Trends come and go but the latest craze to take Wall Street by storm is proving quite persistent. AI hype has been all the rage this year and stocks with exposure to generative AI and LLMs (large language models) have been reaping the benefits.

So much so, that Wall Street’s best analyst thinks it’s time to change tune on many of them. Surveying the SemiCap space, Needham analyst Quinn Bolton is confronted by a plethora of names boasting lofty valuations with little room left to run from here.

“With SemiCap stocks up meaningfully on the AI hype but with AI unlikely to drive a significant increase in WFE spending, we believe many SemiCap stocks are overbought in the near-term,” the 5-star analyst said. “In our opinion, investors will need to look out to 2025 and 2026 and the next WFE up cycle to determine if there is enough earnings power in the upturn to justify buying the stocks at current levels.”

Given the above, Bolton has downgraded the ratings of several SemiCap stocks. That said, not all SemiCap stocks are priced to perfection. Bolton, who boasts a 72% success rate on his stock recommendations and an average return of 39%, currently occupies the top spot amongst the Street’s analysts, so it’s fair to say he has a feel for this game. And he thinks two SemiCap equities, in particular, are still ripe for the picking. Let’s take a closer look.

ACM Research (ACMR)

The first stock we’ll look at is ACM Research, a leader in the advanced technology and manufacturing tools required by the chip industry in the production of silicon wafers. This is a deeper level of an essential industry, and ACM Research has lines of tools for wet processing, electrochemical plating, stress-free polishing, and other vital chip manufacturing processes. Put simply, the companies making the chips that power AI systems couldn’t even begin their work without ACM’s tools.

In addition to the high-tech tools, ACM Research also offers solid customer support, which is maintained through the lifetime of the company’s equipment products. ACM Research will help its customers install its machines, and then work with them to optimize systems and forestall problems, avoiding bottlenecks in chip production. The company’s support activities include software, apps, and spare parts and service, no matter where the customer is located.

The demand for silicon semiconductor chips has been beneficial for ACM Research, which is clearly visible in the company’s last quarterly report for 1Q23. At the top line, ACMR showed revenues of $74.26 million, marking a 76% year-over-year increase and surpassing the forecast by over $5.5 million. The firm’s bottom line earnings, of 15 cents per share by non-GAAP measures, came in 16 cents per share ahead of expectations. The company also stuck to its revenue guide for fiscal year 2023, calling for sales in the range between $515 million to $585 million. The consensus estimate was $540.58 million.

Quinn Bolton likes this company’s balance sheet, as he noted in his recent review of the shares. Setting up his stance on ACMR, he wrote: “As the fastest growing SemiCap stock in our coverage with ~$400MM in cash and very little debt, we believe a 12.5x multiple is more than fair. The stock is currently receiving little attention from investors due to its high-exposure to China. However, we believe this ACMR sentiment will change over time as its growth proves too difficult to ignore.”

Looking ahead, Bolton goes on to rate ACMR as a Buy, with an $18 price target implying a one-year upside potential of 59%.

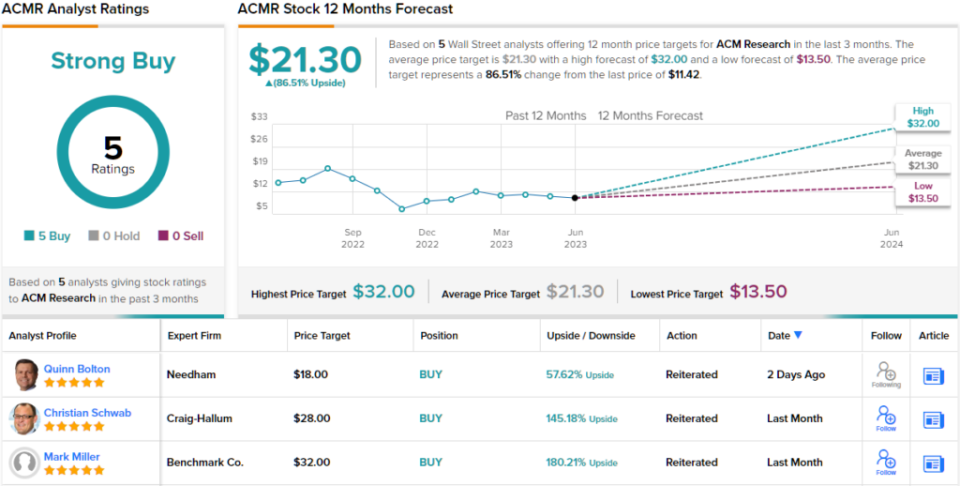

Like Bolton, other analysts also take a bullish approach. ACMR’s Strong Buy consensus rating breaks down into 5 Buys and zero Holds or Sells. Given the $21.30 average price target, the upside potential lands at 86%. (See ACMR stock forecast)

Cohu, Inc. (COHU)

The second of Bolton’s picks that we’re looking at is Cohu, a leading producer of test and inspection equipment used in chip fabrication lines. The products offered by Cohu play a vital role in ensuring meticulous quality control throughout the chip manufacturing process.

Cohu has established itself as a key player in the chip-testing niche, with a broad portfolio of test equipment and services designed to meet the needs of backend semiconductor manufacturers. The company describes itself as a ‘one-stop shop’ for a wide range of testing solutions, including handling equipment, thermal subsystems, and vision inspection & metrology.

The company doesn’t stop with chip makers, however. Cohu has solidified its presence in the high-tech testing business by expanding its offerings, with test and quality control equipment for IoT, industrial & medical, mobility, automotive, computing & network, and consumer product applications. The company has come a long way from its 1947 founding.

Cohu’s last financial release, however, for 1Q23, showed some mixed results. The company’s revenue was down 9.3% y/y, to $179.37 million, and missed the forecast by $0.92 million. Cohu’s non-GAAP gross margin was up, however, from 46.1% in 1Q22 to 48.2% in 1Q23. This helped the bottom-line performance, as adj. EPS of $0.56 beat the forecast by $0.02.

The positive metrics attracted Bolton’s attention, and he wrote of the stock: “Cohu’s NG GM is showing resiliency even at a lower revenue level, and we continue to believe a strong GM will help support shares near current levels. Robust recurring revenue, expanding manufacturing in the Philippines, higher handler margins, and mix is enabling strong GM. Elevated costs had a 29bps impact on GM and will continue through 2023.”

“Notably,” the top analyst went on to add, “COHU received a multi-unit $5MM SiC order for test automation and inspection. COHU believes SiC will make up ~2.5% of sales in 2023. However, we believe COHU’s near and long-term opportunity in SiC is currently underappreciated. We expect COHU’s SiC revenue to grow faster than the top-line in coming years.”

Taking this optimistic stance forward, Bolton gives COHU stock a Buy rating and sets a $52 price target, indicating confidence in a 29% upside on the one-year time horizon.

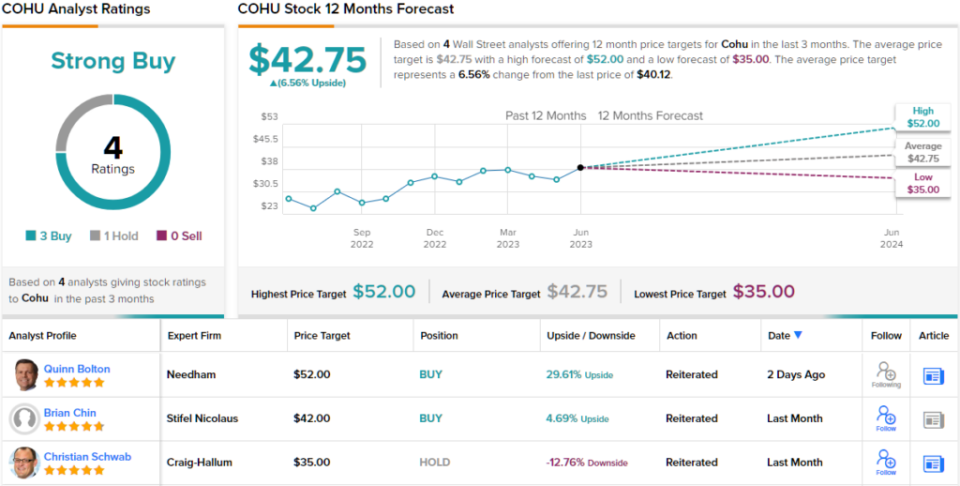

Overall, the Wall Street consensus on COHU is a Strong Buy, based on 4 analyst reviews including 3 Buys and 1 Hold. The shares are selling for $40.12, and the average price target of $42.75 implies a one-year upside of 6.5% for the stock. (See COHU stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.