Aurora Cannabis Inc. led gains among Canadian cannabis stocks on Wednesday after an industry executive was named president of the Cannabis Council of Canada trade group.

Source link

Trade

Is The Trade Desk’s Business Momentum Good Enough to Justify Its Current Stock Price?

It would be difficult to criticize The Trade Desk‘s (TTD -0.58%) recent business performance. Everything seems to be going right for the company. Revenue is growing at robust double-digit rates, customer retention remains extremely high, and the company has a debt-free balance sheet and plenty of excess cash flow.

This financial success, of course, isn’t too surprising for those following the company closely. The programmatic advertising specialist’s product execution has been astounding in recent years. The Trade Desk’s fourth-quarter results were just more of the same. But there’s a looming question: Is the company living up to its current valuation?

Here’s a close look at some of the ways this tech company continues to impress investors.

Market share gains

One of the biggest things that stands out about The Trade Desk’s recent business performance is its market share gains. As The Trade Desk CEO Jeff Green pointed out in the company’s most recent earnings call, the ad tech specialist has grown its revenue faster than the rest of the digital advertising space in each of the last eight consecutive quarters.

In one specific example of its momentum relative to major peers in the space, The Trade Desk’s full-year 2023 revenue increased 23% year over year — and that’s on top of 32% growth in 2022. Compare that to Meta Platforms‘ and Alphabet‘s 16% and 9% year-over-year revenue growth rates in 2023, respectively.

Looking ahead, Green said in the company’s fourth-quarter earnings call that he expects top-line momentum to persist.

While there is much to celebrate about 2023, I’m even more excited about 2024 and beyond, I’ve never felt more confident heading into a new year. I believe we are uniquely positioned to grow and gain market share not only in 2024 but well into the future.

Product execution

Another aspect of The Trade Desk’s business worth applauding is its rapid pace of innovation.

The company’s biggest innovation in 2023 was its overhauled buy-side platform, Kokai. Green said that his product team recently visited nearly 1,000 clients and almost all of them said Kokai was a significant platform upgrade for them.

The Trade Desk also made notable progress in retail media (partnerships with retailers in which they bring data to its platform to share with advertisers). This is “one of the fastest-growing areas” of The Trade Desk’s business, Green said during the fourth-quarter earnings call.

But many other innovations are playing a key role in The Trade Desk’s customer approval. Some key innovations gaining steam with customers include The Trade Desk’s identity solutions UID2 and EUID, its direct pipeline to advertising inventory called OpenPath, and its connected television (CTV) integrations.

All of these factors help contribute to The Trade Desk’s high customer retention rate, which has remained above 95% for 10 years straight.

Robust financials

Lastly, The Trade Desk is a cash flow machine. Free cash flow, or the cash flow left after capital expenditures are accounted for, totaled $543 million in 2023. Such strong cash flow, combined with a debt-free balance sheet, means the company can fund its business growth while also returning cash to shareholders. The Trade Desk repurchased $220 million worth of its stock during Q4 alone and said in its earnings release last week that it has authorized $700 million for repurchases going forward.

All of these factors combine to help justify the stock’s current valuation of approximately 73 times free cash flow. With this said, shares certainly aren’t cheap. It might be wise for investors interested in buying the stock to wait and see if shares pull back to a valuation that leaves more room for error. But given the company’s strong execution, it would also be tough to call the stock overvalued at this point.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Daniel Sparks has no position in any of the stocks mentioned. His clients may own shares of the companies mentioned. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and The Trade Desk. The Motley Fool has a disclosure policy.

The Trade Desk (TTD -8.93%) stock surged higher following the release of its quarterly report for the fourth quarter of 2023. Amid those gains, it achieved a 52-week high before pulling back, taking it to a level last reached in the summer.

Still, with a higher stock price, valuations have become elevated, and the share price has reached a point from which it pulled back months earlier. Does that mean investors missed the opportunity to buy this stock at a reasonable price? Let’s take a closer look.

The Trade Desk’s quarterly report

You can easily see why investors were happy with The Trade Desk’s latest earnings report. For 2023, revenue rose 23% yearly to more than $1.9 billion. While that was less than 2022’s 32% increase, it still amounts to robust growth.

Also, operating expenses increased 19% for the year, and other income (income from interest and short-term investments) rose about fivefold. As a result, the 2023 net income of $179 million spiked from the $53 million reported in 2022.

The company also generated about $552 million in free cash flow, more than the $465 million generated in 2022. That bodes well for shareholders because the company authorized share repurchases amounting to $700 million.

Share counts had grown for years but have begun to level off over the last year near the 490 million level. With the company’s improving financials and lower share count, it is more likely the share price will rise in the near term.

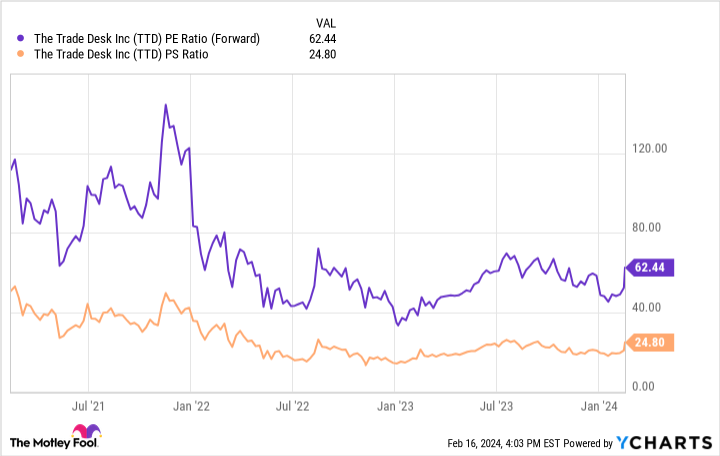

Also, thanks to the aforementioned gains, the stock is up by around 35% over the last year. However, that also amounts to a forward P/E ratio of 62 and a price-to-sales (P/S) ratio of 25. Both multiples have fallen from the levels of the 2021 bull market, but they still make The Trade Desk a pricey stock by almost any measure.

TTD PE Ratio (Forward) data by YCharts

Is The Trade Desk worth its valuation?

Still, the fact that investors are paying these multiples warrants a closer look at the business. The Trade Desk operates a demand-side platform that allows companies and agencies to manage digital ad campaigns. Through this technology, users can run ads when and where they can potentially deliver a higher return on investment.

Moreover, The Trade Desk is a neutral platform. That gives it a competitive advantage over a company like Alphabet. Since Alphabet derives most of its revenue from acting as an advertising site, users may prefer an ad management tool from a company not profiting directly from digital ads.

Additionally, the opportunity in digital advertising is massive. Grand View Research estimated the global digital ad market was a $421 billion industry in 2023. Furthermore, by 2030, it expects the market to grow to $1.15 trillion, a 16% compound annual growth rate. Hence, the company’s crucial role in this growing industry bodes well for The Trade Desk.

Are new investors too late?

Given current conditions, long-term investors can likely still win with The Trade Desk stock. Admittedly, the stock’s valuation may have moved moderately ahead of fundamentals, and its stock price could correct in the near term.

Nonetheless, The Trade Desk has become an increasingly significant player in a massive industry expected to significantly increase in size for years to come. With profits rising and share counts likely to fall in subsequent quarters, both shareholders and new buyers stand a good chance of earning market-beating returns with this SaaS stock.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Will Healy has positions in The Trade Desk. The Motley Fool has positions in and recommends Alphabet and The Trade Desk. The Motley Fool has a disclosure policy.

U.S. trade deficit fell in 2023 to the lowest level in 3 years and boosted GDP

The numbers: The U.S. trade deficit rose slightly in December, but the annual gap still fell to the lowest level in three years and added to economy’s strong performance in 2023.

Record deficits in 2021 and 2022, by contrast, acted as a big drag on gross domestic product, the official scorecard of the U.S. economy.

In December, the trade gap widened by 0.5% to $62.2 billion. It was sharply lower compared to the same month a year earlier, however.

Key details: Imports fell 1.3% in December to $320.4 billion, the government said Wednesday.

For the full year, imports declined 3.6% from a record $3.65 trillion in 2022.

The drop in imports mostly reflected two things: The lower cost of oil and less household demand for consumer goods such as computers and cell phones.

Instead Americans have been spending more on services such as travel and recreation.

U.S. exports also rose 1.2% in December to a $258.2 billion, clinching a record high in 2023. That also gave a boost to the economy.

A weaker dollar and rising U.S. oil shipments helped deliver last year’s record exports, but weaker economic growth around the world could exert a negative influence in 2024.

“Export growth is surely likely to moderate soon,” said deputy chief U.S. economist Andrew Hunter of Capital Economics.

Big picture: The U.S. trade deficit was driven to record highs during the pandemic because of seismic shifts in the global economy.

Now the deficit has tapered off to more normal — though still high — levels as the lingering effects of the pandemic fade away. It’s unlikely to contribute much to GDP in 2024.

Market reaction: In premarket trades, the Dow Jones Industrial Average

DJIA,

and S&P 500

SPX,

rose in Wednesday trades.

The Tron network is a decentralized blockchain platform that aspires to create an expansive and interconnected global digital content ecosystem. At its core, Tron leverages its native cryptocurrency, TRX, to facilitate seamless transactions and interactions within the network.

An outstanding advantage of the Tron (TRX) network lies in its exceptional scalability and impressive transaction processing capacity. This remarkable feature enables Tron to process a substantial number of transactions swiftly, ensuring the smooth execution of smart contracts and decentralized applications (DApps). The network’s scalability is of utmost importance as it plays a vital role in supporting the expansion of its ecosystem and meeting the growing needs of both users and developers.

Tron (TRX) empowers developers to create and launch decentralized applications (DApps) through the integration of smart contracts into its framework. These versatile DApps span across diverse sectors, including finance, gaming, social media, and more. Tron equips developers with essential tools, resources, and support, enabling them to craft cutting-edge and fully operational applications. This fosters a dynamic developer community, driving ongoing expansion and diversification within the Tron ecosystem.

Tron’s emphasis on digital content is a distinguishing feature of the network. It aims to revolutionize the entertainment industry by directly connecting content creators and consumers without the need for intermediaries. The platform empowers creators by enabling them to distribute their content and monetize it through direct interactions with their audience.

The network (TRON) relies on a delegated proof-of-stake consensus mechanism for its security. Validators in the network are rotated every six hours, chosen by users who stake their TRX tokens.

To combat software bugs, Tron involves its community through the Bug Bounty Program. Users can contribute to development and earn rewards by reporting bugs and vulnerabilities. The Tron Foundation generously provides TRX rewards as an incentive, fostering a collaborative environment for network security.

This article delves into the fundamental features of the TRON network and explores its significant potential within the TRON ecosystem while also providing guides on how to buy, sell and trade on the network.

Features Of The TRON Network

Delegated Proof-of-Stake (DPoS) Consensus: The DPoS is a consensus mechanism utilized by the TRON network to enable its users to vote for representatives responsible for validating transactions and securing the network. This system guarantees swift transaction confirmation and streamlined network operations, enabling scalability and suitability for high-demand applications.

Smart Contracts and DApps: TRON offers a platform for the creation and implementation of smart contracts, which are self-executing agreements governed by predetermined rules. These smart contracts serve as the foundation for developing decentralized applications (DApps) that automate processes, enhance peer-to-peer interactions, and introduce trailblazing functionalities in sectors including finance, gaming, social media, and more.

Developer-Friendly Environment: TRON fosters a developer-friendly ecosystem by equipping developers with essential tools, resources, and support to build innovative and functional DApps. It offers user-friendly programming languages, software development kits (SDKs), and comprehensive documentation to optimize the development process. This commitment to developers encourages a vibrant community, promotes collaboration, and fuels ongoing growth and diversification within the TRON ecosystem.

Scalability and Throughput: One of the main purposes of the TRON network is that it is purposefully built to efficiently process a substantial number of transactions with exceptional throughput. Its infrastructure facilitates swift transaction execution, ensuring seamless operations for smart contracts and decentralized applications (DApps). This scalability plays a vital role in meeting the increasing adoption and requirements of users and developers.

Global Accessibility: TRON’s decentralized architecture guarantees worldwide accessibility, enabling individuals from across the globe to engage with the network. The platform’s infrastructure is intentionally designed to be accessible to anyone with an internet connection, promoting inclusivity and fostering a digital ecosystem without any geographical boundaries.

Direct Creator-Consumer Interaction: TRON enables content creators to engage directly with their audience without intermediaries. This direct connection fosters a more intimate and transparent relationship, allowing creators to better understand their audience’s preferences and tailor their content accordingly.

Ownership Rights: TRON acknowledges the significance of content ownership for creators and leverages the immutability and transparency of blockchain technology to safeguard their intellectual property rights. By doing so, TRON empowers creators to retain control over their content and ensures they are duly compensated for its utilization.

Monetization Opportunities: TRON empowers content creators by enabling them to directly monetize their content. By leveraging smart contracts and digital tokens, creators can receive payments directly from their audience, bypassing the need for third-party payment processors. This direct monetization approach allows creators to retain a greater share of their earnings and exert more control over their revenue streams.

How To Get Started On The Tron Network

To buy and sell tokens on the TRON network, you will first need to get a TRON-compatible wallet like Tronlink. In this article, we will give examples using Tronlink. It is a popular TRON wallet extension and is readily accessible on leading browsers such as Google Chrome.

Related Reading: How To Buy, Sell, And Trade Tokens On The Optimism Network

With TronLink, users can effortlessly create and oversee TRON wallets, securely store TRX, as well as other TRC-10/TRC-20 tokens, and seamlessly engage with TRON DApps, all within the convenience of their browser interface.

To add your TronLink Wallet as a browser extension, simply click on the “Add to Chrome” icon located in the top right corner, as demonstrated below. This step will ensure that your TronLink Wallet becomes seamlessly accessible within your browser.

Once installed and set up, Open the TronLink extension in your browser. You will be prompted to either create a new wallet or import an existing one. If you’re new to TronLink, select the option to create a new wallet and follow the instructions to set up a password.

It is imperative to back up your wallet to ensure you can recover your funds in case of any unforeseen circumstances. TronLink will provide you with a unique set of recovery phrases during the wallet creation process. Write down and securely store these phrases in a safe place. (Do not store it on your device).

Trading On The TRON Network

The Tron network is capable of supporting various decentralized applications. Tron is often used to transact, as TRX transactions come with very low fees.

In order to engage in trading activities on the TRON network, it is essential to have TRX tokens in your wallet. TRX serves as the native cryptocurrency of the TRON network and is indispensable for executing trades, interacting with decentralized exchanges, and participating in decentralized finance (DeFi) protocols.

Hence, prior to initiating any trading or transactions on the TRON network, it is crucial to ensure that your wallet is adequately supplied with TRX tokens.

The next step is to fund your wallet. You can add TRX or other TRC-10/TRC-20 tokens to your TronLink wallet. Click on the “Receive” button in your Tronlink wallet to generate a wallet address; tokens will be available in your wallet almost immediately.

You can obtain TRX using popular cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) from cryptocurrency exchanges like Binance and transfer it to your TronLink wallet address.

Note that users can also access various DEXs interfaces like SunSwap through their Tronlink wallet by clicking on the “More” button in the same row as the “Receive” button.

How To Buy and Sell Tokens Using SunSwap

SunSwap is a decentralized trading protocol built on the TRON network, with the objective of facilitating automated liquidity provision and establishing an inclusive financial market accessible to all users. By utilizing the decentralized nature of blockchain, SunSwap enables users to participate in liquidity provision by depositing their TRON-based tokens into liquidity pools.

To protect your wallet from malicious activity, ensure that you are on the correct SunSwap website. To get started, visit the correct SunSwap website and click on the “Connect Wallet” option at the top left corner, as in the image below:

Then, select your preferred wallet (In this case, Tronlink):

Once connected, Users can commence trading activities as SunSwap is automatically linked to the TRON networks because it is a TRON-based DEX.

After accessing the SunSwap interface, the next step is to select the tokens you want to trade. SunSwap operates on a system where you can exchange your TRON-based tokens directly with other tokens.

Click on the “Select token” button to select the trading pair you want to trade against.

For example, if you want to buy USDT using TRX, select TRX – USDT, enter the amount, then click on “swap” or “trade now” and then you can go to your Tronlink wallet to confirm the transaction.

Tracking Token Prices on The TRON Network

Avedex is a powerful on-chain tool for TRON network users, offering comprehensive market insights for specific tokens. It provides valuable information such as price data, contract details, and advanced analytics tools. Traders can analyze price trends, liquidity, and token fundamentals to make informed trading decisions.

Additionally, Avedex allows for token comparison, user reviews, and rating systems, enhancing the decision-making process. With integration to TRON wallets and notification features, Avedex streamlines the trading experience, enabling users to stay updated and act promptly.

Related Reading: Celestia Network: How To Stake TIA And Position For 5-Figure Airdrops

Overall, Avedex empowers TRON traders with reliable information and tools to navigate the market effectively and make well-informed trading choices.

Conclusion

In conclusion, the TRON (TRX) network offers a decentralized blockchain platform that prioritizes the creation of a global digital content ecosystem. With its scalable infrastructure and high transaction processing capacity, TRON enables the swift execution of smart contracts and decentralized applications (DApps) across various sectors. The network’s developer-friendly environment provides essential resources and support for developers to build innovative DApps, fostering a vibrant community within the TRON ecosystem.

To engage with the TRON network, users need a TRON-compatible wallet like TronLink. They can obtain TRX tokens from various popular exchanges, transfer them to their TronLink wallet, and then trade on platforms like SunSwap for decentralized trading.

Overall, the TRON network offers a robust ecosystem for buying, selling, and trading tokens, while its focus on digital content and developer support makes it an attractive platform for creators and users alike.

Featured image from X.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Polygon (formerly Matic Network) is a game-changing Layer 2 scaling solution that addresses Ethereum’s scalability challenges. It empowers developers to create and deploy scalable, interoperable decentralized applications (dApps) by utilizing sidechains, plasma chains, and innovative scaling techniques.

If you’re unfamiliar, sidechains are unique blockchains that are bound to the main Ethereum blockchain and are effective in supporting many Decentralized Finance (DeFi) protocols available on the Ethereum network. This enables rapid transaction speed and cost-effectiveness while maintaining the security and decentralization of the Ethereum network.

As a Layer 2 solution, Polygon operates in parallel to the Ethereum blockchain. Rather than individually validating each transaction, batches of transactions are sent to the Ethereum blockchain, significantly accelerating the validation process and reducing fees.

Polygon implements a proof-of-stake consensus mechanism wherein users can stake tokens for a predetermined duration to validate transactions. In return for their staking activities, participants are rewarded with MATIC tokens.

To ensure robust security, Polygon implements the advanced technique of “commit-chain” or “checkpointing.” It securely anchors the state of Polygon chains onto the Ethereum mainnet at regular intervals, enhancing data integrity and leveraging Ethereum’s inherent security. By capitalizing on Ethereum’s proven security measures, Polygon provides users with a reliable and resilient platform for their transactions and dApps.

The Polygon Network offers a comprehensive set of features that address scalability, security, and developer-friendliness. In this article, we will delve into the key attributes of the Polygon network and assess its substantial potential within the Ethereum ecosystem.

Features Of The Polygon Network

Cross-Chain Connectivity

Polygon network offers bridges that enable smooth transfers of assets and data across diverse blockchains. This fosters interoperability between chains, empowering users to leverage the advantages of multiple blockchain networks and access a broader array of decentralized finance (DeFi) protocols and applications.

Polygon presents a Layer 2 scaling solution for Ethereum by leveraging sidechains to address scalability challenges. This solution facilitates quicker and more economical transactions, alleviating congestion and mitigating high fees on the Ethereum network

Ethereum Compatibility

Polygon seamlessly integrates with the Ethereum Virtual Machine (EVM), enabling developers to effortlessly migrate their existing Ethereum decentralized applications (dApps) to the Polygon network. This compatibility guarantees a seamless transition and adoption of Polygon while leveraging the extensive Ethereum ecosystem and developer tools.

Commit-Chain Checkpointing

Polygon employs commit-chain checkpointing, securing the state of its chains by anchoring them onto the Ethereum mainnet. This approach guarantees the integrity of data, harnesses Ethereum’s robust security measures, and safeguards against any unauthorized alterations or tampering of the sidechain data.

Ethereum Network Security

Leveraging Ethereum as its anchor chain, Polygon leverages the inherent security and decentralization of the Ethereum network. This integration fortifies the overall security of the Polygon ecosystem, ensuring users have access to a reliable and resilient platform for transactions and decentralized applications (dApps).

Developer-Centric Environment

Polygon provides an array of developer tools and infrastructure that empower developers to create and deploy decentralized applications (dApps) seamlessly. The Polygon Software Development Kit (SDK) offers a streamlined framework for building scalable applications on the network, simplifying the development process.

Polygon also prioritizes the needs of developers by offering extensive documentation, guides, and resources. This ensures that developers have access to the necessary information and support to comprehend and harness the platform effectively. The availability of comprehensive resources fosters a vibrant developer community, encouraging collaboration and driving innovation on the network.

MATIC Token Utility And Exchange Availability

Polygon’s rebranding decision resulted in the retention of MATIC as its token ticker symbol. MATIC, an ERC-20 token, ensures compatibility with numerous Ethereum projects. Within the Polygon network, users rely on MATIC to secure and govern the network and cover transaction fees.

The MATIC token serves multiple purposes within Polygon’s ecosystem. Users can utilize MATIC for fee payments during transactions on the Polygon platform. MATIC can also be staked to contribute to the network’s security and earn rewards.

Furthermore, MATIC holders have the ability to engage in governance activities by voting on proposed modifications, influencing the evolution of the network.

In terms of exchange availability, MATIC can be traded on various platforms, including prominent exchanges like UniSwap. This wide accessibility on exchanges enhances liquidity and provides individuals with convenient access to acquire or trade MATIC tokens.

How To Get Started On The Polygon (MATIC) Network

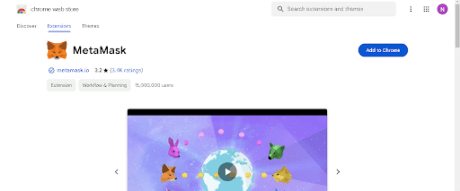

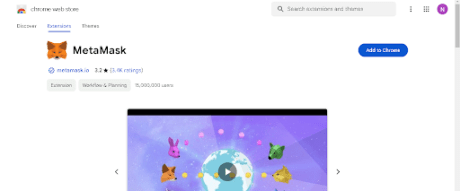

To engage in token transactions on the Polygon network, users must acquire a MetaMask wallet. MetaMask, a widely used browser extension wallet, provides a seamless interface for interacting with blockchain networks, including Ethereum. This user-friendly wallet is accessible as a browser extension for popular browsers like Google Chrome.

To ensure your MetaMask Wallet is added to your browser as an extension, click on the ‘Add to Chrome’ icon located at the top right corner, as depicted below:

After installation and setup, MetaMask enables users to effectively manage their cryptocurrency wallets, seamlessly interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks, all directly from within their web browsers.

Remember to diligently write down your seed phrase on a physical sheet of paper and store it in a secure location. Avoid storing it online or on any electronic device to ensure maximum security.

For the next step, add the Polygon (MATIC) network to your Metamask wallet by following the instructions provided on the Metamask website here.

Trading On The Polygon (MATIC) Network

In order to execute trades on the Polygon (MATIC) network, you will need to fund your wallet with MATIC so as to enable you to cover gas fees. These fees cover the expense associated with utilizing computational resources related to transaction processing and validation.

To purchase MATIC tokens, you can utilize centralized exchanges like Binance. Simply copy your wallet address from MetaMask and proceed to transfer MATIC tokens from your Binance account to your MetaMask wallet.

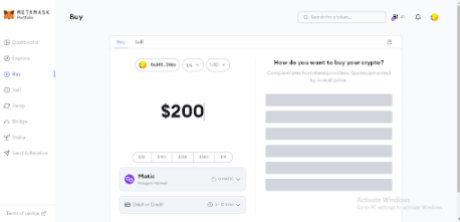

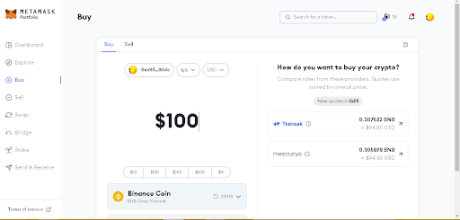

In addition, it is possible to acquire MATIC directly within the MetaMask wallet by utilizing conventional payment methods such as credit or debit cards and other similar options.

Simply click on the “Buy/Sell” button within the MetaMask interface to access the designated section. Within this interface, you can specify the desired amount of MATIC (or any other token) you wish to purchase in terms of US dollars. Additionally, you can select your preferred payment method before finalizing the transaction by clicking on the “Buy” button.

It’s imperative for users to be aware that when purchasing cryptocurrencies directly within MetaMask, you will be required to provide information such as your country and state. However, rest assured that this process is simple and can be completed within a minute.

You can expect your MATIC tokens to arrive in your wallet within a few minutes at most. Once they have arrived, you are ready to start trading tokens on the Polygon network. To begin your trading journey, navigate to UniSwap and commence your trading activities.

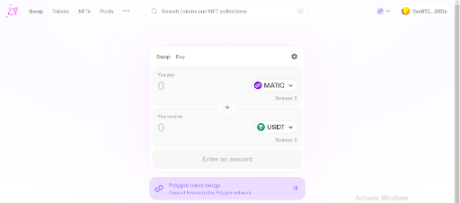

How To Trade Tokens On The Polygon Network Using UniSwap

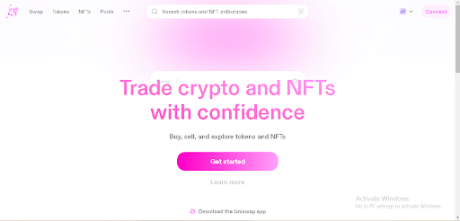

Uniswap is an Ethereum blockchain-based decentralized exchange (DEX) protocol that enables users to trade Ethereum-based tokens from their wallets directly, eliminating the necessity for intermediaries or conventional order books. Uniswap provides users with a hassle-free method to purchase and sell various tokens.

To safeguard your wallet against fraudulent activity, ensure that you are accessing the legitimate Uniswap website.

Begin by clicking on the “Launch App” button located in the top right corner, as depicted in the image below:

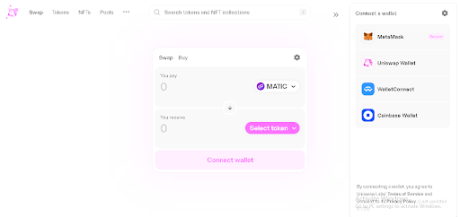

Next, proceed by selecting the “connect” option located at the top right corner of the UniSwap interface, as depicted in the provided image below:

Establish a connection with your preferred wallet, as shown in the image below. In this instance, the suggested wallet is Metamask:

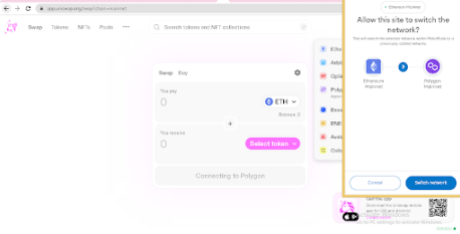

After establishing the connection, adjust your Metamask settings to the Polygon (MATIC) network. (If you are already connected to the Polygon network, there is no need to make any network switches).

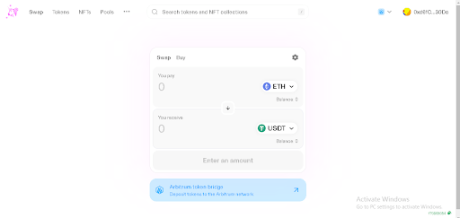

Once you have successfully connected MetaMask to the Polygon network, navigate to UniSwap to begin trading on the Polygon network through the platform.

Moving forward, you need to choose your desired tokens within the UniSwap interface. As Uniswap operates on a token-to-token trading model, click on the “Select Token” button to designate the specific trading pair you wish to trade against.

To illustrate, if you intend to purchase USDT using MATIC, simply choose the MATIC – USDT trading pair, specify the desired amount, and click on “Swap” or “Trade Now.” Confirm the transaction in your Metamask wallet, and you will be able to view the tokens in your wallet’s asset list.

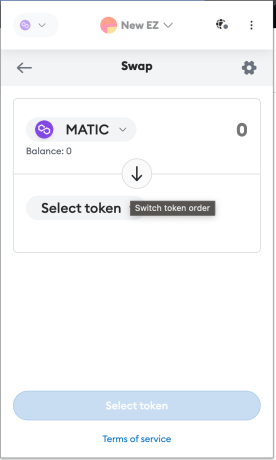

Buying And Selling Tokens With Metamask

Metamask extension wallet, connected to the Polygon network, allows users to buy and sell tokens seamlessly. To proceed, ensure that you are connected to the Polygon network and possess MATIC tokens for swapping and covering gas fees.

Then, locate the “Swap” button, as illustrated below. Clicking on it will direct you to the Swap interface within the Metamask wallet.

Using the image above as a guide, users can search for tokens by name or contract address, just like on UniSwap. Enter the amount of MATIC you want to swap, make sure you have the correct token, and click on “Swap”. Once the transaction is confirmed, the tokens you bought will be sent to your wallet.

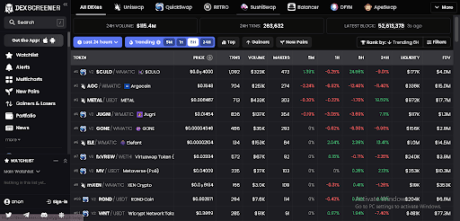

Tracking Token Prices on The Polygon Network

Polygon network users can equip themselves with potential on-chain tools like Dexscreener, which opens up a world of new opportunities for traders. Dexscreener provides users with extensive market insights for specific tokens, ranging from real-time price data to in-depth contract information. It also helps users make well-informed trading decisions based on reliable and up-to-date data.

Stay ahead of the curve on the Polygon network with Dexscreener, keeping track of token metrics and market dynamics.

Dexscreener on the Polygon network offers invaluable features tailored to users. One standout feature is its charting functionality, which provides real-time and historical price data for various tokens.

By utilizing these charts, users can gain valuable insights into price trends, trading volumes, and other important metrics.

Check below for a visual representation:

Conclusion

The Polygon network provides a robust and user-friendly environment for traders to thrive. With its innovative features, growing ecosystem, and commitment to scalability, Polygon is poised to play a pivotal role in shaping the future of decentralized finance.

As Polygon continues to experience growth and wider adoption, we anticipate a broader selection of applications and services tailored to meet the diverse requirements of traders. The network’s dedication to scalability, interoperability, and user satisfaction establishes it as a frontrunner in the ever-evolving blockchain industry.

Featured image from Medium

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Avalanche (AVAX) network has gained prominence as a leading blockchain platform, providing users with a robust infrastructure for token transactions. It is a Layer 1 blockchain protocol that provides a high-performance platform for decentralized applications (dApps) and smart contracts.

Avalanche strives to provide users with a fast, secure, and scalable ecosystem for token transactions. It is a blockchain platform that aims to address the blockchain trilemma of scalability, security, and decentralization, thanks to its unique Proof of Stake (PoS) mechanism. Avalanche is commonly regarded as a viable alternative to Ethereum.

Avalanche serves as a leading light in the Web3 ecosystem by innovating a secure network that doesn’t compromise scalability or decentralization. The network possesses a remarkable characteristic in the form of its consensus protocol, referred to as Snow.

This protocol employs an innovative method known as “Snow consensus”, which enables the network to achieve nearly instantaneous transaction finality. Utilizing the “Snow consensus” method enables the network to achieve rapid confirmation times and efficient throughput by collectively validating transactions through a network of validators, overcoming the limitations of the blockchain trilemma. By addressing the challenges posed by the blockchain trilemma, Avalanche is actively working towards providing robust security and stability to the dynamic advancements in Web3.

This prominent network provides developers and investors with an advantageous blend of cost-effectiveness, high transaction speeds, dependability, and the scalability necessary for widespread acceptance. Avalanche’s commitment to sustainability and environmental consciousness further enhances its appeal. Consequently, it comes as no surprise that Avalanche has emerged as a prominent force in the Web3 ecosystem, commanding a significant presence.

How does Avalanche Work?

Avalanche’s platform sets itself apart from other blockchain projects through three fundamental design aspects: its distinctive integration of subnets, consensus mechanism and utilization of multiple built-in blockchains.

Subnetworks (subnets)

One capability that makes Avalanche innovative is Subnets, a game-changing technology that empowers developers to create projects on networks that they can design to fit their needs. Subnets are deeply customizable and inherit speed and security from Avalanche’s Primary Network.

Subnetworks, composed of groups of nodes, play a crucial role in achieving consensus on the chains within Avalanche’s platform. Each subnetwork is responsible for validating a specific set of blockchains. Additionally, all validators within a subnetwork must also validate Avalanche’s Primary Network.

It is also important to note that the Avalanche blockchain can reportedly process 4,500 transactions per second (depending on the subnet), a significant improvement over Ethereum’s less than 20. Avalanche’s native token is AVAX, which is used to secure the network and pay transaction fees.

Avalanche Consensus

Avalanche Consensus is a novel protocol that builds upon Proof of Stake (PoS) to achieve agreement among nodes in a blockchain network. When a user initiates a transaction, it is received by a validator node that randomly selects a subset of validators to check for consensus.

Through repeated sampling and communication, validators reach an agreement. Validator rewards are based on Proof of Uptime and Proof of Correctness, which consider staked tokens and adherence to software rules. Avalanche’s consensus resembles an avalanche, where a single transaction grows through repeated sampling and agreement.

Built-in Blockchains

Avalanche is built using three different blockchains in order to address the limitations of the blockchain trilemma. Digital assets can be moved across each of these chains to accomplish different functions within the ecosystem.

- i. The Exchange Chain (X-Chain) is the default blockchain on which assets are created and exchanged. This includes Avalanche’s native token, AVAX.

- ii. The Contract Chain (C-Chain) allows for the creation and execution of smart contracts. Because it is based on the Ethereum Virtual Machine, Avalanche’s smart contracts can take advantage of cross-chain interoperability.

- iii. The Platform Chain (P-Chain) coordinates validators and enables the creation and management of subnets.

Unique Features of Avalanche Network

The Avalanche ecosystem has experienced consistent growth, drawing the attention of a considerable number of projects, developers, and users. This expanding ecosystem fosters a dynamic and diverse trading environment, granting traders the opportunity to access an extensive range of assets and trading prospects. Participating in trading activities on the Avalanche network provides a multitude of significant advantages derived from the platform’s exceptional and unmatched features and capabilities. These include:

Enhanced Liquidity

The liquidity on the Avalanche network is strengthened as it continues to attract an expanding user base and an ever-growing assortment of projects. This heightened liquidity is important to traders, as it guarantees the presence of ample buyers and sellers within the market. Consequently, this diminishes slippage and fosters price stability, empowering traders to execute trades at their desired prices with minimal adverse effects.

Cross-chain Interoperability

Avalanche facilitates cross-chain interoperability through its support for the Ethereum Virtual Machine (EVM), enabling smooth interaction and compatibility with assets and decentralized applications (dApps), built on the Ethereum network.

This cross-chain interoperability broadens the horizons of trading opportunities, granting traders access to a wider selection of assets and the ability to leverage the liquidity present in other blockchain networks.

Security

Security is a top priority for the Avalanche network, and it implements robust Byzantine fault tolerance (BFT) mechanisms. These measures safeguard the network against malicious attacks and guarantee the integrity of transactions.

As a result, users can confidently participate in token transactions and interact with dApps on the Avalanche network, knowing that their security remains uncompromised.

Ecosystem Expansion

The expanding market depth on Avalanche empowers traders to broaden their asset selection, granting them access to a more extensive array of trading options. As adoption gains momentum, an increasing number of projects and tokens are introduced on the platform, enriching the diversity of available assets.

This diverse assortment of assets facilitates portfolio diversification and facilitates the exploration of various investment opportunities, accommodating a wide range of trading strategies and individual preferences. Avalanche works with a wide variety of Ethereum DApps and infrastructure projects, including Trader Joe and UniSwap.

How To Get Started On The Avalanche Network

In order to engage in token transactions on the Avalanche (AVAX) network, users are advised to acquire a Metamask wallet. Metamask is a widely utilized browser extension wallet that facilitates interactions with blockchain networks such as Ethereum. It can be easily accessed and installed as an extension on popular web browsers like Google Chrome.

To add your Metamask Wallet to your browser as an extension, simply click on the ‘Add to Chrome’ icon located in the top right corner, as depicted below:

After you have installed and set up MetaMask, you can use it to manage your cryptocurrency wallets, interact with decentralized applications (DApps), and safely perform transactions on supported blockchains directly from your browser.

Remember to write down your seed phrase on paper and keep it in a secure place. Avoid storing it online or on your device.

Afterwards, you can add the Avalanche (AVAX) network to your Metamask wallet by following the instructions provided on the Metamask website here.

Trading On The Avalanche (AVAX) Network

In order to execute trades on the Avalanche Network, users will need to fund their wallet with AVAX tokens. AVAX is the native cryptocurrency for the Avalanche Network, and it functions as the primary medium of exchange for transactions, gas fees and liquidity provision on the platform. Hence, users should ensure a sufficient amount of AVAX tokens in their wallet to cover the cost of trading on the Avalanche network.

Users have the option to purchase AVAX on centralized exchanges like Binance. Once you have obtained AVAX, you can copy your wallet address from Metamask and proceed to send the AVAX tokens from Binance to your Metamask wallet.

You can also buy AVAX directly from your Metamask wallet. Click on the buy/sell button within Metamask to open the interface. Here, you can put how much AVAX token you intend to buy in terms of dollar amounts, pick your payment method, and then click “Buy”.

Kindly note that if you wish to buy cryptocurrencies directly within Metamask, you will need to provide information such as your country and state of residence. Rest assured, the process is quick and uncomplicated, typically taking just a minute to complete.

The arrival of your AVAX tokens in your wallet should take no more than a few minutes. Once they are successfully deposited, you are ready to commence trading tokens on the Avalanche network.

Now, it’s time to visit Trader Joe, and embark on your trading journey.

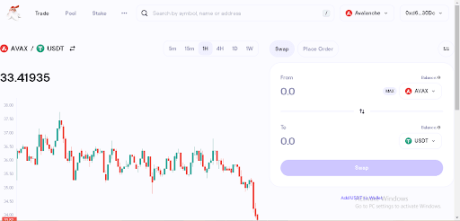

How To Trade Tokens On The Avalanche Network Using TraderJoe

Trader Joe is a decentralized exchange (DEX) on the Avalanche network. It allows users to trade tokens directly from their wallets using liquidity pools. Trader Joe prioritizes user control, security, and privacy while providing a user-friendly trading experience.

Make sure to be on the right Trader Joe website so as to protect your assets from malicious activities. The first step on the website is clicking on the “Connect Wallet” option at the top right corner, as shown in the image below:

Connect to the preferred wallet option (Metamask) as presented in the image below:

Once connected, switch Metamask to AVAX (no need to switch if you’re already on the AVAX network):

After connecting MetaMask to the Avalanche network, go to Trader Joe, and then you can start trading on the Avalanche (AVAX) network using Trader Joe.

Once you reach the Trader Joe interface, you can proceed by choosing your desired tokens. Since Trader Joe follows a token-to-token trading model, simply click on the “select token” button to pick the trading pair you wish to trade against. Users can search tokens by name, symbol or contact address:

Buying and Selling Tokens With The Metamask Wallet

Users of the Avalanche (AVAX) Network have the option to purchase and sell tokens directly through the Metamask extension wallet, which is already connected to the Avalanche network.

To proceed, ensure that you are connected to the Avalanche network and possess AVAX tokens for swapping and paying transaction fees. Next, locate the “Swap” button, illustrated below, and click on it. This action will redirect you to the Swap interface within Metamask.

Using the image above as a guide, you can also search for tokens using the name or the contract address, just like on Trader Joe. Input the amount of AVAX you want to swap, confirm that you have the correct token, and then click “Swap.”

Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

Tracking Token Prices on The Avalanche Network

Utilizing on-chain tools such as Dexscreener, users of the Avalanche network can access extensive market insights for specific tokens. These insights encompass crucial data like price information and contract details, equipping users with reliable and up-to-date information. By leveraging these insights, users can make informed trading decisions and engage in the market with confidence.

Dexscreener also allows Avalanche users can stay updated on token metrics and market dynamics, thereby improving their trading strategies and enhancing their overall trading experience. It provides valuable information such as price data, market cap, token supply, contract details, etc, that empowers users to make more informed decisions and navigate the market properly.

Dexscreener provides a range of beneficial features specifically designed for users on the Avalanche network. One standout feature is its advanced charting functionality, which offers real-time and historical price data for a diverse selection of tokens.

Through these charts, users can access valuable information about price trends, trading volumes, and other essential metrics. This empowers them to identify optimal entry and exit points for their trades with accuracy and certainty.

Conclusion

In conclusion, the Avalanche network provides a robust ecosystem for decentralized finance (DeFi) and token trading. With its fast transaction speeds, low fees, and high scalability, Avalanche offers an efficient and user-friendly platform for buying, selling, and trading tokens.

The network supports various decentralized exchanges, such as Trader Joe, and provides on-chain tools like Dexscreener to empower users with market insights. It is important for users to stay informed, exercise caution, and adapt to the evolving landscape of the Avalanche network to make the most of its features and opportunities.

Featured image from LinkedIn

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Arbitrum (ARB) network is a Layer 2 scaling solution for Ethereum that aims to address the scalability and high transaction fees. It is developed by Offchain Labs and utilizes a technology called Optimistic Rollups to achieve its objectives.

Optimistic Rollups work by processing most transactions off-chain and then periodically submitting a summary of those transactions to the Ethereum mainnet. This approach reduces the transaction costs significantly and increases the throughput of the network while maintaining the security guarantees of the Ethereum mainnet.

In other words, the optimistic rollup feature allows Ethereum smart contracts to scale by passing messages between smart contracts on the Ethereum main chain and those on the Arbitrum second layer chain. Much of the transaction processing is completed on the second layer, and the results of this are recorded on the main chain — drastically improving speed and efficiency.

One of the key features of the Arbitrum network is its compatibility with existing Ethereum smart contracts. Developers can deploy their contracts on the Arbitrum network with minimal modifications, allowing for easy migration of decentralized applications (dApps) from Ethereum to Arbitrum.

Also, the arrival of the Ethereum network introduced a groundbreaking transformation in the realm of blockchain technology, providing a platform for the creation of decentralized applications (dApps) and propelling the growth of decentralized finance (DeFi). Nevertheless, as Ethereum’s preeminence soared, it encountered hurdles related to scalability and exorbitant transaction fees.

This is where the Arbitrum network enters the picture as a Layer 2 scaling solution, poised to tackle these challenges while ensuring seamless integration with Ethereum’s ecosystem. In this article, we will explore the core features of the Arbitrum network and examine its immense potential in the Ethereum ecosystem.

Features Of Arbitrum Network

The promise of Scalability:

Scalability has long been a bottleneck for Ethereum, causing network congestion and skyrocketing transaction fees during times of high demand. Arbitrum tackles this challenge by implementing Optimistic Rollups, a technology that allows for most transactions to be processed off-chain. By aggregating multiple transactions into a single summary, ARB achieves significant scalability improvements, enabling faster confirmation times and a higher throughput. This scalability boost unlocks the potential for a more efficient and seamless user experience on the Ethereum network.

Ecosystem and Adoption:

The Arbitrum network has garnered significant attention and interest within the Ethereum ecosystem. Several prominent projects and protocols have announced plans to deploy on Arbitrum or explore integrations. This growing ecosystem includes decentralized exchanges (DEXs), lending platforms, gaming applications, and more.

The increased adoption of Arbitrum provides users with a wider range of options for interacting with decentralized applications (DApps) and accessing various DeFi services.

Smart Contract Execution:

Arbitrum Network makes use of a technique called optimistic execution to process smart contracts. It assumes that most transactions are valid and executes them off-chain. This enables the network in providing fraud proofs, which allows anyone to challenge invalid transactions by submitting evidence to the Ethereum mainnet. This approach enables efficient and secure smart contract execution.

Decentralization and Security:

While Arbitrum relies on the Ethereum mainnet for final settlement and security, it maintains a high level of decentralization and security. By leveraging Ethereum’s robust consensus mechanism, Arbitrum benefits from the security guarantees of the Ethereum network. The periodic submission of transaction summaries to Ethereum ensures that any potential fraudulent activity can be detected and resolved.

Seamless User Experience:

Using the Arbitrum(ARB) network is designed to be seamless for users. They can continue using their existing Ethereum wallets, such as MetaMask, to interact with the Arbitrum network. This familiarity and compatibility make it easier for users to transition from Ethereum to Arbitrum and enjoy the benefits of improved scalability and reduced transaction fees without significant changes to their workflows.

What Makes Arbitrum Unique?

The Arbitrum (ARB) network is designed to provide an easy-to-use platform developers can use to launch highly efficient and scalable Ethereum-compatible smart contracts. It offers a range of exciting possibilities for developers and users alike. Some examples of what can be done on the network include:

High EVM compatibility

Arbitrum(ARB) is considered to be one of the most EVM-compatible rollups. It’s compatible with the EVM at the bytecode level, and any language that can compile to EVM works out of the box — such as Solidity and Vyper. This makes it easy to build on since developers do not need to get to grips with a new language before building on Arbitrum.

Decentralized Finance (DeFi) applications:

The Arbitrum (ARB) network can be used to build and run DeFi applications, such as decentralized exchanges (DEXs), lending and borrowing platforms, and stablecoin systems. These applications can benefit from the network’s fast transaction processing times and low gas fees, enabling efficient and affordable transactions.

Low transaction fees

As a Layer 2 scaling solution for Ethereum, Arbitrum isn’t just designed to boost Ethereum’s transactional throughput, it also minimizes transaction fees at the same time.

Thanks to its extremely efficient roll-up technology, Arbitrum is able to cut fees down to just a tiny fraction of what they are on Ethereum, while still providing sufficient incentives for validators.

Well-developed ecosystem

Arbitrum is already working with a wide variety of Ethereum DApps and infrastructure projects, including the likes of Uniswap.

Cross-Chain Interoperability

The Arbitrum (ARB) network can also be used to enable cross-chain interoperability between different blockchains. This could allow for the seamless transfer of assets and data between different blockchain ecosystems, enabling greater interoperability and connectivity across the entire blockchain space.

The Arbitrum network’s fast transaction processing times, low fees, and security and decentralization features make it a compelling choice for a wide range of use cases.

How To Get Started on The Arbitrum Network

To buy and sell tokens on the Arbitrum (ARB) network, you must first get a metamask wallet. MetaMask is a popular browser extension wallet commonly used for interacting with blockchain networks like Ethereum. It is available as a browser extension for popular browsers such as Google Chrome.

Ensure your Metamask Wallet has been added to your browser as an extension by clicking on the ‘Add to Chrome” icon on the top right as shown below:

Once installed and set up, MetaMask allows users to manage their cryptocurrency wallets, interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks directly from their browsers. (Make sure to write down your seed phrase on a piece of paper and keep it in a safe place. Do not store it online or on your device).

Next, add the ARB network to your Metamask wallet by following the instructions provided on the Metamask website here.

Trading On the Arbitrum (ARB) Network

In order to execute trades on the ARB network, you will need to fund your wallet with Ethereum (ETH) so as to enable you to cover gas fees even though the majority of the trading activity takes place on the Arbitrum layer 2 solution. This is because the Arbitrum network periodically submits transaction summaries and proofs to the Ethereum mainnet, which requires paying Ethereum gas fees.

You can buy ETH on centralized exchanges such as Binance, copy your wallet address from Metamask, and then send the ETH from Binance to your Metamask wallet.

You can also purchase ETH directly within the Metamask wallet using traditional payment methods such as credit or debit cards, etc.

Just click on the “Buy/Sell” button within Metamask to open the interface. Here, you can put how much ETH (or any other token) you want to buy in terms of dollar terms, pick your payment method, and then click “Buy”.

Note that to buy crypto directly within Metamask, you will need to provide info such as your country and state. However, it is a straightforward process that only takes a minute.

It’ll only take a couple of minutes at most for your ETH to arrive in your wallet. Once the ETH arrives, you are all set to begin trading tokens on the ARB network. So, head over to UniSwap to get started on your trading journey.

How To Trade Tokens On The ARB Network Using UniSwap

Uniswap is a decentralized exchange (DEX) protocol built on the Ethereum blockchain. It allows users to trade Ethereum-based tokens directly from their wallets without the need for intermediaries or traditional order books. Uniswap offers users a simple and straightforward way to buy and sell a wide variety of tokens.

Endeavour to be on the right Uniswap website to protect your wallet from any fraudulent activity. The first step is clicking on the “launch app” button at the top right corner, as shown in the image below:

The next step is clicking on the connect wallet option on UniSwap at the top right corner, as shown in the image below:

Connect to your preferred wallet as shown below. (In this case, it’s Metamask):

Once connected, switch Metamask to the ARB network. (If you’re already on the ARB network, you do not need to switch):

After connecting MetaMask to the ARB network, go to UniSwap, and then you can start trading on the ARB network using UniSwap.

The next step is to select your preferred tokens on the UniSwap interface and since Uniswap operates on a token to token trading model, click on the “select token” button to select the trading pair you want to trade against.

For example, if you want to buy USDT using ETH, select ETH – USDT, enter the amount, then click on “swap” or “trade now” and confirm the transaction in your Metamask wallet. You can view the tokens in your wallet’s asset list.

Buying and Selling Tokens with the Metamask Wallet

ARB Network users can also buy and sell tokens using the Metamask extension wallet already connected to the ARB network.

To do this, make sure you’re connected to the ARB network and have ETH to swap and pay for gas fees. Then, navigate to the “Swap” button as shown below. This will take you to the Swap interface inside Metamask.

Using the image above as a guide, you can also search for tokens using the name or the contract address, just like on UniSwap. Input the amount of ETH you want to swap, confirm that you have the correct token, and then click “Swap.” Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

Tracking Token Prices on The Arbitrum Network

Users of the Arbitrum (ARB) network can take advantage of on-chain tools like Dexscreener to gain access to comprehensive market insights for specific tokens. These insights include price data and contract information, empowering users to make well-informed trading decisions based on reliable and up-to-date information.

With Dexscreener on the Arbitrum network, users can stay informed about token metrics and market dynamics, enhancing their trading strategies and overall trading experience.

Dexscreener offers a variety of advantageous features tailored to users on the Arbitrum network. Among these features, an exceptional one is the charting functionality, which delivers both real-time and historical price data for a wide range of tokens.

By utilizing these charts, users gain valuable insights into price trends, trading volumes, and other pertinent metrics. This enables them to pinpoint potential entry or exit points for their trades with precision and confidence.

Take a look at the example below:

Conclusion

In conclusion, the Arbitrum network offers a compelling ecosystem for buying, selling, and trading tokens, providing several notable advantages over other platforms. With its seamless integration of on-chain tools like Dexscreener, users gain access to detailed market insights, real-time price data, and historical charts, enabling them to make informed trading decisions with confidence.

Additionally, Arbitrum’s scalability and low transaction fees enhance the overall trading experience, ensuring quicker and more cost-effective transactions. By leveraging the power of the Arbitrum network, traders can enjoy a secure, efficient, and feature-rich environment that empowers them to navigate the world of token trading with ease.

Featured image from CoinMarketCap

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The captivating Binance Smart Chain (BSC) Network has morphed into a powerful force within the blockchain ecosystem, offering various benefits and opportunities for users and developers alike. Introduced by Binance, a top player in the global cryptocurrency exchange realm, BSC provides a robust and efficient infrastructure for decentralized applications (dApps) and digital asset transactions.

The key advantage of the BSC network is its high-speed and low-cost transactions. With its standout consensus mechanism, BSC achieves fast block confirmations, enabling quick and seamless transfers of digital assets. This scalability advantage makes BSC an attractive choice for users who value speed and efficiency in their transactions.

Advantages Of The Binance Smart Chain (BSC) Network

The Binance Smart Chain (BSC) offers several advantages that have contributed to its popularity and growth within the blockchain ecosystem. Here are some key advantages of the BSC network:

High Speed and Low Transaction Fees: BSC is known for its fast block confirmations, which result in quick transaction processing times. This speed is achieved through its unique consensus mechanism. Additionally, BSC’s low transaction fees have made it a preferred platform for developers and users.

Compared to other popular blockchain networks, BSC offers significantly lower transaction costs, making it more accessible for individuals and businesses of all sizes. This cost-effective system has aided the exponential growth of decentralized finance (DeFi) applications on the BSC network by providing a wide range of financial services to users around the world.

Scalability: BSC has been designed to handle high transaction volumes, allowing for the smooth and efficient execution of decentralized applications (dApps). This advantage enables BSC to accommodate the growing demands of users and developers without compromising performance.

Compatibility with Ethereum: The compatibility of BSC with the Ethereum Virtual Machine (EVM) has made it easy for developers to port their existing Ethereum-based projects to BSC, expanding the pool of available applications.

This opens up a world of possibilities, as it expands the range of applications available on BSC, offering users a greater selection of innovative and diverse decentralized applications to choose from. This interoperability has fostered innovation and attracted a diverse range of projects, including decentralized exchanges, yield farming platforms, and NFT marketplaces.

The close integration between BSC and the Binance exchange also creates a host of advantages for users. The seamless connection between these two platforms facilitates effortless token swaps and transfers.

Trading On The BSC Network

Decentralized exchanges (DEXs) on the Binance Smart Chain (BSC) network provide traders with a range of features and opportunities to enhance their trading experience. Here’s an elaboration on the features of DEXs on BSC:

Automated Market Makers (AMM): DEXs on BSC leverage AMM protocols to enable token swaps. AMM algorithms automatically set token prices based on supply and demand dynamics within liquidity pools. This feature eliminates the need for traditional order books and enables continuous liquidity, allowing traders to execute swift and efficient trades.

Yield Farming: Yield farming is a popular practice in the decentralized finance (DeFi) space, and many BSC DEXs offer yield farming opportunities where traders provide liquidity to specific token pairs by depositing their assets into smart contract-based liquidity pools. In return, they receive liquidity provider (LP) tokens, which represent their share of the pool.

Traders can then stake these LP tokens in yield farming programs to earn additional tokens or rewards. Yield farming enables traders to earn passive income by utilizing their idle assets effectively.

Liquidity Pools: These are fundamental components of DEXs on BSC which consist of pairs of tokens that are used for trading. Traders can contribute their assets to these pools and become liquidity providers.

By providing liquidity, traders help ensure that there is sufficient liquidity available for trading. In return for their contribution, liquidity providers earn a portion of the trading fees generated by the DEX. This incentivizes traders to provide liquidity, as they can earn fees from the trading activity in the pool.

Token Trading: DEXs on BSC offer traders the ability to trade a wide range of tokens. These tokens can include native tokens of projects built on the BSC network, as well as tokens that have been bridged from other blockchains, including Ethereum.

Traders have access to various trading pairs, allowing them to buy and sell tokens directly from their wallets. The availability of diverse tokens and trading pairs provides traders with abundant opportunities to explore various markets and investment opportunities.

Additionally, the Binance Smart Chain (BSC) is a modified Ethereum fork which simply means that it is compatible with the Ethereum network. Both of these blockchain networks have similar infrastructure, which is why they have the same address in your wallet.

This is to ensure that your funds are not permanently lost when you send them via the wrong network. Simply put, if you send a token to your ETH via the BSC network, the funds will still be on the blockchain and you’ll be able to retrieve them.

How To Get Started On The BSC Network

To buy and sell tokens on the Binance Smart Chain (BSC) network, you will first need to get a Metamask wallet and fund it with BNB tokens. MetaMask is a popular browser extension wallet commonly used for interacting with blockchain networks like Ethereum and Binance Smart Chain (BSC). It is available as a browser extension for popular browsers such as Google Chrome.

Ensure your Metamask Wallet has been added to your browser as an extension by clicking on the “Add to Chrome” icon on the top right as shown below:

Once installed and set up, MetaMask allows users to manage their cryptocurrency wallets, interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks directly from their browsers. (Make sure to write down your seed phrase on a piece of paper and keep it safe. Do not store it online).

Next, add the BSC network to your Metamask wallet by following the instructions provided on the Metemask website here.

Getting BNB Tokens To Trade On The BSC Network

Once that is done, you need to fund your wallet with BNB before you can begin trading on the BSC network. You can buy BNB on centralized exchanges such as Binance, copy your wallet address from Metamask, and then send the BNB from Binance to your Metamask wallet.

You can also purchase BNB directly within the Metamask wallet using traditional payment methods such as credit or debit cards, PayPal, bank transfer, CashApp, etc.

Just click on the “Buy/Sell” button within Metamask which will open up the interface. Here, you can put how much BNB you want to buy in terms of dollar terms, pick your payment method, and then click “Buy”.

Note that to buy crypto directly within Metamask, you will need to provide info such as your country and state. However, it is a straightforward process that only takes a minute.

It’ll only take a couple of minutes at most for your BNB to arrive in your wallet. Once the BNB arrives, you are all set to begin trading tokens on the BSC network. So head over to Pancakeswap to get started on your trading journey.

How To Trade Tokens On The BSC Network Using PancakeSwap

PancakeSwap is the leading decentralized exchange on the BSC network. Here, users are able to buy and sell a large range of tokens, and it is a straightforward process.

Make sure you are on the correct Pancakeswap website to prevent your wallet from being drained. The next step is clicking on the “Connect Wallet” option on Pancakeswap at the top right corner as illustrated below:

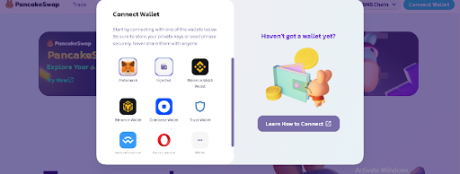

Connect to your preferred wallet as shown below. (In this case, it’s Metamask):

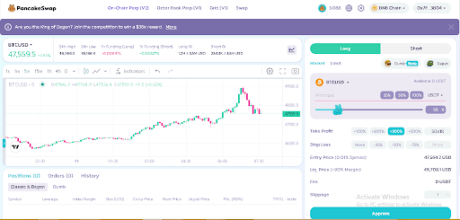

Once connected, switch Metamask to the BSC network. (If you’re already on the BSC network, you do not need to switch):

With MetaMask connected to the BSC network, go to PancakeSwap, then you can start trading on the BSC network using PancakeSwap. Search for the token you want to purchase using the name or the contract address.

Set slippage to auto to avoid having to manually set it with each swap. Once done, pick how much BNB (at the top) you want to convert to the new token (at the bottom), click on “Swap,” and confirm the transaction in your Metamask wallet.

Once the transaction is confirmed, the tokens will be sent to your wallet. To convert your tokens back into BNB, repeat this process by putting the new token at the top and picking BNB at the bottom. Click Swap and BNB will be sent to your wallet.

Buying And Selling Tokens With The Metamask Wallet

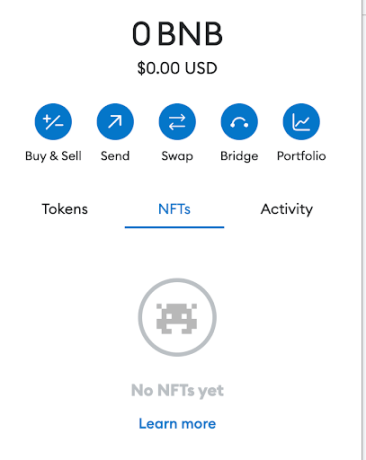

BSC Network users can also buy and sell tokens using the Metamask extension wallet already connected to the BSC network.

To do this, make sure you’re connected to the BSC network and have BNB to swap and pay for gas fees. Then navigate to the “Swap” button as shown below. This will take you to the Swap interface inside Metamask.

Here, you can also search for tokens using the name or the contract address, just like on Pancakeswap. Input the amount of BNB you want to swap, confirm that you have the correct token, and then click “Swap.” Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

Tracking Token Prices On The BSC Network

BSC network users can leverage on-chain tools such as Dextools to access detailed market insights about a particular token such as price and contract information to enable them to make informed trading decisions.

Dextools offers a range of features that are particularly beneficial for users on the BSC network. One notable feature is the ability to check charts, providing real-time and historical price data for various tokens. These charts enable users to analyze price trends, trading volumes, and other relevant metrics, helping them identify potential entry or exit points for their trades, as shown below:

In addition to charting capabilities, Dextools provides a “Contract Audit” feature that is especially valuable for BSC users. This feature allows users to check the audit score of a smart contract before investing in a token. Audits assess the security and reliability of a contract’s code, highlighting potential vulnerabilities or risks.

By accessing the audit score through Dextools, users can evaluate the level of trustworthiness and credibility of a token’s underlying smart contract, minimizing the chances of falling victim to scams or vulnerabilities.

Conclusion

The BSC network has become popular within the blockchain ecosystem due to its advantages and has attracted a diverse range of projects and users. BSC’s compatibility with Ethereum facilitates seamless token transfers between the two networks, enhances diversification of development and usage, and promotes collaboration within the broader blockchain ecosystem.

Additionally, it offers interoperability, allowing developers to easily port existing Ethereum-based applications and assets to BSC. This compatibility grants access to the extensive Ethereum ecosystem, enabling users to leverage the infrastructure and liquidity of Ethereum while benefiting from BSC’s faster transactions and lower fees.

BSC’s combination of interoperability, accessibility to liquidity, and enhanced transaction efficiency makes the BSC network a compelling choice for both developers and users, solidifying its position as a prominent player in the evolving blockchain landscape.

Featured image from Medium

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Investors interested in Bitcoin ETFs in the US have been transferring their 401k retirement plans to institutions offering seamless trading in a bid to obtain financial freedom.

The approval of 11 spot Bitcoin exchange-traded funds (ETFs) has received mixed reactions in the past two days. On one hand, the approval of spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC) can be seen as a major event that opens a new era of mass adoption of Bitcoin and the web3 sector. On the other hand, the approval of spot BTC ETFs has been viewed as a violation of the law by undermining the set anti-money laundering laws. Furthermore, US SEC Chair Gary Gensler indicated that the approval of spot BTC ETFs is not an endorsement of the crypto assets.

“While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse Bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto,” Gensler noted.

Notably, US Senator for Massachusetts Elizabeth Warren differed with the SEC’s decision to approve spot Bitcoin ETF amid concerns over anti-money laundering. Nonetheless, the crypto community has reminded Senator Warren that the US justice system paved the way for the approval of spot BTC ETFs.

The @SECgov is wrong on the law and wrong on the policy with respect to the Bitcoin ETF decision.

If the SEC is going to let crypto burrow even deeper into our financial system, then it’s more urgent than ever that crypto follow basic anti-money laundering rules.

— Elizabeth Warren (@SenWarren) January 11, 2024

Major Banks’ Reactions to the Approval of Spot Bitcoin ETFs

Following the approval of spot Bitcoin ETFs in the United States on Wednesday, Vanguard Group indicated that it will not facilitate their buying but only sales. As a result, investors seeking to get Bitcoin exposure to their portfolios have opted to transfer to friendly financial institutions like Fidelity Investments which supports seamless trading of spot Bitcoin ETFs.

Just transferred my 401k from Vanguard to Fidelity. It took about 15 minutes.

If you have an account with a broker currently blocking access to #bitcoin ETFs, close it and get out.

Make these boomers hurt

— Julian Fahrer (@Julian__Fahrer) January 11, 2024

Meanwhile, UBS Group AG (NYSE: UBS), a Zürich-based wealth management firm, has announced that it will allow access to some clients who want to trade spot Bitcoin ETFs. However, people close to the bank indicated that UBS will approve access under several conditions. One of the conditions set is that UBS cannot solicit the trades and accounts with a lower risk tolerance will not be able to buy the spot Bitcoin ETFs.

Similarly, New York-based Citigroup Inc (NYSE: C) intends to offer seamless trading services to the approved spot Bitcoin ETFs to its individual clients. Another financial firm that has already confirmed the support of spot Bitcoin ETFs trading is Charles Schwab Corp (NYSE: SCHW).

The approval of spot Bitcoin ETFs in the United States has significantly increased the crypto bullish sentiments. With Bitcoin halving less than 100 days away, crypto experts expect Bitcoin price to reach a six-figure value within the next few quarters. Moreover, the demand is rising exponentially on a limited supply of Bitcoin and other digital assets.

next

Funds & ETFs, Market News, News

You have successfully joined our subscriber list.