in wallets without significant movement, suggesting a long-term investment strategy.

- Liquid Supply: Bitcoins that are actively traded or spent, indicating higher market activity.

- Very Liquid Supply: This category represents bitcoins that are not just traded but are readily available for trading on exchanges within a short timeframe.

- Exchange Supply: Bitcoins held in exchange wallets, ready to be traded or sold.

The chart below shows the different liquidity cohorts for Bitcoin across time. The illiquid supply is by far the largest sector. However, interestingly, the highly liquid portion is greater than the liquid portion, indicating a dichotomy among investors. Bitcoin holders are either hodlers or traders, with very few on the fence about whether to hold or transact with Bitcoin.

Now we understand the liquidity situation, let’s look at how the different cohorts stack up. The official max supply of Bitcoin is 21,000,000 coins. The current circulating supply is 19,600,000. According to Glassnode, the total amount of lost coins is roughly 1,400,000; this includes Satoshi’s coins, among others. There are other higher estimates of lost coins; however, given that this number has remained relatively consistent since 2012, I think it is the most reliable number.

Interestingly, this means that when we remove the lost coins from the maximum supply, we end up with the same number as the current circulating supply. While this is purely coincidental for this exact moment in time, it gives an idea of how it will feel when all the coins have been mined, at least in terms of market liquidity. Of course, after all coins are mined, the lack of block rewards for miners will add another aspect to the mix I won’t get into right now. I will say that I believe fees will be more than enough to continue to secure the network given the current direction Bitcoin is heading in.

| Metric | Value |

|---|---|

| Max Supply | 21,000,000 |

| Current Supply | 19,600,000 |

| Adj. Max Supply | 19,600,000 |

| Adj. Current Supply | 18,200,000 |

| Illiquid Supply | 15,402,422 |

| Liquid Supply | 1,306,262 |

| Very Liquid Supply | 2,892,486 |

| Exchange Balance | 2,360,087 |

The current supply can also be adjusted to remove lost coins. The three main cohorts to analyze are the liquidity levels, as explained below, and the balance of Bitcoin on crypto exchanges. The total liquid and very liquid coins amount to just 4,198,748 BTC ($175 billion,) which accounts for around 21% of the $815 billion Bitcoin market cap.

What if BlackRock keeps buying up all the Bitcoin?

Now, for the fun part that you are all reading for What if BlackRock inflows were to continue at the level seen during its debut? While some have bemoaned the launch of spot Bitcoin ETFs as a failure, and Bitcoin’s price has even dropped to $0.0413 million from its recent high of nearly $49,000, I think they will surely end up with the ‘egg on their face,’ as we say in the UK. Here’s why!

Currently, 900 new Bitcoins are mined daily, and this will drop to 450 BTC around April 18, 2024. Additionally, as I said previously, BlackRock is acquiring around 6,266 BTC daily. If BlackRock were to attempt to buy directly from miners, this would lead to a net deficit of 5,266 BTC.

So, it needs to get Bitcoin from somewhere else. So far, the Coinbase OTC desks have had sufficient liquidity to soak up the requirement. However, this cannot last forever; there is no endless liquidity. The table below shows what would happen if BlackRock bought from each cohort with miner participation.

At its current rate, over the next 10 days, BlackRock would achieve around 81,481 BTC with little to no significant impact on any cohort. So, the launch is a failure?

I don’t think so.

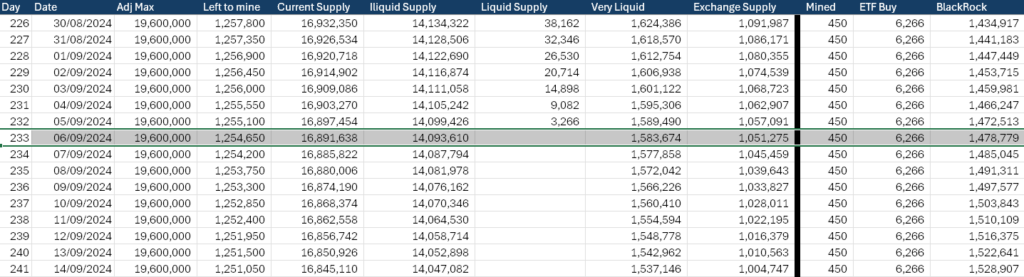

If we extend this down to Sept. 6, 2024, and BlackRock is only buying from the liquid supply, with miners adding to this cohort and reducing the impact, the entire cohort would be absorbed.

Let’s carry on.

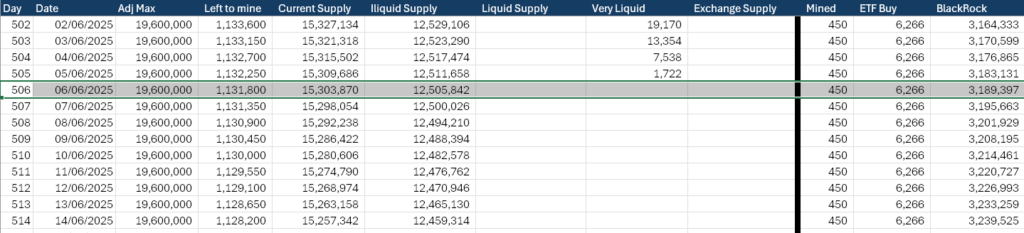

To keep it nice and clear, each table going forward will be under the following hypothetical scenario.

What if BlackRock bought exclusively from this cohort at the rate it has during the first four days and newly mined Bitcoin was also included, thus reducing the impact of BlackRock’s buying?

By March 3, 2025, the Bitcoin held on exchanges would be gone, and BlackRock would have 2.6 million BTC.

The ‘very liquid’ cohort would be absorbed by June 6, 2025. This group is probably the most easily accessible for BlackRock to find liquidity, and it is still just 18 months away.

In just eight years, by 2032, BlackRock’s Bitcoin holding would be worth $686 billion by today’s standards and consist of 16,404,391 BTC. This would require it to have found a way to buy all of the Bitcoin from the ‘illiquid’ supply and give it around 79% of all Bitcoin in circulation under management.

Finally, in just 3,073 short days, on June 16, 2032, BlackRock would have bought all of the Bitcoin in circulation and finally have to stop its 6,266 BTC per day purchase. Going forward, there would only be 113 BTC available each day from newly mined Bitcoin, of which there would be 327,538 BTC left to mine.

Of course, few of the above scenarios are going to happen. BlackRock is unlikely to be able to sustain these levels of inflows in Bitcoin terms without Bitcoin’s price either falling significantly or demand increasing along with price.

For example, 6,266 BTC is worth $262 million at $0.04184 million per Bitcoin. At $0.2 million per Bitcoin, this amount becomes $1.25 billion daily. Conversely, at $0.01, it is only $62.6 million.

So unless Bitcoin stays around $0.04 million for the next eight years, BlackRock is able to convince investors to buy its ETF at the same pace, and it can find HODLers willing to sell, we aren’t going to see BlackRock take custody of all the Bitcoin.

However, we can now start to see what sort of an impact consistent Bitcoin ETF inflows can have on different parts of the supply. Personally, my Bitcoin is illiquid and remains that way. I see the benefits of spot Bitcoin ETFs, and I also see the supply crunch that’s coming in some shape or form. Definitely not today, probably not this quarter, but after that…

CryptoSlate will continue to dig into the numbers and nerd out on chain for you, so if you enjoyed this exploration into Bitcoin supply, please let us know on our X account @cryptoslate or reach out to me directly @akibablade. Also, shout out to Samson Mow for the ‘M’ notation for Bitcoin!

BlackRock CEO’s crypto pivot continues, turns bullish on tokenization to eliminate ‘corruption’

BlackRock’s spot Bitcoin ETF launch was highlighted in an interview with CEO Larry Fink on CNBC. Fink, who had previously expressed skepticism about Bitcoin, now views it as a viable asset class, though not a potential currency. This change of stance aligns with BlackRock’s broader strategy of embracing technological advancements in the financial sector, mainly through ETFs and the eventual tokenization of financial assets.

In his CNBC interview after the historic first day of trading for BlackRock’s Bitcoin ETF, Fink revealed a notable transformation in his perception of Bitcoin. Fink has evolved to see Bitcoin as an asset class similar to digital gold, suitable for wealth holding but not as a currency.

Fink’s discussion with the CNBC host delved into the implications of Bitcoin’s value, its comparison to gold, and its potential price trajectory. He emphasized that Bitcoin, like gold, is a haven asset that gains value amidst geopolitical and economic uncertainties.

However, unlike gold, Bitcoin has a near-fixed supply limit, enhancing its appeal as a store of value. When probed about predictions like Cathie Wood’s that foresee Bitcoin reaching $600,000 or more, Fink refrained from speculating on specific valuations, focusing instead on the asset’s potential for wealth preservation.

The conversation also touched on the broader implications of BlackRock’s ETF initiative. Fink sees ETFs as the first step in a technological revolution in financial markets, with the tokenization of financial assets being the next phase.

This vision, he believes, aligns with BlackRock’s successful history of integrating ETFs into various asset classes, demonstrating a consistent strategy of leveraging technology to transform the financial landscape.

Fink’s comments on the first day’s inflows into the Bitcoin ETF were positive, with BlackRock capturing significant market interest. He highlighted the competitive advantage of ETFs over traditional trusts, noting the lower fees associated with ETFs. This aspect, coupled with the tax implications of transferring assets from trusts like Grayscale to other, lower-fee ETFs, presents both challenges and opportunities in the evolving cryptocurrency market.

Finally, when discussing the future of crypto ETFs, Fink expressed optimism about the potential for other cryptocurrencies like Ethereum to be included in ETF offerings.

He emphasized the importance of tokenization in enhancing transparency and reducing corruption in financial transactions, pointing to a future where financial assets and identities are tokenized, thus creating a more secure and efficient financial system. He concluded:

“These are just stepping stones towards tokenization, and I really do believe this is where we’re going to be going… This eliminates all corruption by having a tokenized system.”

Bitfinex predicts crypto market cap will double to over $3T as it continues global expansion efforts

Bitfinex predicts the total market capitalization of the cryptocurrency market, currently at approximately $1.6 trillion, is poised to double — potentially reaching a staggering $3.2 trillion, according to its year-end Alpha report.

Despite the challenges faced in 2023, including regulatory hurdles and reputation concerns, the company remains optimistic about the resilience and potential growth of Bitcoin and other crypto assets.

Bitfinex’s expansion continues unabated amid this positive sentiment. The exchange recently launched a dedicated platform for Vietnamese customers in line with its commitment to global growth and accessibility.

A high percentage of Vietnam’s population uses cryptocurrencies, and the move reflects the company’s confidence in the crypto market’s potential and its strategy to deepen its presence in key markets.

2x market cap

According to Bitfinex, the market cap doubling prediction is bolstered by a range of metrics and sentiment indicators, which suggest a similar performance to previous market cycles. The company anticipates the crypto fear and greed index to swing towards “extreme greed,” correlating with new highs for Bitcoin during a mid-year bull market.

Institutional investors are expected to be pivotal in the coming growth trajectory. The anticipated launch of a spot Bitcoin ETF is seen as a catalyst for increased institutional investment, primarily favoring Bitcoin, at least in the first half of 2024. However, a shift towards higher-risk crypto assets might occur as the year progresses.

Meanwhile, the MVRV (Market Value to Realized Value) metric indicates current valuations similar to those in mid-2019 and mid-2016, suggesting potential price dips before sustained recoveries. Bitfinex expects Bitcoin’s price to fluctuate within the $44,000 to $45,000 range before a significant upward movement.

Bitcoin miners are already beefing up their operations in anticipation of the halving event, which will reduce the mining rewards by half.

The exchange said:

“Our analysis indicates that the market is currently in a healthy state, with continued growth in $BTC prices and limited anticipated selling by miners.”

Despite potential initial selling to fund upgrades, miner inflows to exchanges are expected to remain subdued, indicating limited selling pressure as Bitcoin prices rise, according to the exchange.

Adoption and inflation

Global Bitcoin adoption continues to show promise, especially in markets like El Salvador, where it has been declared legal tender, and in Argentina, where citizens increasingly view crypto as a hedge against inflation and currency devaluation.

According to the exchange:

“Bitcoin adoption in certain key markets are also looking promising and we anticipate that the number of global crypto owners could escalate to up to 950 million.”

Bitfinex foresees intensified efforts to bolster Bitcoin infrastructure and public awareness in these regions, especially as the world tackles a deceleration in wage growth and a moderate increase in the unemployment rate to around 4.3 percent in 2024.

Inflation rates are projected to decline due to improved supply chains and a subdued global economy. However, geopolitical tensions and oil production cuts could pose risks of increased headline inflation.

If inflation remains high, it will become another catalyst for people to turn to Bitcoin as it cements its status as digital gold.