When Eric Schauer was laid off last July at age 55, he wasn’t too worried about landing a new position.

A senior manager in Albany, N.Y., Schauer figured the generous severance package he got from his company in the chemicals industry would tide him over until he found a new job in the tight labor market. Nearly a year later, he’s been a finalist for a handful of positions but hasn’t been hired yet. Schauer suspects his age may be to blame.

“Once they get me in person,” he says, “that’s where it ends.”

His experience is hardly unique. Only about half of Americans work continuously throughout their 50s, according to an analysis of Health and Retirement Study data by researchers Beth Truesdale, Lisa Berkman, and Alexandra Mitukiewicz in the recent book, Overtime: America’s Aging Workforce and the Future of Working Longer. Among the top reasons are being laid off or pushed out of work, health concerns, and caregiving responsibilities, according to the authors. While lower-income workers are most likely to be affected, the issue spans demographics.

The financial fallout is serious. Common advice assumes you can increase your retirement savings in your 50s, when, presumably, you can afford to make the extra contributions that the Internal Revenue Service allows for workers ages 50 and over. But for those out of work, not only can be it become impossible to save, but some are forced to do the opposite—raiding retirement accounts to pay for living expenses.

If you’re not steadily employed in your 50s, you’re less likely to work beyond that. Eighty percent of those who worked continuously in their 50s continued to work into their next decade of life, versus just 35% of those who were intermittently employed, according to Overtime.

In the popular imagination, you work up until you decide to retire. But for many, the reality is less linear.

It’s not up to individuals to fix the structural problems that can prevent older workers from staying employed, like ageism and the dearth of paid family leave. But there are some steps that you can take to prepare for a decade that could be bumpier than expected. Here’s what to do:

Don’t Wait to Save

Workers age 50 and over are allowed to make what the IRS calls “catch-up contributions” to their retirement accounts. For 2023, the amounts are an extra $7,500 for 401(k) and similar plans, and an extra $1,000 for individual retirement accounts. Only about 16% of eligible workers made these contributions in 2022, according to Vanguard’s How America Saves 2023 report.

Ideally, workers will have been contributing to their retirement accounts all along, so they won’t have to catch up in their 50s. “I think of catch-up contributions as panic contributions,” says Teresa Ghilarducci, professor of economics at the New School. “That’s what Congress should have called them.”

The importance of starting retirement contributions early is typically framed in terms of compound interest. If you begin contributing $475 a month to a retirement account at age 22, you’ll have $2.4 million by age 67, versus just $1.1 million if you wait until 32, and only $450,040 if you wait an additional 10 years until 42, assuming annualized 8% returns, according to an illustration by MassMutual.

As important as compound interest is, it’s also worth thinking about contributing early as risk management. You may not be in a position to catch up in your 50s, so don’t wait. Save what you can now, even if it’s just enough to get your company match. And think of catch-up contributions as an opportunity to turbocharge your savings after decades of steady contributions.

While Schauer’s unemployment hasn’t been financially ruinous, his retirement progress has stalled. He and his wife have no children, and his wife’s job in project management has helped keep them afloat. But he is no longer contributing to his 401(k), and she is contributing only a minimum amount. “We’re kind of stagnating on retirement,” he says.

Reduce Your Expenses

Rand Spero, president of Street Smart Financial in Lexington, Mass., talks to clients frequently about their job security and how they would pay their bills if they lost their work. “I get a range of responses, from ‘I could get 10 jobs tomorrow’ to ‘That’s pretty scary,’” he says.

He advises clients to keep at least six months’ worth of expenses in a liquid emergency fund. Those who anticipate a harder time landing a job if they become unemployed might want to save even more. If that’s a stretch, homeowners who qualify for a home-equity line of credit might want to open one while they’re still employed, so it can function like an emergency fund if they lose their jobs, Spero says.

In addition to padding an emergency fund, older workers who feel their jobs are precarious might want to dial back their spending. “In your 50s, you have a certain lifestyle,” Spero says. “The question is, what is fixed and what is discretionary?” Taking a more modest vacation—or deciding not to splurge on a new car—can help you build a buffer to withstand future financial shocks.

Check Your Expectations

Hugh Taylor saw the writing on the wall in 2009, when he got laid off from

IBM

at age 44 in a mass layoff that affected thousands of employees. He didn’t want to find himself in that position again, so he resolved to become his own boss. After spending a couple of years as the head of marketing for a start-up, he’s been working steadily as a freelance content writer for the past 12 years.

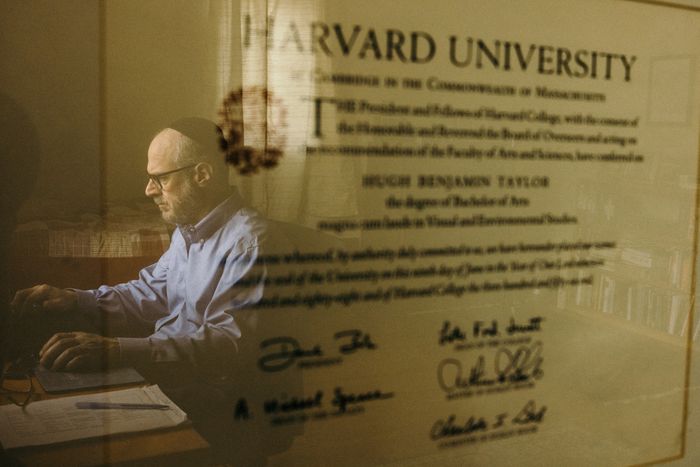

Now 58, Taylor has watched some of his peers struggle. A 1992 graduate of the Harvard Business School, he has seen former classmates get sidelined by health concerns or a failure to adapt to changing circumstances.

Taylor says he’s seen some of his Harvard Business School classmates struggle with their careers in their 50s.

Photograph by Peter Larson

People who get laid off in their 50s often seek to replicate their prior positions and salaries in their new positions. However understandable, this impulse often holds them back. “The idea that you’re just going to go from one Fortune 500 company to another in the same role—it happens, but it’s not easy,” Taylor says.

David Wiczer, associate advisor at the Federal Reserve Bank of Atlanta and a research fellow at the IZA Institute of Labor Economics, says it’s normal after a period of unemployment for people in their 50s to get offered a lower salary than the one they left. In fact, his research has found workers 56 and older earn about a quarter less on average in their new job after they’ve remained unemployed for at least a month.

His advice? Take the lesser offer. Once you’re in the job, you can try to maneuver your way into something better. “The best way to get back to where you were is to be employed,” Wiczer says.

For his part, Schauer has come to realize that his salary expectations might be putting prospective employers off. “Maybe I can’t be too choosy,” he says.

He reads widely and has kept himself current on developments in his field. In interviews, he tries to leverage his emotional intelligence as an asset. While his job search has grown demoralizing, he’s not giving up.

“I still feel like I have something to contribute,” Schauer says.

Write to Elizabeth O’Brien at elizabeth.obrien@barrons.com