The big benchmarks paused just as the stock market prepares to head into the final week of June and of the second quarter. Stocks were certainly due for a break. How they behave over the coming week may provide some clarity on where things are headed — and how investors should act. Earnings from Nike (NKE) will wrap up the Dow’s earnings season. Carnival (CCL) reports, as cruise lines continue their rally. And Constellation Brands (STZ) report will receive tight scrutiny, as investors keep a close eye on the Bud Light Beer Wars.

X

Stocks To Watch: Stocks Hold Buy Points Amid Pullback

Amid a market pullback, look for stocks that are holding up, at least relatively well. Monday.com, Parker-Hannifin (PH), Shopify (SHOP), Installed Building Partners (IBP) and Paccar (PCAR) are all consolidating in buy zones or just below buy points. Some of these are still extended from their 50-day lines. Investors could buy some of these stocks now, but they may want to wait for the overall market to revive. Ultimately, stocks may be actionable from traditional buy points or from high handles as a result of these consolidations.

Economic Calendar: Consumer Spending, Jobless Claims In Focus

Economic news in the coming week will be headlined by Friday’s personal income and outlays report for May, to be released at 8:30 a.m. ET. Not only will the data shed some light on how consumer spending is holding up, but it will update the Federal Reserve’s favorite inflation indicator, the personal consumption expenditures price index. While the overall PCE inflation rate could slip below 4% for the first time since March 2021, core prices, excluding food and energy, are seen rising 0.4% on the month. That would leave the core inflation rate near April’s 4.7%. The Fed has recently put more emphasis on prices for core services minus housing, since such prices are seen as pretty closely tied to wage pressures.

Supreme Court Ruling May Raise U.S. Recession Risk

Jobless claims, out Thursday at 8:30 a.m., will be another focus after new claims topped 260,000 in each of the past three weeks. Yet the number of people continuing to receive jobless benefits hasn’t climbed in tandem, which one would expect if the job market is really turning soft.

Housing data will also get a close look after May’s jump in housing starts raised hope for a sustained rebound. New home sales are due out Tuesday at 10 a.m. Pending home sales, out Thursday at 10 a.m., will provide an early read on May sales of existing homes ahead of the drawn-out closing period.

Stock Market Perspective: Winning Streak Ends

The Nasdaq composite snapped its eight-week advance, its longest string of weekly gains since early 2019. The S&P 500 ended a powerful five-week rally, while the Dow wrapped up a three-week run. The Dow settled back to its 50-day moving average. The Nasdaq remains almost 7% above that line of support. Dollar stores had a strong week, as Dollar General (DG), Dollar Tree (DLTR) and Five Below (FIVE) all posted gains of around 5%.

Pullback Healthy So Far, Apple Hits High; What To Do Now

Blue Chip Journal: Nike, Walgreens Earnings

The Dow industrials will put the final touches on the earnings season when Walgreens (WBA) reports fiscal third-quarter results on Tuesday, and Nike reports fiscal Q4 earnings late Thursday. Walgreens is seen posting its first earnings advance in five quarters and a second straight rise in sales. Analysts set a low bar for Nike: a 24% EPS drop, although the sales target is up not quite 3%. Nike shares dropped 17% in May, leaving them down almost 7% year to date.

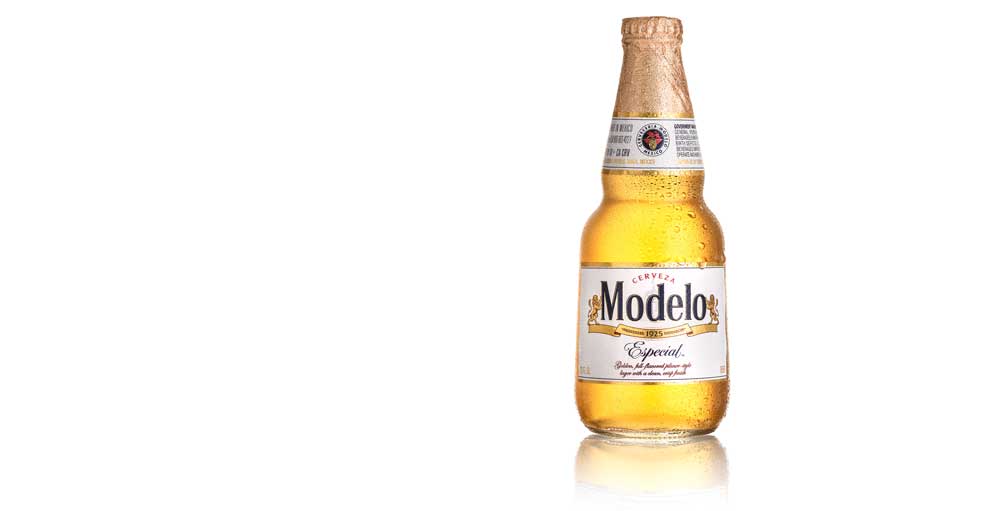

Beer Wars: The New Top Brew Reports

Modelo Especial brand owner Constellation Brands reports its Q1 results early Friday. Analysts polled by FactSet expect earnings to rise for the first time in two quarters with a 6.4% jump to $2.83 per share. FactSet guides 4.4% sales growth to $2.47 billion. Modelo overtook Bud Light as the top beer in the U.S. last month, claiming 8.4% of all retail sales compared to Bud Light’s 7.6%. The Anheuser-Busch brand held the crown since 2001, but boycotts caused Bud Light sales to dive following its April 1 ad with transgender influencer Dylan Mulvaney. In a research note Thursday, Deutsche Bank said Bud Light sales may never fully recover and could have a permanent impact on Anheuser-Busch’s U.S. business. But the firm thinks the worst of the boycotts are over and upgraded AB InBev shares to a buy rating and raised the price target to 60 euros from 59 euros.

Earnings Bullets

Monday

Carnival reports early Monday. Wall Street expects the cruise operator to lose 34 cents a share, narrowing from a $1.64 loss a year ago, as revenue nearly doubles. That would continue an uninterrupted string of quarterly losses since the pandemic began, but Carnival should swing to a profit in the current quarter.

Tuesday

AeroVironment (AVAV) releases its fourth-quarter results late Tuesday. FactSet analysts expect the drone and aerospace technology maker’s earnings to soar 236% to $1.01 per share on a 23.8% sales jump to $164.3 million.

Schnitzer Steel Industries (SCHN) announces fiscal third-quarter financials early Tuesday. Analysts predict profits will slump 75% to 64 cents per share and see revenue falling 18% to $824 million. Wall Street forecasts an EPS fall of 84% for SCHN in fiscal 2023 after booming earnings in both fiscal 2021 and 2022.

Jefferies Financial Group (JEF) announces Q2 results Tuesday evening. Analysts predict earnings will fall for the sixth consecutive quarter, tumbling 37.2% to 27 cents per share. Revenue is expected to dive 24% to $1.04 billion to mark the seventh straight decline.

Wednesday

Micron Technology (MU) will post its fiscal third-quarter results late Wednesday. Analysts expect the memory-chip maker to lose $1.60 a share while sales decline 58% to $3.67 billion amid a cyclical downturn in demand.

General Mills (GIS) reports early Wednesday. The cereals and snacks maker should post a 5% EPS decline on a 6% sales gain.

Worthington Industries (WOR) reports fiscal fourth-quarter financials after the market closes Wednesday. Wall Street consensus is profits will jump 20% to $1.90 per share with sales sliding 10% to $1.36 billion. Analysts expect the steel processor to see fiscal 2023 EPS fall 31% to $4.99 from the fiscal 2022 highs. Full-fiscal year revenue is also forecast to slip more than 6%.

Thursday

Smart Global Holdings (SGH) plans to announce its fiscal third-quarter earnings late Thursday. Wall Street predicts the data storage systems maker will earn 40 cents a share, down 54% year over year, on sales of $375 million, down 19%.

Progress Software (PRGS) is set to deliver its fiscal second-quarter results late Thursday. The provider of application development and infrastructure software is seen earning 90 cents a share, down 13%, on sales of $169.8 million, up 13%.

YOU MAY ALSO LIKE:

Stocks Near A Buy Zone

The Key To Big Gains? Fewer Stocks, Not More

Learning How To Pick Great Stocks? Go Inside Investor’s Corner

Here’s What Leading The Stock Market Now

The Latest In IBD Videos